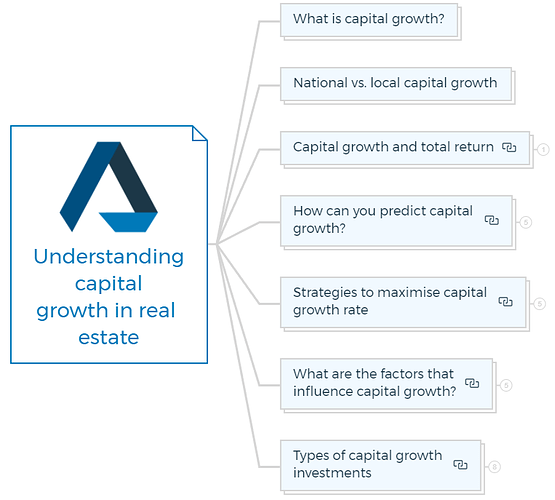

Understanding capital growth in real estate

Real estate investment is known for its potential to generate substantial returns over time. One of the key drivers of profitability in real estate is capital growth, also referred to as capital gain. This part of the property development course provides a comprehensive understanding of capital growth in real estate, explaining its concept, factors influencing it, and strategies to maximize it.

What is capital growth?

Capital growth, or capital gain, in real estate refers to the increase in the value of a property over time. It represents the difference between the property’s original purchase price and its current market value.

You are missing out if you haven’t yet subscribed to our YouTube channel.

National vs. local capital growth

Capital growth is measured nationally and locally. National-level capital growth refers to the overall growth experienced in the entire country, while local-level capital growth focuses on specific suburbs or areas. Due to regional differences in capital growth, local issues should be considered when planning property development or investment.

Impact of new developments

Infrastructure upgrades and population shifts can boost capital gains.

For instance, suddenly, a company announces that it’s going to open a mine here and set up infrastructure here. This leads to a sudden wave of rise in the prices.

Everybody wants to avail the benefits, so they tend to shift in since everything feels so smooth until the company decides to end its future venture.

New Development is referred to as the changes made in the demographics or geographical means. This could be done by improving the infrastructure or the quality of the service provided.

Learn More

Capital growth and total return

Total return in real estate is the sum of capital growth and rental yield. Due to supply and demand, residential regions offer similar average total returns. However, mining towns may present exceptions to this trend.

Rent-capital growth relationship

Rent inversely affects capital growth. If the capital growth increases the price, the rental returns are automatically dropped. This is because investors increase rent while the owners increase the prices.

When rental yields rise, capital growth may slow, which could raise property values. Understanding this link can help developers make smart choices.

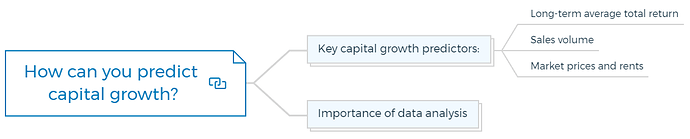

How can you predict capital growth?

Key capital growth predictors:

Several factors predict capital growth. Developers and investors can predict trends by analysing these characteristics.

Long-term average total return

Long-term annual average total returns reveal patterns and movements. If a property’s annual total return surpasses the average, capital growth or rental income may improve.

Sales volume

Tracking property sales can reveal trends. Rising sales numbers indicate capital expansion, whereas dropping sales levels may indicate rental returns.

Market prices and rents

Comparing market prices and rents with similar places can reveal patterns. Prices and rentals that are high compared to other places may rise further.

Importance of data analysis

Accurate data collection and analysis are essential for capital growth prediction. Developers and investors need market trends, sales volumes, rental rates, and comparable properties.

Data-driven insights help them optimise capital growth and investment returns.

When measuring the gathered information, the first thing you gotta do is compare long-term capital growth and rental return as compared to the recent performances to analyse the shifts and trends in the patterns.

As per your results, if the relationship between the rent and prices is not aligned, then whichever is lesser needs to be increased, especially if the annual total return on the property is greater than the annual average total return.

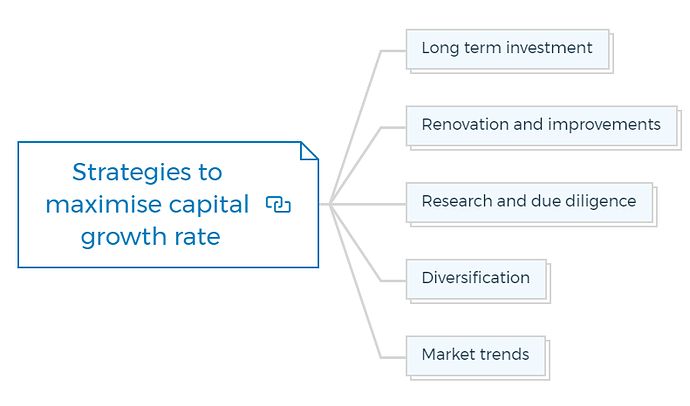

Strategies to maximise capital growth rate

Long term investment

Property investment should be long-term. Holding properties for a long time permits property market cycles to increase capital growth.

Renovation and improvements

Renovating and enhancing homes can boost capital growth. Upgrades, modernisation, and maintenance can make a property more appealing to purchasers or tenants.

Research and due diligence

Real estate investing requires thorough research and due diligence. The market study, growth estimates, and local zoning laws can assist in identifying capital growth zones.

Diversification

Diversifying real estate investments across property types and regions reduces risk and maximises capital gain. A well-rounded property portfolio includes residential, commercial, and industrial assets in various areas.

Market trends

Property investors must follow market trends and industry news. Investors can exploit capital expansion by monitoring interest rate changes, supply and demand dynamics, and government policies.

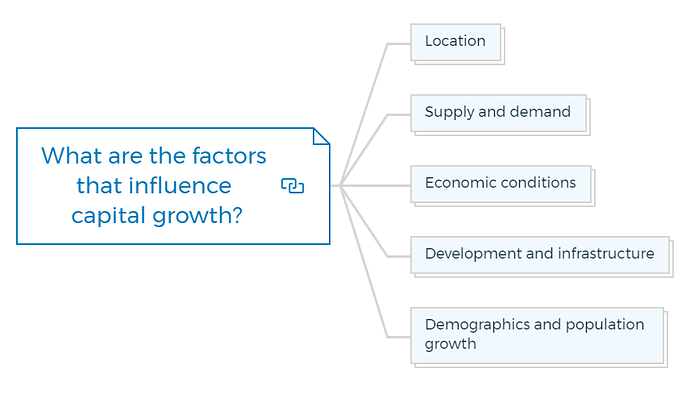

What are the factors that influence capital growth?

Location

Investment properties situated in areas with strong economic growth, good infrastructure, proximity to amenities, and desirable neighbourhoods tend to experience higher appreciation in value.

Supply and demand

Real estate capital growth depends on supply and demand. Buyer rivalry increases pricing and capital growth in areas with little supply and high demand.

Economic conditions

Capital growth is affected by GDP growth, employment, interest rates, and inflation. Property values rise with positive economic indicators.

Development and infrastructure

New infrastructure projects, including transportation networks, commercial centres, and educational institutions, can increase residential and commercial property values and capital growth.

Demographics and population growth

Demographic dynamics like population increase, migration, and household composition affect capital growth. New occupants enhance housing demand, which raises property values.

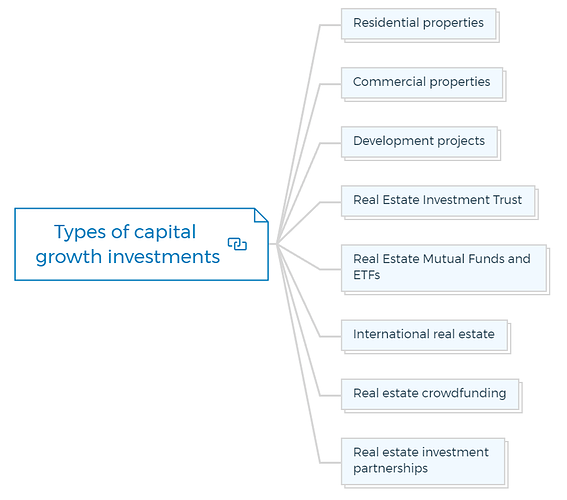

Types of capital growth investments

Real estate capital growth investments might potentially offer high profits over time. Here are some common real estate capital growth investments:

Residential properties

Single-family homes, apartments, and condominiums can appreciate in value. Location, demand, and property conditions affect residential property values.

Commercial properties

Commercial properties include office buildings, retail areas, industrial warehouses, and hotels. Commercial properties in high-growth locations or with rising demand might increase in value.

Development projects

New residential or commercial developments can offer capital growth prospects. These projects entail buying land, getting permits, and building properties to sell or rent.

Real Estate Investment Trust

REITs allow property investors to pool their money to invest in a diverse real estate portfolio. Some REITs invest in great commercial properties or fast-growing residential neighbourhoods.

Real Estate Mutual Funds and ETFs

Similar to REITs, mutual and exchange-traded funds invest in real estate. These funds may target assets with capital growth potential, giving investors real estate exposure without owning properties.

International real estate

Diversifying and accessing higher-growth areas by investing in real estate outside your home country.

International real estate investments can be made directly by purchasing properties or through real estate funds focusing on global markets.

Real estate crowdfunding

Crowdfunding platforms let small investors invest in real estate projects. These platforms aggregate investor funds to support real estate enterprises, especially capital growth ones.

Real estate investment partnerships

Real estate investment partnerships let investors buy and manage properties together. These alliances can enable larger or more lucrative real estate deals.

Test Your Knowledge

Assignment: Understanding Capital Growth in Real Estate

Objective:

This assignment aims to deepen your understanding of the concept of capital growth in real estate, the factors influencing it, and strategies to maximise it. Through a series of questions, research tasks, and practical exercises, you will explore the dynamics of real estate investment and its potential for generating substantial returns over time.

Instructions:

Provide detailed responses to all questions and complete each task thoroughly.

Where research is required, use credible sources to gather information and include references where applicable.

Apply the concepts learned in the article to real-world scenarios to demonstrate your understanding of capital growth in real estate.

Questions:

Define Capital Growth:

- What is capital growth in real estate, and how is it calculated?

National vs. Local Capital Growth:

- Explain the difference between national and local capital growth. Why is it important to consider both when investing in real estate?

Impact of Developments:

- Discuss how new developments, such as infrastructure upgrades and population shifts, can impact real estate capital gains.

Capital Growth and Total Return:

- Describe how capital growth and rental yield contribute to the total return of a real estate investment.

Rent-Capital Growth Relationship:

- Explain the inverse relationship between rent and capital growth. How does this affect property values?

Predicting Capital Growth:

- Identify and explain three key predictors of capital growth in real estate.

To Do’s:

Research Local Real Estate Market:

Choose a specific suburb or area and research its recent real estate capital growth trends. Analyze factors that have influenced these trends and predict future capital growth based on your findings.

Case Study Analysis:

Find a real estate investment case study that showcases significant capital growth. Summarize the investment, identify the key factors contributing to its capital growth, and discuss the strategies employed to maximize returns.

Data Analysis Exercise:

Using online real estate databases or market reports, collect data on sales volume, market prices, and rents for a specific region over the last 5 years. Analyze this data to identify trends and insights related to capital growth.

Research Questions:

Global Real Estate Markets:

Investigate how capital growth trends in real estate vary globally. Choose two countries with differing economic conditions and analyze how these conditions affect their real estate capital growth.

Effect of Economic Conditions:

Research the impact of economic factors (such as GDP growth, employment rates, interest rates, and inflation) on real estate capital growth. Provide examples to illustrate your points.

Real Estate Investment Vehicles:

Compare and contrast different real estate investment vehicles (such as direct property investment, REITs, real estate mutual funds, ETFs, crowdfunding, and investment partnerships) in terms of their potential for capital growth.

Submission Guidelines:

- Compile your answers, research findings, and analysis into a comprehensive report.

- Ensure your report is well-organized, with a clear introduction, body, and conclusion.

- Submit your assignment via mail or comments.