Project Report - Part 1

The video “Project Report - Part 1” offers a comprehensive guide on the significance, structure, and strategic planning necessary for creating an effective project report, especially aimed at those seeking to attract lenders or investors for real estate developments. Here are the key insights and strategies discussed:

Necessity

A project report is crucial when you need to establish trust and authority with lenders and investors. It’s essential for convincing them of your professionalism and the viability of your project, especially for no money down deals.

Target Audience

Primarily, the report is for lenders and investors. It helps in proving your competency and professionalism, thereby making your proposal more appealing.

Content and Credibility

The report should contain market research, facts, and numbers to support your project’s viability. Including endorsements or involvement from known builders, architects, or planners adds credibility.

Professional Presentation

Showcasing your professionalism through the report’s content and presentation is critical. Detailing past successes, if any, enhances trust.

Comprehensive Details

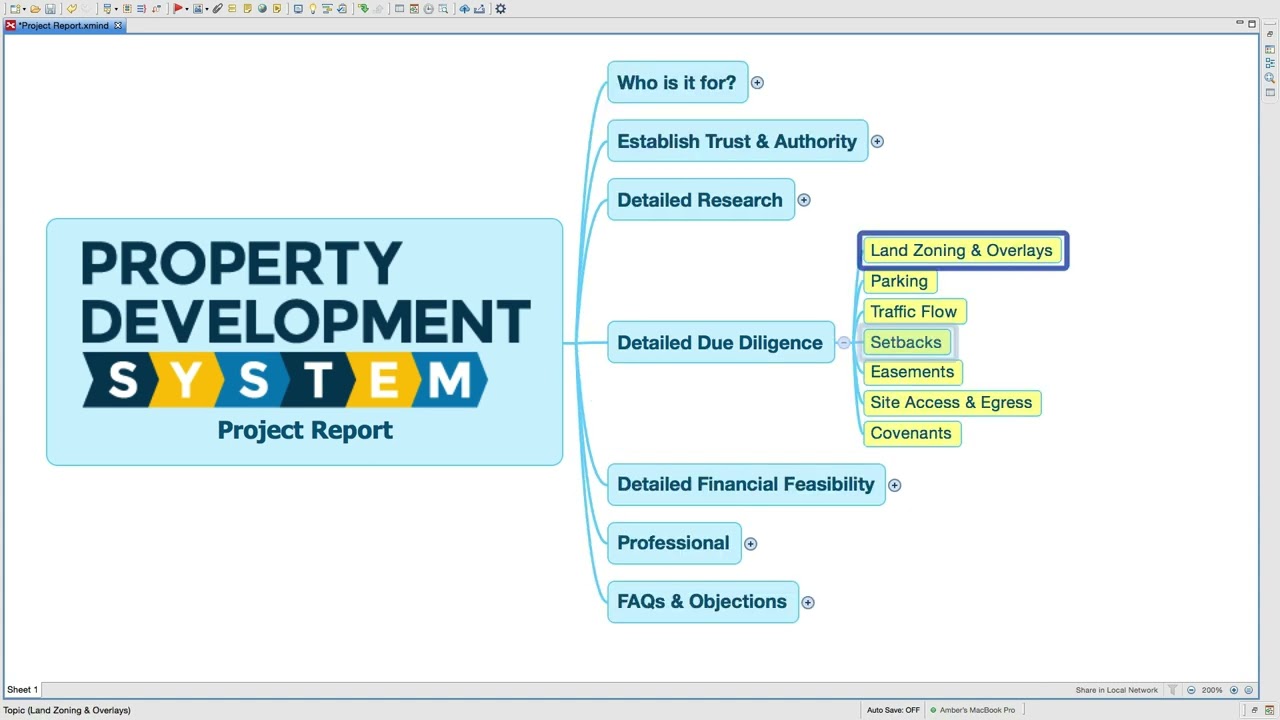

It should include information about the project like land zoning, parking, traffic flows, financial feasibilities with assumptions clearly stated, and responses to potential objections and frequently asked questions.

Due Diligence

A detailed project report must cover due diligence aspects like land zoning, setbacks, easements, and financial feasibility, among others. Assumptions used in financial projections should be explicitly mentioned.

Engagement and Authority

The report should effectively communicate the project’s worth, demonstrating why and how decisions were made concerning location, design, and financial estimations.

Frequently Asked Questions

How do project reports influence investor decisions in real estate projects?

Foundation of Trust

A well-compiled project report is the bedrock of establishing trust between the project initiator and potential investors or lenders. It demonstrates the seriousness, professionalism, and thoroughness of the person or team behind the project, making it easier for investors to consider the project as a viable investment opportunity.

Demonstration of Professionalism

Investors are more inclined to engage with projects that showcase a high level of professionalism. The inclusion of detailed market research, financial feasibility studies, and clear assumptions in the project report presents the project as well-thought-out and backed by solid research, thus increasing its appeal to investors.

Credibility through Association

Mentioning known builders, architects, or planners in the project report adds an additional layer of credibility. Investors recognize these names and their involvement as a marker of quality and reliability, which can significantly sway their decision-making process in favor of investing.

Clarity and Transparency

The report’s detailed financial analysis and explicit listing of assumptions provide clarity and transparency to investors. It helps them understand the financial underpinnings of the project and assess its viability and profitability based on concrete data and projections.

Preempting Objections

By addressing potential objections and frequently asked questions within the project report, initiators can preempt concerns that investors might have. This proactive approach not only saves time but also further establishes the initiator’s credibility as someone who is thoroughly prepared and knowledgeable about the project and its potential challenges.

In what ways can including known builders or architects in a project report enhance its credibility?

Enhanced Credibility

Involving reputable professionals in a project inherently boosts its credibility. Investors and lenders often recognize these names and regard their involvement as a validation of the project’s quality and feasibility. It signals that experts have reviewed and potentially endorsed the approach and execution plan, which significantly reduces perceived risk.

Professional Validation

A project report mentioning known industry professionals serves as a form of professional validation. It suggests that the project has been scrutinized and deemed viable by experts, which can be a deciding factor for investors sitting on the fence. This third-party validation can make the difference in securing the necessary funding.

Increased Trust

Trust is a critical factor in investment decisions, especially in large-scale projects such as real estate developments. By associating a project with established and respected names in the industry, project initiators can leverage their reputations to build trust with potential investors. This association implies that the project is being managed and executed according to high standards.

Marketability

Projects associated with reputable professionals are often more marketable. They can attract more interest not just from potential investors but also from future buyers or tenants, as the involvement of known builders or architects is seen as a mark of quality and reliability. This increased marketability can enhance the overall value proposition of the project to investors.

Risk Mitigation

From an investor’s perspective, the involvement of well-known industry professionals serves as a form of risk mitigation. It reassures investors that the project is less likely to encounter significant issues related to planning, execution, or quality, as it benefits from the expertise of these professionals.

In conclusion, the strategic inclusion of recognized builders, architects, or planners in a project report can significantly influence an investor’s decision by enhancing the project’s credibility, demonstrating professional validation, increasing trust, improving marketability, and mitigating risks. This strategic move demonstrates a well-considered approach to project planning and execution, making the investment opportunity more attractive.

What is a project report and why is it important?

A project report is a comprehensive document that outlines the details of a real estate development project, aimed at establishing trust and authority with lenders and investors. It is crucial for demonstrating professionalism, the viability of the project, and convincing potential financiers of the project’s worth, especially in scenarios involving no money down deals.

Who is the target audience for a project report?

The primary audience for a project report includes lenders and investors interested in real estate development. The report serves to prove the project team’s competency and professionalism, making the investment opportunity more attractive.

What content should a project report include to be credible?

To ensure credibility, a project report should encompass market research, facts, and figures supporting the project’s viability. Incorporating endorsements or involvement from reputable builders, architects, or planners can significantly enhance the report’s credibility.

How does professional presentation affect a project report?

A professional presentation of the report, including detailed content on past successes and a clear layout, is critical. It showcases the project team’s professionalism and builds trust with potential lenders and investors.

What comprehensive details are necessary in a project report?

A detailed project report must include information on land zoning, parking, traffic flows, and financial feasibilities with clearly stated assumptions. It should also address potential objections and include frequently asked questions to provide a thorough understanding of the project.

Why is due diligence important in a project report?

Due diligence is crucial for a project report as it covers aspects such as land zoning, setbacks, easements, and financial feasibility. Explicitly mentioning the assumptions used in financial projections is important to ensure the report’s accuracy and reliability.

How should a project report handle objections and FAQs?

Including a section on potential objections and frequently asked questions within the project report can significantly enhance its effectiveness. This shows forethought and professionalism by anticipating concerns and providing clear, reasoned responses.

Test Your Knowledge

Multiple-Choice Questions on “Project Report - Part 1”

1. What is the primary purpose of a project report in real estate development?

A) To provide a detailed architectural design of the project.

B) To establish trust and authority with lenders and investors.

C) To advertise the project to the general public.

D) To serve as a legal document for property registration.

2. Who is the intended audience for a project report?

A) General contractors and construction workers.

B) Government regulatory bodies.

C) Lenders and investors.

D) Potential tenants and property buyers.

3. What type of information enhances the credibility of a project report?

A) Celebrity endorsements.

B) Fictional narratives of potential success.

C) Market research, facts, and endorsements from known builders or planners.

D) Speculative financial returns without data backing.

4. How does professional presentation of a project report affect its reception?

A) It has no significant impact compared to the project’s financial projections.

B) It detracts from the content, making it less serious.

C) It enhances trust and showcases the project team’s professionalism.

D) It makes the report too complex for understanding.

5. What does due diligence in a project report include?

A) Only the legal history of the land.

B) Celebrity endorsements and speculative financial returns.

C) Land zoning, setbacks, easements, and financial feasibility with explicit assumptions.

D) The project team’s personal biographies.

6. Which of the following is NOT a reason for including objections and FAQs in a project report?

A) To take up more space and make the report longer.

B) To demonstrate forethought and professionalism.

C) To improve standing with potential investors by addressing concerns proactively.

D) To provide clear responses to potential questions and objections.

7. What emphasizes the necessity of having numbers and market research in the project report?

A) It is a formal requirement by all regulatory bodies.

B) Numbers and research substitute for a detailed project plan.

C) They substantiate the project’s potential success and financial feasibility.

D) They are only necessary if the project is over a certain budget.

8. How should assumptions and projections be presented in the project report?

A) In an ambiguous manner to allow for flexibility.

B) Clearly listed to ensure investors understand the financial planning basis.

C) Only shared in person, not included in the report.

D) Summarized without detailed justification.

Answers:

- B) To establish trust and authority with lenders and investors.

- C) Lenders and investors.

- C) Market research, facts, and endorsements from known builders or planners.

- C) It enhances trust and showcases the project team’s professionalism.

- C) Land zoning, setbacks, easements, and financial feasibility with explicit assumptions.

- A) To take up more space and make the report longer.

- C) They substantiate the project’s potential success and financial feasibility.

- B) Clearly listed to ensure investors understand the financial planning basis.

Assignment

Creating a Project Report for Real Estate Development

Objective:

Demonstrate your understanding of the key insights and strategies necessary for creating an effective project report aimed at attracting lenders and investors for real estate developments.

Instructions:

You are to assume the role of a project manager for a hypothetical real estate development project. Your task is to create a project report that incorporates the essential elements discussed in “Project Report - Part 1.” Your report should aim to establish trust and authority, present your team’s professionalism, and convincingly demonstrate the project’s viability.

Part 1: Research and Preparation

Market Research:

Conduct market research to identify trends, demand, and potential challenges in the location of your project.

Collect facts and numbers that support the viability of your project. This could involve demographics, property values, or rental rates.

Identify Endorsements:

List potential local builders, architects, or planners who could endorse your project.

Explain how these endorsements could add credibility to your report.

Due Diligence:

Determine the necessary due diligence aspects for your project, such as land zoning, setbacks, and easements.

Prepare a financial feasibility analysis with clear assumptions and projections.

Part 2: Drafting the Report

Introduction:

Briefly describe your project, including the location, scope, and objectives.

Explain the necessity of the project report in establishing trust with lenders and investors.

Professional Presentation:

Outline how you will present the report in a professional manner. Consider layout, readability, and the inclusion of relevant graphics or charts.

Detail any past successes of your team that can enhance trust.

Comprehensive Details:

Provide information on land zoning, parking solutions, traffic flow analysis, and financial feasibilities of your project.

State clearly the assumptions made in your financial projections.

Engagement and Authority:

Discuss how you will communicate the worth of your project, showcasing the decision-making process regarding location, design, and financial estimations.

Addressing Objections and FAQs:

Anticipate potential objections and questions that lenders or investors might have.

Prepare responses that demonstrate forethought and professionalism.

Part 3: Final Presentation

Compile your research, analysis, and sections drafted in Part 2 into a cohesive project report.

Ensure that the report is well-organized, professionally presented, and comprehensively covers all necessary details to convince lenders and investors of the project’s viability.

Submission Requirements:

- Submit a PDF of your project report.

- Ensure your report is between 10 to 15 pages, including any appendices or references.

- Use charts, graphs, and visuals where appropriate to support your data and assumptions.