Without A Degree…

How To Become A Property Developer & Other Similar Questions answered in this section:

- How to Become a Real Estate Developer?

- How to be a property developer?

- How to be a real estate developer?

- What does a property developer do?

In order to become a developer real estate, you have to be an entrepreneur who understands the complete property development process as well as the financial and development related issues.

Possess knowledge and skills to conduct financial feasibilities, due diligence, organise development finance, setup development entity structures, conduct market research and understand property economics, i.e. the demand and supply of stock surrounding the development.

Before we find out about how to become a property developer, I think we should first understand…

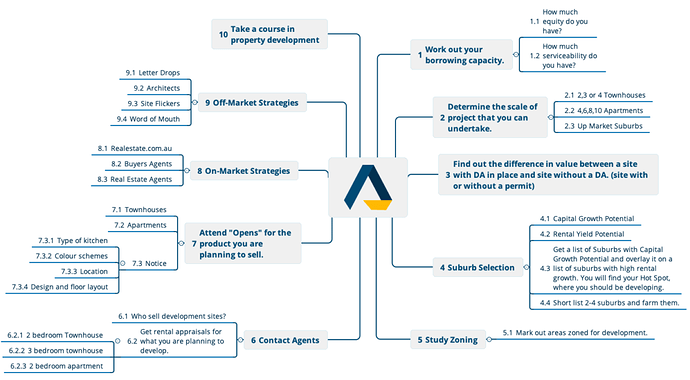

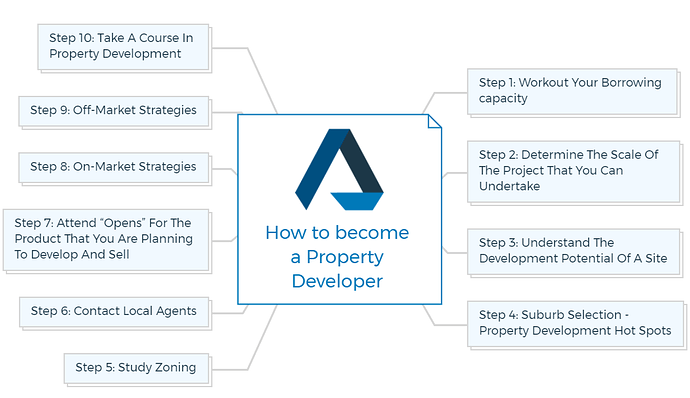

Step 1: Workout Your Borrowing capacity

Before you can even think about getting into property development, you as a property developer must determine your current financial position.

Your property development financial position is the sum of cash that you have in your bank & your total borrowing capacity. To determine your borrowing capacity, you must answer the following questions:

- How much equity do I have?

- What is my borrowing capacity, i.e. how much serviceability (your capacity to service the debt) do I have?

- How much money do I have?

You are missing out if you haven’t yet subscribed to our YouTube channel.

For Some, A More Appropriate Question Would Be…

How Much Money Do I Need To Start Property Development?

You can be part of a development with other property investors and in this scenario, you may only require $100,000 to $150,000 or even less in some scenarios, especially if you are part of a property syndicate and depending upon the financial compliance requirements in your country.

However, if you are planning on doing your own developments, your equity or cash contribution will depend upon your borrowing capacity and the size of your development.

A developer’s money requirement for a project depends upon the maximum amount they can borrow for the development, in other words the Loan to Value Ratio offered by your lender for your development.

For example, let’s say the total development cost of your project is $1,000,000 and the maximum that your lender will lend you is $700,000. This means that you will need $300,000 of your own money to get into your development project.

For more details, please read How to finance your property development project? 1

Step 2: Determine The Scale Of The Project That You Can Undertake

The above questions will help you determine the size of your development financially. It will help you determine whether or not you can initiate a 2, 3 or 10 Townhouse / Apartment / Unit development.

This will also be a deciding factor when selecting the location for your developments. The scale of your project constitutes the total costs which include land value.

By determining the size and scale of your development depending on your financial position (total cash in bank + borrowing capacity), you will be able to determine whether you can develop in a low, medium or up market location.

Step 3: Understand The Development Potential Of A Site

Understand the difference between the value of a site that has a DA (Development Approval aka Town Planning Permit) and the site without one. You can increase your understanding by studying the local zoning maps.

The development potential of property, whether its residential, commercial or industrial - will be determined based on its location or suburb, improvements made or potential for improvements, zoning and overlays, local employment and unemployment, and the availability (or lack of availability) of other similar properties i.e. supply and demand of competing stock.

Step 4: Suburb Selection - Property Development Hot Spots

Your next step is to determine the right suburb or location for your development. Will you be targeting a location for its capital growth potential or rental yield?

To find out the best location or your property investment hot spots, get a list of suburbs with Capital Growth Potential and overlay it on a list of suburbs with high rental growth. You will find your HotSpot, where you should be developing.

Short list 2-4 suburbs and farm them. Farming a location means that you monitor these locations for price fluctuations, design intent, neighbourhood character, what’s selling, what’s not and the historical sold prices in the area.

Step 5: Study Zoning

Spend some time to study your local town planning and understand the zoning determined by your LGA (Local Government Area) or council.

A good understanding of your local town plan will help you determine the highest best use for your development site and its potential.

Step 6: Contact Local Agents

Find out who are the agents, who sell development sites in your area. Get rental and market appraisals for similar kinds of properties that you are planning to develop.

This exercise will give you a very good understanding of the potential sites available on the market as well as the end sale value of your developed stock.

Step 7: Attend “Opens” For The Product That You Are Planning To Develop And Sell

You must attend the opening for the existing stock that is on sale in the market. This will give you an understanding of what your target audience / potential clients are looking for.

You can very easily determine the type of kitchen accessories liked by potential buyers as well as colour schemes, preferred streets, design and floor layouts.

Step 8: On-Market Strategies

When looking for potential sites, you can go with two options. First one being, the On-Market Strategies. These are potential development sites that are available on the market and are up for grabs publicly.

The downside is that you will be competing with other people who also wish to become property developers and are looking for their first development.

The upside is that although the site is publicly listed on property selling websites and with agents, more information about the property will be available publicly.

You can approach buyers agents, real estate agents and check out the property listing websites in your area.

Step 9: Off-Market Strategies

You can also try off-market strategies to acquire a site by contacting architects in your area, flippers (people who acquire a site, add value and simply flip them), word of mouth and by doing a letter drop in your area.

The biggest upside to this strategy is that you have the time to negotiate price and favourable terms.

Step 10: Take A Course In Property Development

Here you are, you have just acquired your first property development project and are now truly on the way to becoming a property developer.

However, you now need to spend some time and invest in property development education. Property development is very similar to a business venture, only more lucrative.

And we all know the success rate of most businesses.

Since you are going to have a considerable amount of exposure in terms of your money invested and the debt required to complete a development project, I would highly recommend that you spend some time learning everything about property development.

If you are merely starting out and are looking for a short course in property development, I would recommend my Quick-Start course.

List of Property Development Courses Online

Checkout a catalogue of my property development courses before deciding which one helps you the most now.

However, if you think that you are ready and would like to know everything there is about doing small and medium size development.

I would recommend my Property Development System course, which not just teaches you the complete property development process in detail, it also gives you the two financial feasibility tools that you need in order to become a property developer.

This is a complete course in property development that simply makes you a property developer.