Analysis Paralysis in Property Investment: A Costly Hurdle

Have you ever found yourself in the whirlwind of property investment options, feeling overwhelmed and unsure of where to start? Imagine standing at a crossroads, with each path representing a different property opportunity. This scenario, often referred to as ‘real estate analysis paralysis’, is a common predicament for many property investors.

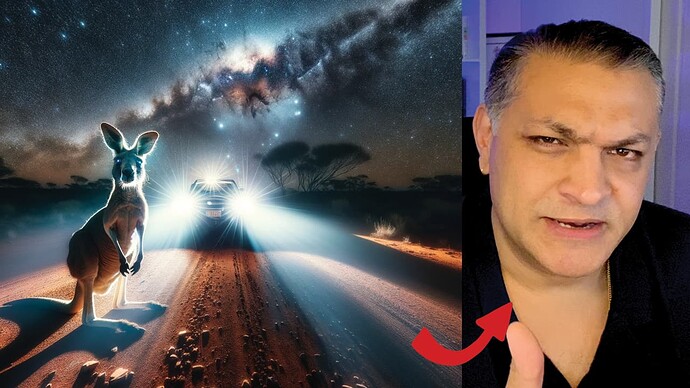

It’s like being a kangaroo in the headlights, frozen by the sheer volume of choices and data. But what if you could confidently navigate through this maze, making informed decisions that lead to profitable investments?

Welcome to “Paralysis to Profit - Overcome Analysis”, a guide crafted specifically for property investors who are seeking to break free from the shackles of indecision.

Understanding Analysis Paralysis in Property Investment

Analysis paralysis in the property world is akin to being at a buffet with endless options but unable to decide what to eat. It’s a dilemma caused by an overload of options and excessive data.

This paralysis typically occurs when property investors get bogged down in the minutiae of data and potential outcomes, rendering them unable to make a decision. It often stems from the fear of making the wrong choice, leading to an endless cycle of analysis without action.

The root of this issue is frequently a lack of trust in one’s own judgment, resulting in missed opportunities and a plethora of ‘what ifs.’

The Cost of Analysis Paralysis

The impact of analysis paralysis is significant. It can lead to missed opportunities, as investors who succumb to it often find themselves regretting not seizing potential gains. The cost of inaction can be as high as the risk of making a poor investment.

Overcoming Analysis Paralysis

To overcome analysis paralysis, investors need to develop trust in their decision-making capabilities. This can be achieved through various strategies, including seeking mentorship and simplifying the approach to decision-making.

The Role of a Mentor

A mentor, particularly one with experience in property investment, can be invaluable. They offer objective guidance and reassurance, aiding in the development of confidence and decision-making skills. They help filter out the noise, focusing the investor on what truly matters.

Strategies for Simplification

Simplifying the approach to property investment can also help. Instead of considering every possible metric and scenario, focusing on a few key factors at a time can reduce overwhelm and facilitate clearer decision-making.

The Four Pillars of Overcoming Analysis Paralysis

Recognizing the Issue

The first step to overcoming analysis paralysis is acknowledging when you’re overanalyzing. It’s crucial to identify when your research and deliberation process stops being productive and starts hindering your decision-making.

Seeking Guidance

Don’t hesitate to seek advice if you feel lost. Professional guidance can provide a new perspective, helping you navigate through the complex maze of property investment.

Simplifying Your Approach

Focus on a few key metrics instead of getting lost in a sea of data. This approach will streamline your decision-making process, making it more manageable and less overwhelming.

Trusting Your Judgment

Have confidence in your decision-making abilities. Just as you believe in a trusted figure like Maxwell, believe in your own judgment and instincts.

Smart REIA: Your Investment GPS

Enter Smart REIA, akin to having a GPS for your investment journey. This tool helps steer you clear of financial potholes by allowing you to simulate different scenarios and get a complete financial picture before making a commitment.

It’s about including every little cost and consideration to get a true sense of your investment’s potential, whether you’re looking at the short-term or projecting as far as 50 years into the future.

The Risks of Inaction

Imagine watching an exciting game of footy without a cold one in hand – not much fun, right? That’s what it’s like to sit on the sidelines in property investment. You miss all the action, excitement, and potential gains. It’s essential to be in the game, actively participating and making informed decisions, rather than watching opportunities pass by.

Conclusion

In conclusion, “Paralysis to Profit - Overcome Analysis” offers a beacon of hope for property investors caught in the web of analysis paralysis. By understanding and acknowledging this common hurdle, seeking appropriate guidance, adopting a simplified approach, and building trust in one’s judgment, investors can navigate the complex world of property investment with greater ease and confidence.

Next Step -

Now that you’ve gained valuable insights into overcoming real estate analysis paralysis, it’s time to take action. Don’t let this opportunity pass you by. Sign up for free at leadinvestors.com.au and become part of a community that’s making informed and profitable investment decisions. Share your thoughts, experiences, or any questions you might have in the comment section. Together, let’s keep our investments cooking and our decisions savvy. Join us now and start turning paralysis into profit!