Property Options: Your Definitive Guide

Property Options or Real Estate Options is one of the common Site Acquisition strategies. And in recent times it has been marketed as a be-all and end-all strategy by property gurus.

I know this because when I started out, I myself spent $6000 for a weekend of taurus excretus on property options.

Trust me when I tell you that a property option is nothing more than an agreement between a buyer and a seller of land.

And just like any other agreement, a property options agreement can be negotiated to include terms and conditions that both parties can agree on.

I have personally signed options agreements without paying an options fee and these property options agreements are no longer than 3-4 pages, basically outlining the rights and obligations of the buyer as well as the seller packaged into a property option agreement.

And in this Property Options Guide, I will bust all the property option myths that are circulating in online property forums, magazines and seminars.

I won’t be surprised if you have already come across a property options course or seminar being marketed as this secret way to control property without using your own money that only the billionaires and multi millionaires know about.

Property Options have been around for many years and are used primarily as an acquisition strategy, only where both the seller and the buyer can agree on terms.

This last line is important, because no land owner these days is dumb enough that they are sitting ducks waiting for you to get an option on their property.

What Are Property Options? Or

What Is A Property Option?

A property option or a real estate option is a legal agreement or contract between the potential buyer i.e. holder of the options contract aka optionee, and the seller or vendor who grants the option aka optionor.

In simple terms, a real estate option or a property option is an agreement between…

Buyer: Optionee & Seller: Optionor

In a property options agreement, the seller grants to the buyer the exclusive and irrevocable right to purchase a property they own for a specified amount (property value) during a specified time horizon / period and under specific terms, conditions and obligations.

You are missing out if you haven’t yet subscribed to our YouTube channel.

Property Options Agreement Vs Contract Of Sale Agreement

What makes a property options agreement different from a normal contract of sale agreement is that it can be negotiated in favour of the buyer or optionee to give them the right to purchase the property without an obligation to purchase.

When negotiated correctly to the buyer’s advantage, the beauty of a property option lies in the buyer (optionee) being able to lock in a property value in future for a specific time period (option term).

And then be able to control the property to add value to the property by way of permitting or development approval and then on sell it or assign the option to someone else without having to settle on the property.

And do all this while being able to legally pull out of the options contract or deal without repercussions during the option term.

Contract Of Sales are different because they go unconditional after a period of time and there is no way to pull out of the contract once they are unconditional.

3 Components Of A Property Options Contract

- Option Fee / Premium - Fees in exchange for time & control.

- Option Term - the time period during which the option can be exercised.

- Property Value - The negotiated value of the property when the option is exercised.

Benefits Of Property Options

Property Options are a great way to gain control of the property and profit from that property without using significant capital of your own.

It minimizes risk because it gives the buyer an out or a get out of jail free card if the buyer chooses to as well as create a huge leverage for them.

This massive leverage can enable a buyer to have multiple property option deals simultaneously with the same amount of money.

Types Of Property Options

Property Options give the buyer control of the property in exchange for an option fee to achieve certain objectives in a specified period of time.

Put Options

If you are the buyer or optionee, this is the type of option you need to be wary of. And if you are the seller or optionor you would want to make sure that you have the put option. Hence the need to arrive at a negotiated sweet spot in terms of option fee, time horizon and property value for the options agreement.

Put options put the control back in the seller’s hand and give them the right, but not the obligation, to force the buyer or optionee to purchase the property at a set price, within a specified time period and under specific terms and conditions.

Put options are better known as a financial market derivative, however, they are not very common in a real estate transaction.

Call Options

Call Options on the other give the buyer the right, but not the obligation, to purchase the optioned property at a set price, within a specified time period under specific terms and conditions.

For a property developer looking to flip, develop or control a property for profit and on-sell it without actually closing the sale or settling on the property, call options must be part of their arsenal.

Call options are designed to advantage the buyer rather than the seller. Therefore, having negotiation & entrepreneurial skills to convince the seller to sign a call option on their property is an invaluable skill and starts with identifying the needs of the seller.

Property Option Scenario

Imagine yourself in their shoes… you as a real estate developer are looking to secure an option on their property. You have identified that you can add value to their property by changing the zoning or getting a permit that maximizes their properties potential value.

You have figured out that it will cost X but once you have the permit or development approval and you can on-sell it for X+50%. You need 12 months to get the site permitted and sold. So you need to convince the seller to give you a property option on their site for you to be able to get the permit & on-sell it before the option expires.

What’s In It For You - The Buyer (Optionee)?

This negotiation could take many forms and could include offering the seller an above market price in exchange for time, or sharing a percentage of the profit, or sharing a fixed amount of profit you make.

By entering into a call option you the developer in effect take control of the property without having to own it. The seller on the other hand will continue to live in it if that’s the case and will have to continue to pay rates, property taxes, maintenance costs and their current mortgage if there is one.

All you have done is risked a small option fee to control the property for a period of time and you will on-sell the property at a profit before the option expires.

What’s In It For The Seller - The Optionor?

From the seller perspective, this can be lucrative if they do not have the money, means or knowledge to do what you are doing i.e. adding value to their site themselves.

They get an upfront fee which can prove to be a cash injection for them to pay down an existing debt or to go on a holiday, whatever their need may be at the time.

Power Of Leverage

The leverage power of a call option can be huge. For a small option premium, the developer can potentially control a property worth thousands or millions of dollars.

A smart developer can control and profit from millions of dollars worth of property with a minimum upfront outlay and without ever purchasing them with their downside risk limited to the amount spent on adding value to the site + the options fee.

Put and Call Options In Conjunction

Put and Call options when used in conjunction give the seller the right, but not the obligation, to sell and the Buyer the right, but not the obligation, to buy the property.

A put and call option is generally structured such that the buyer’s option term expires before the seller’s option period. If the buyer fails to exercise their call option to purchase then the seller still has time to exercise their put option to sell. This has the effect of the seller forcing the buyer to buy.

Hence my reason to caution you as a property developer to not sign a put option unless you are 100% sure that you can and or don’t mind settling on the property, if required.

Common Property Option Types & Negotiated Terms:

As I mentioned earlier a property option is an agreement between a buyer and seller and a property options agreement can be negotiated to include terms and conditions that both parties can agree on, which presents a multitude of options that can be drafted into an options agreement.

Purchase Option

An option followed by a contract of sale, which does give the buyer the right to settle / close the sale at the end of the option period or not. The buyer can use the option agreement to delay the settlement.

Buy Back Option

Apart from using a put option, the seller can also haven an option to buy back the option at an agreed property value.

Listing Option

The buyer could get a listing option so they can on-sell the site with or without adding value at a higher price.

Management Option

The buyer or seller could negotiate a management option which would give them an option to purchase in a management agreement and or claim the management rights of the property.

One of my fellow developer friends recently negotiated the management rights for 65 self service apartments from another developer.

Payment Plan Option

You can negotiate an instalment plan with the seller to pay off the property in monthly or annual payments over a period of time.

Shared Capital Gains Option

Where both parties can share the uplift in value based on negotiations.

Access To Assets

Access to soil, rock, timber or chattels during the options period. If the seller does not live on the site, the buyer can negotiate to excavate & sell rock on site during the option period.

As long as the property developer can negotiate with the seller, they can have various terms in the options agreement to suit them whether to fund the project or add value to the site.

Lease Options

Lease options are similar to “rent to buy” agreements. A Lease option can be put in place when a property option agreement is combined with a rental lease agreement.

This enables the option holder to not only control the property for a specified period before purchasing it but to also occupy it under the terms of the lease.

Lease Options are common with rehabilitation entrepreneurs. Lease Options enable them to first lease the property and over a period of time they can slowly refurbish the property while living in the property. Once they are finished with the rehabilitation and their option period is coming to an end, they can simply sell the property and move on.

What’s In A Property Options Agreement?

I cannot reveal the intricate details of my property options agreement, but I am including some excerpts from one of my property options agreement that you can reference as a property options contract template.

All property options agreement clauses been converted to text for easy reading.

A Property Options Contract Template Would Include The Following…

Party Details

Details of both parties, their individual names or the names of the entities that are entering into the agreement.

Options Premium Or Options Fee

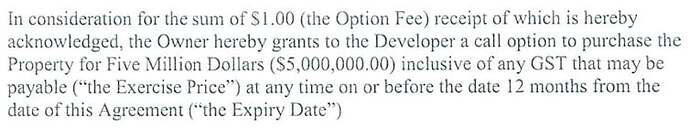

In the Options Fee clause example below, I only paid $1 as the option premium for a $5m property.

In consideration for the sum of $1.00 (The Option Fee) receipts f which is hereby acknowledged, the Owner hereby grant to the Developer a call option to purchase the Property for Five Million Dollars ($5,000,000.00) inclusive of any GST that may be payable (“the Exercise Price”) at any time on or before the date 12 months from the date of this Agreement (“the Expiry Date”).

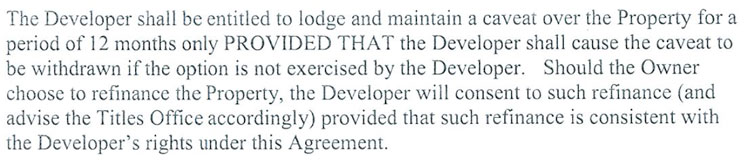

Security For The Property Developer

The Developer shall be entitled to lodge and maintain a caveat over the Property for a period of 12 months only PROVIDED THAT the Developer shall cause the caveat to be withdrawn if the option is not exercised by the Developer.

Should the Owner choose to refinance the Property, the Developer will consent to such refinance (and advise the Titles Office accordingly) provided that such refinance is consistent with the Developer’s rights under this Agreement.

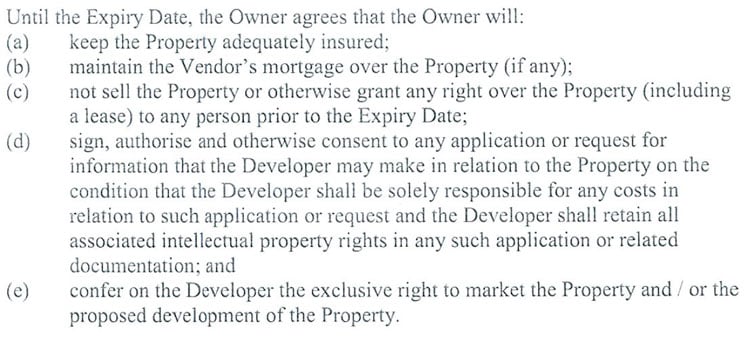

Sellers / Owners Obligations

Until the Expiry Date, the Owner agrees that the Owner will:

(a) keep the Property adequately insured;

(b) maintain the Vendor’s mortgage over the Property (if any);

(c) not sell the Property or otherwise grant any right over the Property (including a lease) to any person prior to the Expiry Date;

(d) sign, authorise and otherwise consent to any application or request for information that the Developer may make in relation to the Property on the condition that the Developer shall be solely responsible for any costs in relation to such application or request and the Developer shall retain all associated intellectual property rights in any such application or related documentation; and

(e) confer on the Developer the exclusive right to market the Property and/ or the proposed development of the Property.

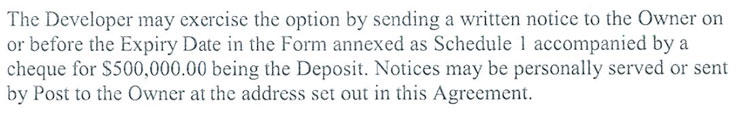

Exercising The Option

The Developer may exercise the option by sending a written notice to the Owner on or before the Expiry Date in the Form annexed as Schedule l accompanied by a cheque for $500,000.00 being the Deposit.

Notices may be personally served or sent by Post to the Owner at the address set out in this Agreement.

Extra Security For The Developer

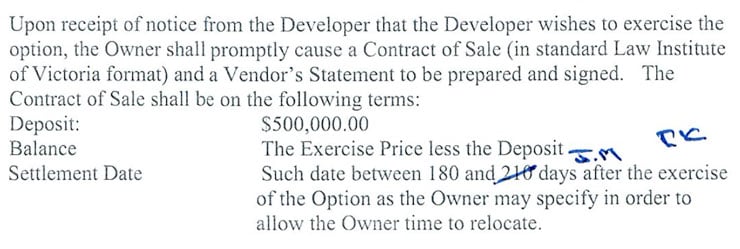

Upon receipt of notice from the Developer that the Developer wishes to exercise the option, the Owner shall promptly cause a Contract of Sale (in standard Law institute of Victoria format) and a Vendor’s Statement to be prepared and signed. The Contract of

Sale shall be on the following terms:

Deposit: $500,000.00

Balance: The Exercise Price less the Deposit

Settlement Date: Such date between 180 and 210 days after the exercise of the Option as the Owner may specify in order to allow the Owner time to relocate.

Option To On-Sell The Property Option

The Owner warrants that the Vendor’s Statement, which shall be provided by the Owner when the contract of sale is signed, shall not contain any unusual expense, encumbrance, covenant or other factor that may adversely impact the market value of the property that has not previously been disclosed by the Owner to the Developer in writing.

Should there be any such non-disclosure, the Developer shall be entitled to terminate this Option Agreement and recover from the Owner any Option Fee paid and other expenses incurred by the Developer in relation to the Property.

The Owner grants a charge over the Property to secure any monies owed to the Developer under this clause or otherwise under the terms of this Agreement or in relation to the Property.

Nominating Property Option Beneficiary

The Developer may assign the benefit of the Option to a third party by written notice to the Owner. The Developer may increase the exercise price paid by the third party on the condition that the Developer indemnifies the Owner against any liability for stamp duty.

Owner / Seller Selling The Property To Third Party

Should the Owner sell the Property to a third party pursuant to clause 8 or otherwise the Developer shall be entitled to the amount by which the contract price exceeds the Exercise Price.

Binding Property Option

This Option Agreement shall be binding upon the parties and their respective heirs, administrators, successors and assigns.

Obligation To Facilitate

The parties shall do such acts and sign such documents as may be reasonably necessary or desirable from time to time to give full effect to this Option Agreement and, after exercise of the option, to facilitate the sale of the Property and the settlement of that sale.

Confidentiality Clause

The parties agree that the terms of this Agreement and any plans or proposals for the development of the Property are and shall remain confidential.

To Each Their Own

The parties shall pay their own legal and other costs of and in relation to the negotiation, preparation and execution of this Agreement.

Option For The Seller To Partake In Development

The Owner may elect to invest in the development of the Property but the parties acknowledge that there is no binding offer or agreement at the date of this Agreement.

If The Developer Does Not Exercise The Option

If the Developer decides that the Developer does not intend to exercise the Option then the Developer shall advise the Owner of this in writing as soon as practicable and the Developers rights in relation to the Property under this Agreement shall be at an end.

Developers Obligations

The Developer shall at all times ensure that the Developer does not obstruct or otherwise adversely impact the business being conducted by the Owner at the Property prior to settlement of the Developer’s purchase of the Property.

Governing Law

This Option Agreement shall be governed by the laws and courts of the State of Victoria.

How To Finance Your Property Development Project?

And Other Books On Real Estate Development Finance

Includes 5 x detailed eBooks

✓ Property Development Finance: Easily Finance Your Project? (26 Pages)

✓ 10 Big (Financial) Property Investing Mistakes Made By Investors (58 Pages)

✓ 10 Finance Options For Your Next Property Development Project (29 Pages)

✓ What Is Equity Finance And How Does It Work? (42 Pages)

✓ Property Investment Finance - Ultimate Guide

Property Option Secrets

There are 2 property option secrets to making sure that you are successful at securing a property option.

Property Options Secret # 1

Never Involve A Real Estate Agent When Negotiating Property Options

Why? Because the inherent nature of property options is that the seller gets an option fee in exchange for time.

A real estate agent on the other hand would usually get a commission when the property is sold, so it’s never a good outcome for them if instead of a sale, an options agreement is negotiated between the seller and the buyer.

Because this delays their pay day. So if you have a real estate agent involved in the deal, they would do everything in their power to make sure that an options agreement is never negotiated. So to begin with you are already fighting external forces.

Don’t get me wrong, there are always real estate agents that know you and if you have bought from them before, they would rather bring the project to their regular buyer than to go through the full marketing campaign.

If they can quickly offload a site, they would be happy to bring the site to you, provided you are not a tyre kicker. However, you will need to sweeten the deal for them and find a way to remunerate them even if an option is being signed.

However, if a real estate agent is not involved, it usually means that the site you are after is not on the market or is not yet listed. Which brings us to the second property options secret.

Property Options Secret # 2

Sourcing Off Market Sites

Source Off Market Sites For Real Estate Development i.e. sites that are not yet listed and are not on the market. This helps in 3 ways:

- You do not have competition i.e. you are probably the only one talking to the seller / vendor.

- You are not fighting external forces like real estate agents.

- And finally, it works best because the seller and vendor knows comparatively less about their site than they would if the site was on the market.

Here are 3 ways to Source Off Market Sites For Your Next Property Development Project

Door Knocking

There are three ways to source off-market sites. The number one way is if you go door knocking, and a lot of places do not allow door knocking to be able to find out whether or not that site’s available.

Letter Drop

An alternative to door knocking is that you can do a letter drop. You can send in a letter, asking people if they want to sell, what price they would want to sell, and so on.

Secret Agents

The second way of getting an off-market site is if you’ve got some sort of a rapport with an agent that you work with.

The only way that can happen is if you are concentrating on an area, and you spend time to build a rapport with your local agent. Quite often, they will come up with a site that they haven’t even listed as yet on the market.

That way, you can actually talk to them and say, “Look. If you find something like that, bring it to me.” They can then help you get a site that’s actually not listed, which basically means you’re cutting the competition out, and you’re getting in there before somebody else gets there.

Network

Have you got a network? How do you get a network? Well you’ve got to be in the industry. You have to go to different networking events. Networking takes a little longer but you have to start.

I myself started out by sending out letters. I had three people call me. One of them couldn’t pay the mortgage, so he just wanted to sell his house.

Continued at…

Property Options – An Ace Up The Developer’s Sleeve [Part 2-2]