How do i get funding for property development

Securing funding for property development is crucial before you commence any real estate development project.

Banks have always been a significant source of funding for real estate developers and investors, but now there are many other alternatives, including second-tier banks, joint ventures, private funders, etc.

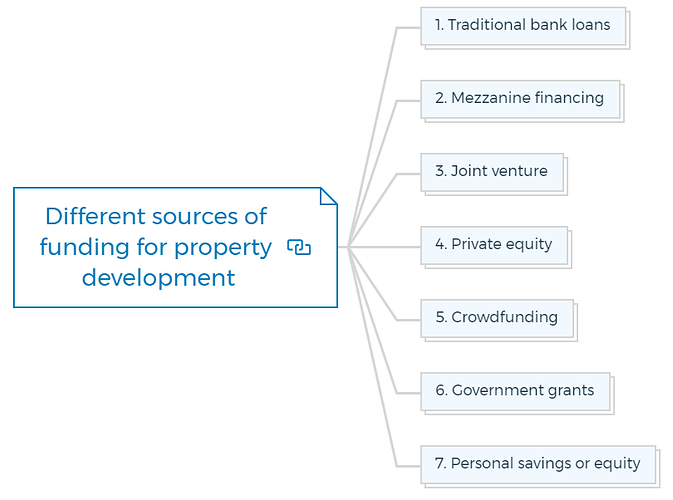

Different sources of funding for property development

There are several ways to get funding for property development, including:

1. Traditional bank loans

Real estate developers can apply for a traditional bank loan, which they can use to finance the purchase of land or existing properties or to cover the construction costs of a development project.

2. Mezzanine financing

Mezzanine financing is the best way to increase the borrowing potential of a property developer. It is a type of financing that combines debt and equity.

Developers who have exhausted all the traditional lending options and are looking for additional funding for a development project use Mezzanine financing.

Using a Mezzanine loan, you can secure 65% to 90% of your Total Development Cost.

You are missing out if you haven’t yet subscribed to our YouTube channel.

3. Joint venture

With a joint venture in real estate, two or more people can pool their resources and knowledge to make deals that would be out of their reach on their own.

In such a deal, all the parties share a project’s costs, risks, and profits. Most joint ventures start because one investor doesn’t have something that the other investor does.

This could be money, credit, experience, contacts, or assets, among other things.

4. Private equity

Developers can also raise capital from private equity firms, which are investors that provide funding in exchange for a stake in the project.

Real estate private equity (REPE) firms get money from outside investors called Limited Partners (LPs). They then use this money to buy and develop properties, run and improve them, and sell them for a profit.

Learn More

5. Crowdfunding

Developers can also consider crowdfunding as an alternative funding source, allowing them to raise capital from many individuals.

Crowdfunding for real estate involves a lot of small investments from many people who want to buy or improve real estate.

A crowdfunding platform makes this possible by vetting investment and development projects and connecting the investors.

How To Finance Your Property Development Project?

And Other Books On Real Estate Development Finance

Includes 5 x detailed eBooks

✓ Property Development Finance: Easily Finance Your Project? (26 Pages)

✓ 10 Big (Financial) Property Investing Mistakes Made By Investors (58 Pages)

✓ 10 Finance Options For Your Next Property Development Project (29 Pages)

✓ What Is Equity Finance And How Does It Work? (42 Pages)

✓ Property Investment Finance - Ultimate Guide

6. Government grants

Another great option to get funding for property development is Government Grants. Government grants and incentives are easily available for real estate development projects.

7. Personal savings or equity

Equity is the difference between the current market value of a property and the remaining balance on the home loan.

Developers can use their savings or equity in their existing properties as a deposit or collateral to secure a development loan.

These are some of the popular options for property development financing. You can check the detailed article: How to finance your property development project.