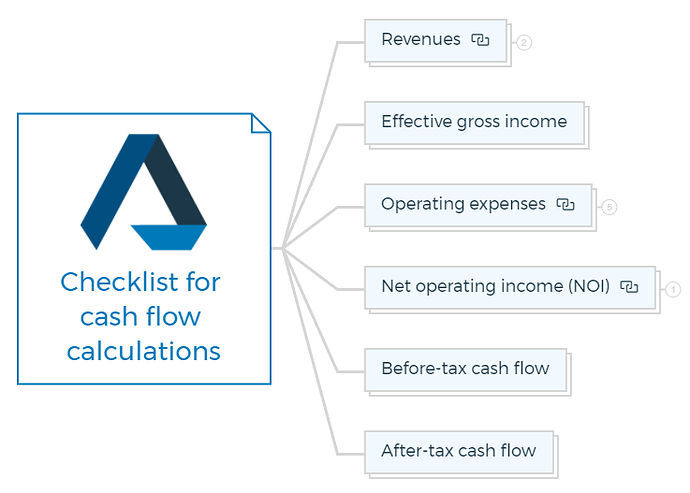

Checklist for cash flow calculations

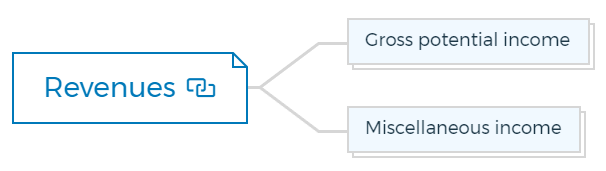

1. Revenues

- Gross Potential Income

- Miscellaneous Income

1.1. Gross potential income

The initial revenue analysis step is to calculate the property’s gross potential income. It is calculated by multiplying the total number of units by the potential rent for each unit.

Formula -

Gross Potential Income = Total Units × Potential Rent per Unit

1.2. Miscellaneous income

Miscellaneous income is the sum of all additional sources of income, such as parking fees, laundry income, or late fees.

2. Effective gross income

Effective gross income is calculated by subtracting vacancy and credit loss from the gross potential income.

Formula

Effective Gross Income = Gross Potential Income - Vacancy and Credit Loss

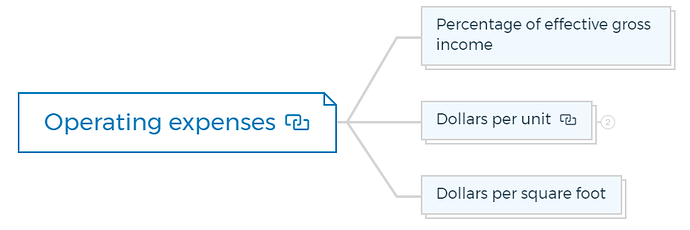

3. Operating expenses

- Percentage of Effective Gross Income

- Dollars per Unit

- Dollars per Square Foot

3.1. Percentage of effective gross income

Percentage of effective gross income is the ratio of total operating expenses to effective gross income, expressed as a percentage.

Formula

Percentage of Effective Gross Income = (Total Operating Expenses / Effective Gross Income) × 100

Learn More

3.2. Dollars per unit

Dollars per unit represents the operating expenses per unit, providing a standardized comparison across different property sizes.

Formula

Dollars per Unit = Total Operating Expenses / Total Units

3.2.1. Fixed expenses

Fixed expenses remain constant regardless of property occupancy. They include property taxes, insurance, and management fees.

3.2.2. Variable expenses

Variable expenses fluctuate with property usage. These include utilities, maintenance, and repairs.

3.3. Dollars per square foot

Dollars per square foot represents the operating expenses per square foot of the property’s total area.

Formula

Dollars per Square Foot = Total Operating Expenses / Total Square Feet

4. Net operating income (NOI)

NOI is the difference between effective gross income and total operating expenses.

Formula:

NOI = Effective Gross Income - Total Operating Expenses

4.1. Debt service

Debt service is the regular payment of principal and interest on loans.

5. Before-tax cash flow

Before-tax cash flow is the income remaining after deducting debt service from NOI.

Formula:

Before-Tax Cash Flow = NOI - Debt Service

6. After-tax cash flow

After-tax cash flow considers the impact of income taxes on cash flow.

Formula:

After-Tax Cash Flow = Before-Tax Cash Flow - Income Tax

Learn More