Understanding Capital Growth 3

Capital growth is a property’s appreciation over time, whereas rental returns are its revenue. Both metrics are crucial when investing in real estate.

Real estate investors must grasp their differences and find a balance between them to succeed.

Let’s understand the comparison of rental yield vs capital growth in detail.

What is capital growth?

Capital growth, or capital appreciation, is a property’s value rising over time. Market conditions, location, demand, economic growth, and local development affect it.

Capital growth helps real estate investors generate wealth by selling properties for more than they paid.

What is the rental return?

Rental return, often called rental yield, is property rental income. Location, rental demand, property type, and rental rates determine the percentage of the property’s worth.

Real estate portfolios might rely on rental income to generate cash flow.

To accurately calculate the capital growth and rental return, check out the complete video where I am guiding you on how to use the capital growth calculator.

You need to punch some numbers, such as purchase value, market value, and that’s it. You can get your numbers to make a fair and profitable property investment decision.

You are missing out if you haven’t yet subscribed to our YouTube channel.

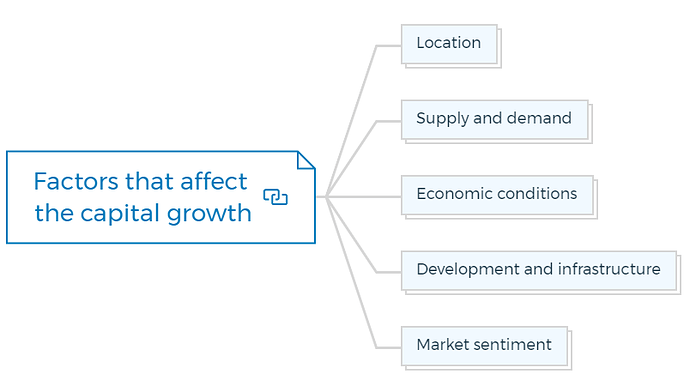

Factors that affect the capital growth

Several factors influence the capital growth of a property. These include:

Location

Properties in desirable areas with good amenities, infrastructure, and closeness to schools, transportation, and employment hubs have faster capital growth.

Supply and demand

Limited supply and high demand for properties in a given location might increase prices and capital growth.

Economic conditions

A healthy economy, low unemployment, and positive economic indicators support capital growth.

Development and infrastructure

Improvements like refurbishments or extensions can increase a property’s market worth and capital growth.

Market sentiment

Market sentiment, investor confidence, and interest rates affect property demand and capital gains.

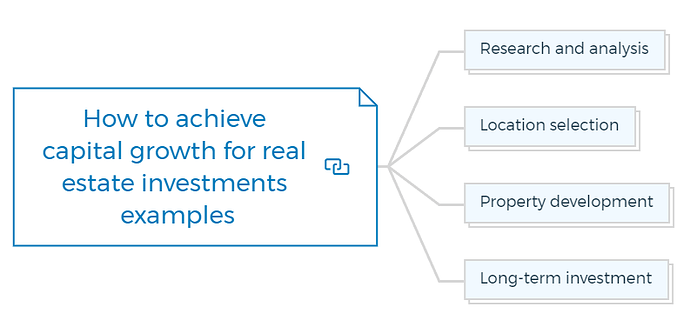

How to achieve capital growth for real estate investments examples

Consider these real estate investment strategies for achieving capital growth in your project:

Research and analysis

Find capital growth areas. Look for indicators such as population growth, infrastructure plans, and economic development.

Location selection

Choose homes in high-growth locations that will attract homeowners and tenants. Consider work, school, and lifestyle facilities.

Property development

Improvements like refurbishments or extensions can increase a property’s market worth and capital growth.

Learn More

Long-term investment

Capital growth investments require patience. In places with stable growth, holding onto a property enables appreciation.

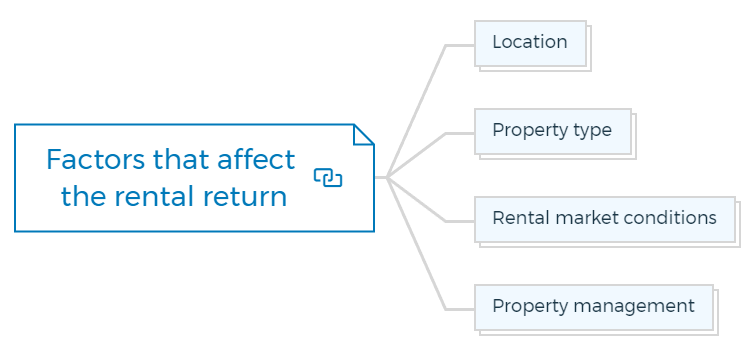

Factors that affect the rental return

Real estate rental yields depend on several things. These are:

Location

Rental returns are higher for properties near universities, business centres, or tourist attractions.

Property type

Residential, commercial, and holiday rentals have different rental returns. Size, condition, and amenities affect rental returns.

Rental market conditions

A region’s rental demand, rates, and vacancies affect investment returns.

Property management

Regular maintenance, tenant screening, and prompt communication can maximise rental returns by minimising vacancies and tenant satisfaction.

What is good capital growth on a property?

Good capital growth on a property refers to a significant increase in its market value over a certain period. The specific measure of what is considered “good” capital growth can vary depending on factors such as location, market conditions, and the investor’s expectations.

However, a general benchmark for good capital growth is often considered higher than the average market appreciation rate.

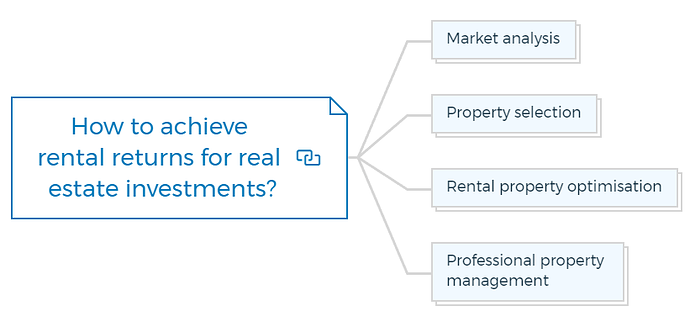

How to achieve rental returns for real estate investments?

Consider these real estate investment rental strategies for better returns:

Market analysis

Understand rental rates, demand, and vacancy rates in suitable investment regions.

Property selection

Consider amenities, transportation, and desired tenant profiles to match rental demand.

Rental property optimisation

Maintain a clean, well-maintained property with amenities that attract tenants and justify reasonable rental charges.

Professional property management

A good property management business can streamline operations, manage tenants, and keep the property rented.

How much capital gains do I pay on an investment property?

The capital gains tax you pay on an investment property depends on several factors, including your tax jurisdiction and the specific tax laws applicable in your country or region.

Here is a general overview, but please note that you should consult with a tax professional or accountant who can provide personalised advice based on your circumstances.

Determine the capital gain

To calculate the capital gain, subtract the property’s original purchase price (adjusted for any eligible expenses) from the selling price. This determines the profit made on the investment property.

Understand the capital gains tax rate

Tax rates on capital gains can vary depending on factors such as the duration of ownership, your income tax bracket, and any applicable tax exemptions or deductions.

In many countries, capital gains are subject to progressive tax rates, meaning that the rate increases as the amount of the gain increases.

Consider holding period

Some jurisdictions offer tax incentives for long-term investments. For example, if you hold the investment property for a certain minimum period, such as more than one year, you may be eligible for a lower tax rate or other tax benefits.

Deductions and exemptions

Check if any deductions or exemptions are available that could reduce your capital gains tax liability.

Common deductions may include costs related to property improvements, legal fees, or real estate agent commissions. Additionally, some jurisdictions offer exemptions or reduced rates for primary residences or specific types of investment properties.

Learn More

Rental yield vs capital growth in real estate

Real estate investors need capital growth and rental returns but for different reasons. Capital growth provides long-term wealth accumulation through property appreciation, while rental returns offer ongoing income.

Investor goals, risk tolerance, and market conditions determine the balance.

Finding a balance between capital growth and rental yield

A solid real estate investment portfolio must balance capital growth and rental earnings. Diversify your portfolio with properties that offer capital growth and reliable rental returns.

Capital appreciation and rental income bring stability and long-term wealth.

Case studies

Two case studies illustrate how successful real estate investors prioritise capital growth or rental returns:

Case study A

Investor X invested in a rapidly developing neighbourhood for capital gain. They bought and held several low-cost properties for years. Investor X sold their houses at high prices due to the area’s expansion and demand.

Case study B

Investor Y bought properties in a desirable area with a steady stream of renters to maximise rental income. They carefully analysed rental market conditions, set competitive rents, and hired a property management business to supervise tenants. Thus, Investor Y had stable rental revenue and cash flow.

Real estate investors must understand capital growth and rental returns. Rental yields generate income, while capital growth builds wealth. Diversify your portfolio and use the tactics provided to construct a profitable real estate investment portfolio that maximises capital growth and rental income.

Test Your Knowledge

Assignment: Understanding Capital Growth vs. Rental Return in Real Estate Investments

Objective

This assignment aims to deepen your understanding of capital growth and rental return in real estate investments. Through research, analysis, and practical exercises, you’ll learn to evaluate properties, calculate potential returns, and strategize investments for optimal performance.

Instructions:

Complete each section below, using the concepts discussed in the provided article on capital growth versus rental return. You may need to conduct additional research to answer some questions or complete certain tasks.

Part 1: Conceptual Understanding

Define Capital Growth and Rental Return

In your own words, explain what capital growth and rental return are and why they are important for real estate investors.

Comparative Analysis

List at least three factors that can influence capital growth and three factors that can affect rental returns. Discuss how each factor impacts the property’s financial performance.

Part 2: Practical Exercise

Case Study Analysis

Select a real estate market or specific property type. Research current market conditions, including average capital growth rates and rental yields. Summarize your findings and discuss what they indicate about the market or property type you selected.

Calculation Exercise

Assume you have purchased a property for $300,000. Five years later, the market value of the property has increased to $350,000. Additionally, the property has been generating an annual rental income of $15,000. Calculate:

- The capital growth rate.

- The annual rental yield.

- Provide a brief analysis of these figures in the context of investment performance.

Part 3: Research Questions

Investment Strategies for Capital Growth

Research and describe at least two investment strategies that can potentially lead to high capital growth. Provide examples or case studies to support your descriptions.

Optimizing Rental Returns

Investigate and outline strategies for maximizing rental returns on investment properties. Include practical tips for property management, tenant relations, and property improvements.

Tax Implications

Research the capital gains tax implications for real estate investments in your country or region. How do these taxes affect investment returns, and what strategies can investors use to minimize tax liabilities?

Part 4: Reflection and Application

Personal Investment Goals

Reflect on your own investment goals. Would you prioritize capital growth, rental returns, or a balance of both? Explain your reasoning and how it fits with your financial objectives and risk tolerance.

Portfolio Diversification

Discuss how diversifying your investment portfolio with a mix of properties offering high capital growth and strong rental returns can achieve a balanced investment strategy. Provide examples of how you would implement this strategy in your portfolio.

Submission Guidelines

- Complete all sections of the assignment in a word processor or similar software.

- Support your analysis and strategies with data, citations, and references where appropriate.

- Ensure your work is well-organized, clearly written, and free of spelling and grammatical errors.

- Submit your assignment via email or comments.