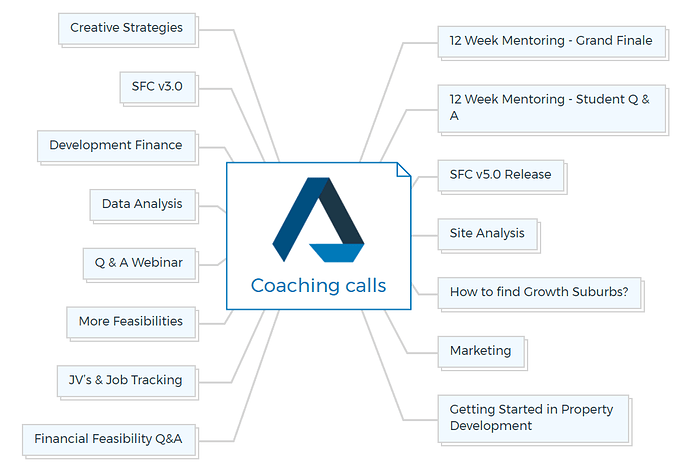

Coaching calls

12 Week Mentoring - Grand Finale

Here is a detailed walkthrough and discussion on various aspects of real estate development, focusing on the planning, financial, and strategic elements involved in completing successful property development projects.

It covers several key topics, providing viewers with a comprehensive understanding of the complexities and considerations of real estate development.

Key Topics Covered:

No Money Down Deals

The conversation starts with a discussion about “no money down” deals, emphasizing the importance of understanding investor roles, the use of trusts, and the mechanics behind no money down transactions.

Project Management Tools

A mind mapping software called Xmind is recommended for project planning and management, highlighting its utility in bringing clarity and organization to the development process.

Real Estate Development Strategies

The video delves into strategies for managing real estate development projects, including dealing with land valuation, development approvals (DA), and tax implications associated with primary residences and capital gains tax. It offers insights into optimising tax liabilities and structuring projects for financial efficiency.

Investor Relations and Funding

The importance of clear communication with investors is stressed, advising on how to present project reports and financial feasibilities without seeming condescending. The need for transparency with investors about the risks and potential returns of a project is underscored.

Project Feasibility and Market Analysis

The mentor advises on conducting thorough market research and financial feasibility studies. This includes considering various scenarios, like changes in market conditions, to ensure investors are well-informed about potential risks and rewards.

Legal and Contractual Considerations

The discussion covers the significance of engaging specialised legal counsel to manage risks and protect interests through well-drafted contracts.

Construction Management and Contingencies

The video emphasises the importance of accounting for contingencies in project budgets and managing construction timelines and costs effectively.

Market Trends and Projections

Lastly, you will get an overview of the current market trends in Melbourne, discussing the implications of population growth on property demand and values.

Insights Based on Numbers

- A detailed example is provided on calculating tax implications and profitability for a development project, illustrating the importance of careful financial planning and the impact of taxes on project returns.

- The discussion includes a practical case study, estimating profits from a development project considering factors like land valuation, development potential, and tax implications.

- The mentor highlights the utility of project contingency funds, recommending a 5% contingency for construction costs to account for unforeseen expenses.

Frequently Asked Questions

How do “no money down” deals work in real estate development, and what are their legal and financial implications?

Understanding “No Money Down” Deals

These deals are structured to allow the developer to initiate a real estate project without initially investing their own capital. Instead, the funding is sourced from investors who provide the financial backing needed to purchase land or property and cover initial development costs.

Use of Trusts

The video discusses how trusts can be effectively utilized in “no money down” deals. Trusts act as legal entities that can hold property and manage funds on behalf of the beneficiaries. In the context of real estate development, a trust can be used to manage the investment made by backers, providing a layer of legal protection and structured management for the project’s finances.

Legal and Financial Implications

The legal implications revolve around the structuring of agreements that define the terms of investment, the roles of each party, and the distribution of profits upon the completion of the project. It’s crucial for these agreements to be clear and comprehensive to avoid potential disputes. Financially, “no money down” deals require meticulous planning to ensure the project is viable and offers a return on investment that justifies the risk taken by investors. The video emphasises the importance of transparency with investors regarding the project’s feasibility, potential risks, and expected outcomes.

Investor Relations

A key aspect of successfully managing “no money down” deals is maintaining open and honest communication with investors. This includes presenting detailed project reports and financial analyses that accurately represent the project’s potential and risks. The video suggests using tools and software for project management and financial planning to enhance clarity and organisation.

What strategies can be employed to optimise tax liabilities in property development projects?

Capital Gains Tax Considerations

A significant portion of the discussion centres on understanding the impact of capital gains tax (CGT) on property transactions, especially for primary residences (PPR). The video outlines strategies for property developers to work around CGT, particularly when dealing with development projects that involve primary residences. It emphasises the importance of valuation and timing, suggesting that developers obtain a property valuation before and after obtaining development approval (DA) to leverage tax exemptions related to primary residences.

Valuation and Development Potential

The video discusses the necessity of getting a professional valuation to establish a baseline for the project’s initial value and its potential post-development value. This step is crucial for tax planning, as it can significantly affect the CGT calculations and liabilities.

Entity Structure and Tax Planning

Another strategy highlighted involves careful consideration of the entity structure through which the development project is managed. The video advises on setting up separate entities for different aspects of the development process, such as ownership, management, and investment holding. This approach can provide flexibility in managing tax liabilities, enabling developers to distribute income and profits in a manner that minimises the overall tax impact.

Engaging with Tax Professionals

The importance of consulting with tax professionals is underscored with a recommendation for developers to work closely with accountants and tax advisors. These professionals can provide tailored advice on structuring the project and transactions to optimise tax outcomes, taking into consideration the specific circumstances of the project and current tax legislation.

Investor Relations and Transparency

Transparency with investors regarding tax implications and strategies is also emphasised. The video suggests that clear communication about how the project is structured to manage tax liabilities can build trust and confidence among investors, ensuring they are informed about the potential financial outcomes of their investments.

How do market research and financial feasibility analysis influence the planning and execution of real estate development projects?

Importance of Market Research

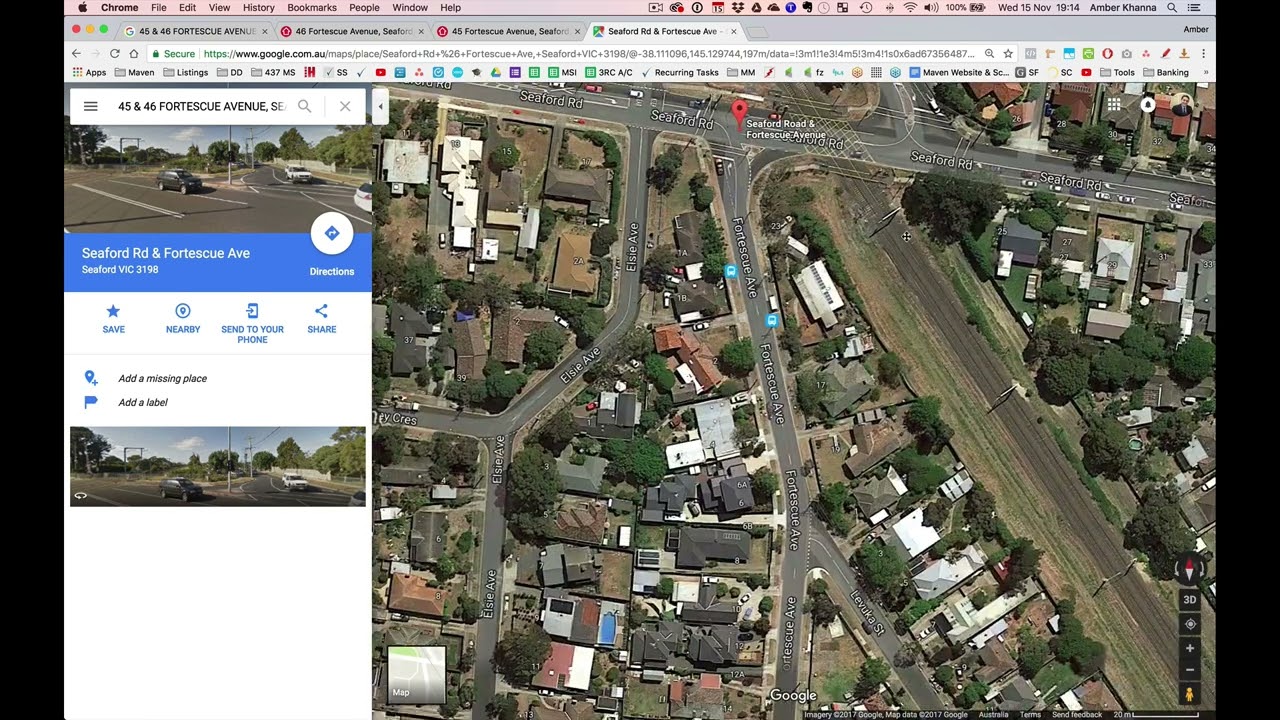

Market research is highlighted as a foundational step in the development process, offering insights into current market conditions, consumer preferences, and potential demand for the proposed development. The video discusses how developers should conduct thorough market research to identify trends, understand the competitive landscape, and assess the viability of specific development projects in targeted areas. It suggests leveraging market research to make informed decisions about location, project size, and the types of properties to develop, ensuring alignment with market demand.

Financial Feasibility Analysis

The video details the process of conducting a financial feasibility analysis, emphasizing its importance in evaluating the potential financial performance of a development project. This analysis involves calculating anticipated costs, including land acquisition, construction, marketing, and legal expenses, against expected revenues from the sale or lease of the developed property. The goal is to determine the project’s viability, profitability, and return on investment, guiding developers on whether to proceed, modify, or abandon a proposed project based on financial projections.

Scenario Planning

A notable aspect of the discussion is the emphasis on scenario planning within the financial feasibility analysis. The video advises developers to consider various scenarios, including best-case, worst-case, and most-likely outcomes, factoring in potential changes in market conditions, cost overruns, and delays. This approach allows developers to assess risks, prepare contingency plans, and make informed decisions that account for uncertainties in the development process.

Strategic Decision-Making

Market research and financial feasibility analysis are presented as critical tools for strategic decision-making in real estate development. The video highlights how these analyses inform key decisions related to project scope, design, pricing strategies, and marketing approaches. By grounding these decisions in solid research and financial projections, developers can enhance the likelihood of project success and profitability.

Investor Communication

Finally, the video underscores the importance of using market research and financial feasibility analysis to communicate with investors transparently. Presenting detailed research findings and financial projections helps build investor confidence, providing a factual basis for the project’s anticipated returns and risks. This transparency is crucial for securing investor support and funding for the project.

What are “no money down” deals in real estate?

“No money down” deals refer to real estate transactions where the buyer invests little to no upfront capital. The discussion in the video emphasizes understanding the roles of investors, using trusts, and the mechanics behind these types of transactions to successfully complete a deal without a significant initial investment.

How important is clear communication with investors?

Clear communication with investors is crucial. The video stresses the importance of presenting project reports and financial feasibilities in a straightforward manner, without seeming condescending. It emphasizes the need to be transparent about the risks and potential returns of a project to maintain trust and confidence.

What is project feasibility and market analysis?

Project feasibility and market analysis involve conducting thorough research to assess the financial viability and market demand for a real estate development project. The mentor advises considering various scenarios, like market condition changes, to inform investors about potential risks and rewards adequately.

Why is legal counsel important in real estate development?

Engaging specialised legal counsel is vital to managing risks and protecting interests in real estate development. The video highlights the significance of well-drafted contracts to ensure that all parties are clear on their obligations and that protections are in place to handle potential disputes or challenges.

What are contingencies in construction management?

Contingencies in construction management refer to budget allocations for unforeseen expenses. The video underscores the importance of accounting for these contingencies, recommending a 5% contingency for construction costs to cover unexpected costs effectively.

How are tax implications and profitability analysed?

The video provides a detailed example of calculating tax implications and profitability for a development project. It illustrates the importance of careful financial planning and highlights how taxes can impact the returns on a project. This analysis helps viewers understand the financial intricacies of real estate development.

Test Your Knowledge

1. What is a key element of “no money down” real estate deals?

A) Large upfront payments

B) Understanding investor roles and the use of trusts

C) Avoiding legal counsel

D) Ignoring market trends

2. Which software is recommended for project planning and management in real estate development?

A) Microsoft Excel

B) Adobe Photoshop

C) Xmind

D) AutoCAD

3. What is NOT a focus area in the real estate development strategies discussed?

A) Land valuation

B) Development approvals (DA)

C) Color schemes for interiors

D) Tax implications

4. The importance of clear communication with investors is to:

A) Confuse them with complex terminology

B) Present project reports and financial feasibilities clearly

C) Hide potential risks

D) Only highlight potential returns

5. In project feasibility and market analysis, what is crucial?

A) Guessing market conditions

B) Ignoring competitor activities

C) Conducting thorough market research

D) Assuming financial feasibility without analysis

6. Why is engaging specialised legal counsel important in real estate development?

A) To bypass legal requirements

B) To manage risks and protect interests through well-drafted contracts

C) Legal counsel is not necessary

D) To make the project seem more prestigious

7. What percentage contingency is recommended for construction costs to account for unforeseen expenses?

A) 1%

B) 5%

C) 10%

D) 15%

8. What impact does population growth in Melbourne have on property demand and values, according to the mentor?

A) Decreases demand and values

B) Has no impact

C) Increases demand and values

D) Only affects property values, not demand

9. Calculating tax implications and profitability for a development project demonstrates the importance of:

A) Avoiding taxes

B) Guesswork in financial planning

C) Careful financial planning and understanding the impact of taxes

D) Focusing solely on construction costs

10. Which of the following is not mentioned as a key topic covered in the video?

A) The use of social media in real estate

B) No money down deals

C) Project management tools

D) Legal and contractual considerations

Answers:

- B) Understanding investor roles and the use of trusts

- C) Xmind

- C) Color schemes for interiors

- B) Present project reports and financial feasibilities clearly

- C) Conducting thorough market research

- B) To manage risks and protect interests through well-drafted contracts

- B) 5%

- C) Increases demand and values

- C) Careful financial planning and understanding the impact of taxes

- A) The use of social media in real estate