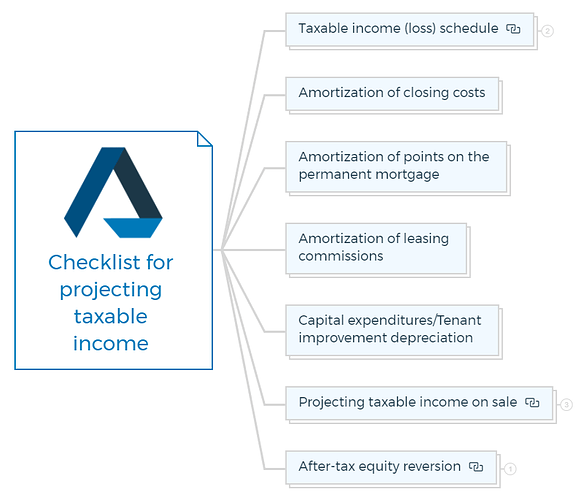

Checklist for projecting taxable income

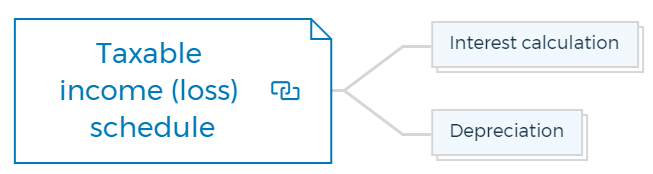

1. Taxable income (loss) schedule

- Compile a comprehensive income statement for the property, detailing rental income and other revenue streams.

- Subtract allowable deductions such as operating expenses, property management fees, repairs, and utilities to determine the property’s net operating income (NOI).

- Include interest paid on any loans associated with the property.

Formula

1.1. Interest calculation

- Record interest expenses on mortgages, loans, and other forms of debt related to the property.

- Calculate the deductible interest by referencing applicable tax laws and regulations.

Formula

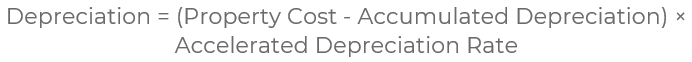

1.2. Depreciation

- Determine the appropriate depreciation method (e.g., straight-line or accelerated) for the property.

- Calculate depreciation for the property and any eligible components.

Formula for Straight-line depreciation

![]()

Formula for Accelerated depreciation

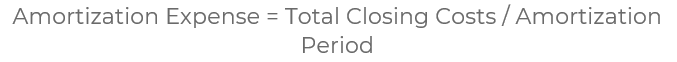

2. Amortization of closing costs

- List all closing costs associated with property acquisition.

- Determine which closing costs can be amortized over time for tax purposes.

- Amortize eligible closing costs over the applicable time frame according to tax regulations.

Formula

You are missing out if you haven’t yet subscribed to our YouTube channel.

3. Amortization of points on the permanent mortgage

- Identify any points paid at the time of securing a permanent mortgage.

- Determine if points can be deducted or amortized over the life of the loan.

- Calculate the amortization schedule for points, if applicable.

Formula

![]()

4. Amortization of leasing commissions

- Keep track of leasing commissions paid to secure tenants.

- Determine whether leasing commissions can be deducted immediately or amortized over the lease term.

- Apply the appropriate amortization method to calculate deductible leasing commissions.

Formula

5. Capital expenditures/Tenant improvement depreciation

- Identify capital expenditures and tenant improvements made to the property.

- Classify these expenses as either immediate deductions or depreciable assets.

- Calculate the depreciation for depreciable assets using the appropriate method.

Formula

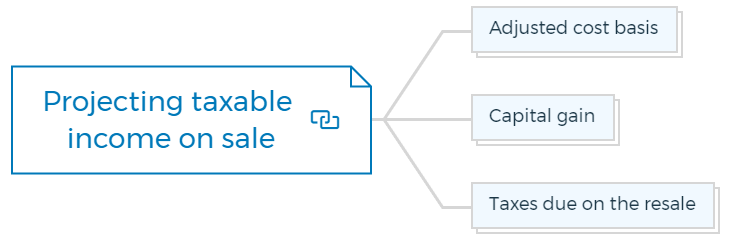

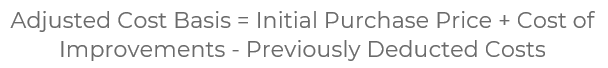

6. Projecting taxable income on sale

6.1. Adjusted cost basis

- Determine the adjusted cost basis of the property, including the original purchase price, improvements, and allowable adjustments.

- Exclude costs that have been previously deducted or amortized.

Formula

Learn More

6.2. Capital gain

- Estimate the property’s fair market value at the time of sale.

- Calculate the capital gain by subtracting the adjusted cost basis from the sale price.

Formula

![]()

6.3. Taxes due on the resale

- Calculate capital gains taxes based on the capital gain and the applicable tax rate.

- Consider any relevant tax exemptions or deferrals that might apply.

Formula

![]()

7. After-tax equity reversion:

The after-tax equity reversion is figured by subtracting the mortgage balance and the taxes due on the sale from the net sales price.

7.1. Profit

- Calculate the net profit from the property investment after considering all income, expenses, and taxes.

- Factor in the impact of any financing or leverage used in the investment.

Formula: