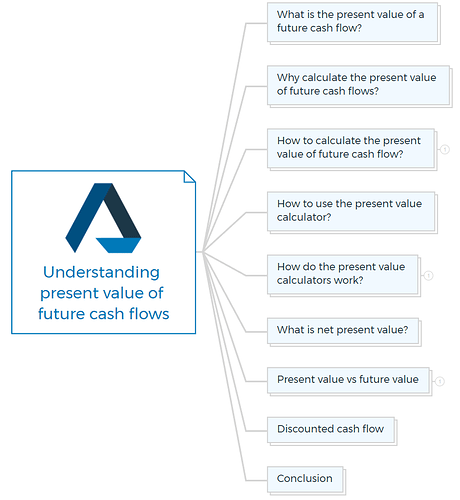

What is present value in finance, and how is it calculated?

Understanding the present value of a future cash flow can help make financial decisions. This method uses future cash flows and an interest rate to value a cash flow today.

What is the present value of a future cash flow?

Present value (PV) is the current value of a future sum of money or cash flow at a set rate of return. Considering the time value of money, the present value of a future cash flow is its value today.

The current value of future cash flows decreases with the discount rate. Valuing future earnings or debt obligations requires choosing the right discount rate.

Inflation, interest rates, and other variables affect money’s worth. Given the expected interest rate, the present value is the future cash flow in today’s dollars.

You are missing out if you haven’t yet subscribed to our YouTube channel.

Why calculate the present value of future cash flows?

The main reason why property investors calculate the present value of future cash flow is that income-producing properties generate cash flow each year if maintained and operated correctly.

These investment properties produce the last big cash flow when investors or developers sell them. They want to know the total value of all those future cash flows in today’s dollars. At a discount rate, their investment is worth that.

There are several other reasons to calculate the present value of future cash flows -

- It can help investors choose an investment option. By calculating the present value of predicted future cash flows, investors may compare the prospective return on investment to the cost of capital and make informed investment decisions.

- Financial planning requires calculating future cash flow present values. If you’re saving for retirement, knowing the present value of your expected future cash flows, such as pension payments or social security benefits, might help you decide how much to save now.

How to calculate the present value of future cash flow?

Present value of future cash flow formula:

PV = FV/(1 + r)^n

Where:

PV = Present Value

FV = Future Value

r = Interest Rate

n = Periods

Example of present value of future cash flow calculation

Say you expect a $10,000 cash flow in three years at 5% interest.

The present value of this cash flow is

$10,000 / (1 + 0.05)^3 = $8,530.23.

Given a 5% interest rate, $10,000 in future cash flow is worth $8,530.23 today.

How to use the present value calculator?

If you are not a math genius, use the present value calculator to calculate future cash flows. Online calculators let you enter future value, interest rate, and number of periods to calculate instantly.

Learn More

How do the present value calculators work?

Present value calculators determine the present worth of future cash flows. They calculate the time value of money using a mathematical formula that accounts for inflation and interest rates.

Present value calculators usually require these inputs:

Future value: Your expected future income.

Time period: This is the length of time until you receive the cash flow.

Interest rate: Your money’s growth rate.

After entering this information, the present value calculator will compute the present value using the following formula:

PV = FV/(1 + r)^n

The present value calculator will calculate the future cash flow’s present value depending on your input.

Example of present value calculation for future cash flows

You predict a $10,000 cash flow in five years at 4% interest. Enter $10,000, 5 years, and 4% into a present value calculator.

The calculator would then apply the formula above to compute the present value of the future cash flow; for this case, it would be $8,433.09.

Financial decision-makers can use present value calculators. They can help you compare the present value of different investments or cash flows and decide where to invest.

Present value calculations depend on future interest rates and inflation; therefore, they may be inaccurate. Before using present value calculations, consider their limitations and risks.

Property Development Feasibility Study Bundle

Includes 5 x detailed eBooks (193 pages)

✓ Property Development Feasibility Study [THE KEY] - (45 pages)

✓ Real Estate Development ProForma - Ultimate Guide - (39 pages)

✓ Residual Value Of Land Vs Profit Margin - The Winner - (24 pages)

✓ Preliminary Development Feasibility Assessment - (35 pages)

✓ How To Choose a Property Development Feasibility Template? - (50 pages)

What is net present value?

Another critical notion is the net present value (NPV). The initial cost of an investment is subtracted from the sum of the present values of the expected future cash flows to compute NPV.

The investment may be a good investment if the NPV is positive and the return exceeds the cost of capital.

Present value vs future value

Given the predicted interest rate, the future value is connected to the present value of a future cash flow.

Investment and financial decisions often use present and future value. Future value is the future value of an investment or cash flow, while present value is its current value.

Calculate the present value and future value

Present value formula:

PV = FV/(1 + r)^n

Where PV is the present value, FV is the future value, r interest rate, and n periods.

The present value calculation accounts for inflation and the opportunity cost of not having money.

Future value formula:

FV = PV x (1+r)^n

Where FV is the future value, PV is the present value, r is the interest rate, and n is the number of periods.

The present value and predicted growth rate are used to calculate the future value of an investment or cash flow.

The present value represents a future cash flow in today’s dollars, whereas the future value represents today’s money in the future, given the predicted interest rate.

Discounted cash flow

Discounted cash flow (DCF) analysis uses present and future value to evaluate an investment’s value. DCF analysis discounts future cash flows to their present value using a time-value-of-money discount rate.

Conclusion

In conclusion, understanding the present value of future cash flows is essential for making informed financial decisions. It is an effective way to determine the value of cash flows at a particular time by considering the time value of money and discount rates.

Calculating the present value of future cash flows can help investors choose the right investment option, while financial planning requires it to make better retirement savings decisions.

Present value calculators are an excellent tool for predicting future cash flows, while the net present value is essential for determining if an investment is good or not. Moreover, discounted cash flow analysis is an efficient way to evaluate the value of an investment.

Property Finance Made Easy

We specialise in Development funding | Commercial finance | Construction loans | Portfolio refinancing & Property investment loans in Australia.

Click Here to strategise with Amber