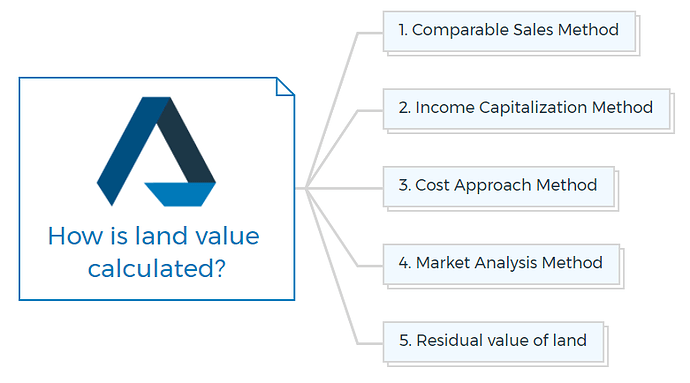

You can calculate the value of land using several different methods, depending on the purpose of the calculation and the information that is available. Some of the most common methods used to calculate land value include:

1. Comparable sales method

This method is also referred to as Comparative Market Analysis (CMA). Sometimes called Direct comparison, it is a prominent property appraisal approach.

It compares the property to recently sold properties of comparable sorts and qualities.

This land value calculation method involves comparing the sale price of similar properties in the same area to estimate the value of the land.

The land value is determined by taking the sale price of the property and subtracting the value of any improvements, such as buildings or other structures, that are on the land.

Factors commonly reviewed in this method include:

- Date of Sale

- Location of Property

- Size of the property

- Physical characteristics (clearance, access etc.)

- Amenities and services (proximity to public transport, infrastructure etc.)

- Zoning of the property

You are missing out if you haven’t yet subscribed to our YouTube channel.

2. Income capitalization method

This land value calculation method involves estimating the income that the land can generate and then applying a capitalization rate to determine the land value. The income could be derived from renting out the land, farming or any other use.

Capitalisation Rate (Cap Rate) is a ratio used to assess income-producing assets. As a percentage, the cap rate is the net operating income divided by the property’s sales price.

The Cap Rate calculation considers a property’s selling price, gross rentals, non-rental revenue, vacancy amount, and operational expenditures, offering a more accurate value estimate.

3. Cost approach method

This method estimates the cost of reproducing the land and any improvements, then subtracts depreciation. The value of the land is determined by adding the cost of reproducing the land to the value of any improvements and then subtracting any depreciation.

Property Development Feasibility Study Bundle

Includes 5 x detailed eBooks (193 pages)

✓ Property Development Feasibility Study [THE KEY] - (45 pages)

✓ Real Estate Development ProForma - Ultimate Guide - (39 pages)

✓ Residual Value Of Land Vs Profit Margin - The Winner - (24 pages)

✓ Preliminary Development Feasibility Assessment - (35 pages)

✓ How To Choose a Property Development Feasibility Template? - (50 pages)

4. Market analysis method

This method involves analyzing the land values in the area and the trends of the land market. It considers the factors that affect land value, such as location, zoning, infrastructure, and other land characteristics.

Learn More

5. Residual value of land

The residual value of the land method is a commonly used approach for estimating the land value in real estate appraisals. It is based on the idea that you can calculate the value of a property by subtracting the cost of the building and other improvements from the total value of the property.

The residual value is the difference between the total value of the property and the value of the building and other improvements.

It’s worth noting that the value of land can be influenced by various factors, including location, zoning, accessibility, topography, and environmental factors. Additionally, land value can fluctuate over time due to market conditions and other economic factors.