Your Development Strategy Framework

Development Strategy Framework [PDF]

FAQs on Real Estate Development Strategy

What is the site acquisition process in real estate development?

The site acquisition process involves evaluating a potential site for development based on several factors including infrastructure availability, topography, government and zoning regulations, town planning issues, and more. It’s the initial step in determining whether a piece of land is suitable for a proposed development project.

How does financial feasibility affect real estate development?

Financial feasibility is critical in real estate development, assessing whether a project is financially viable. This involves defining project objectives, conducting market research, analyzing comparable sales, understanding absorption rates, evaluating taxes and site-specific issues, as well as considering design trends and the area’s master plan. These factors collectively impact the project’s potential success and profitability.

What are the different ownership structures in real estate development?

Ownership structures in real estate development can vary, including corporations (LLC in the US, Pty Ltd in other countries), joint tenancy, tenants in common, limited partnerships, joint ventures, develop lease options, and develop-and-sell options. Each structure has specific implications for project management, execution, legal and tax considerations, and risk-sharing.

How do product type decisions impact real estate development?

The decision on product type — whether focusing on residential (such as multifamily units, townhouses, apartments) or commercial properties (including office spaces, industrial sites, retail, mixed-use developments, schools, and care centers) — is crucial. It significantly influences the development strategy, aligning it with market demand and investment goals.

Why are objectives and goals important in real estate development?

Understanding the social and financial objectives of a development is essential for aligning the project with the broader business plan. Objectives and goals help in setting clear targets for the project, ensuring that every aspect of the development strategy contributes to the desired outcomes.

What financial criteria are considered in real estate development?

Key financial criteria include desired development margin, return on equity, debt-to-equity ratio, and the project’s long-term strategy (whether it’s for immediate sale or to hold as an investment). These criteria are fundamental in evaluating the project’s financial health and potential for success.

How does site topography influence real estate development?

Topography, or the physical characteristics of the land, affects many aspects of development such as infrastructure development, regulatory compliance, design, and construction costs. Understanding the topography is crucial for planning, as it can significantly impact the financial feasibility and overall strategy of a development project.

What factors should influence the choice of ownership structure in a development project?

The choice of ownership structure should consider legal and tax implications, investment and financing needs, project scale and complexity, control and decision-making preferences, and future goals. This decision is strategic, impacting the project’s risk management, financial feasibility, and success from inception to completion and beyond.

How does the choice of ownership structure affect a development project?

The ownership structure affects a project’s legal and tax standing, ability to attract investment and secure financing, risk-sharing among stakeholders, and the clarity of profit distribution. It’s a foundational decision that influences the project’s governance, operational control, and financial outcomes.

Summary

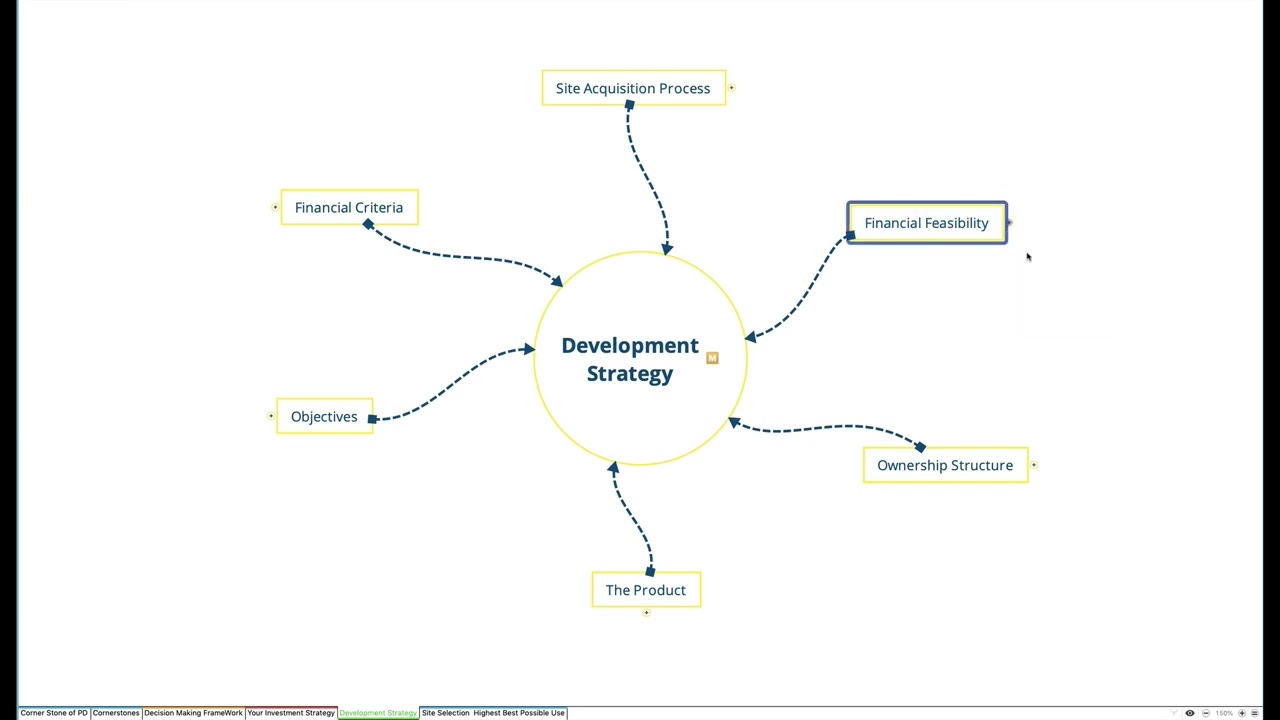

The video discusses various factors influencing real estate development strategy, emphasizing the interconnectedness of several components critical to planning and executing a development project.

It covers the significance of…

Site Acquisition Process

It involves assessing the suitability of a site based on its infrastructure, topography, government regulations, zoning, town planning issues, and other relevant factors.

Financial Feasibility

This section outlines the importance of defining the project’s objectives, conducting market research, understanding comparable sales, absorption rates, council rates, taxes, site issues, design trends, and the area’s master plan. These factors collectively impact the financial viability of the development.

Ownership Structure

The video explains different forms of ownership structures such as corporations (LLC in the US, Pty Ltd in other countries), joint tenancy, tenants in common, limited partnerships, joint ventures, develop lease options, and develop-and-sell options. Each has implications for how a project is managed and executed.

Product Type

Decisions regarding whether the development will focus on residential (e.g., multifamily units, townhouses, apartments) or commercial properties (e.g., office spaces, industrial, retail, mixed-use, schools, child care centers, age care centers) are crucial for tailoring the development strategy.

Objectives and Goals

The video emphasizes the importance of understanding the social and financial objectives of the development, aligning with the broader business plan.

Financial Criteria

Critical financial considerations include the desired development margin, return on equity, debt-to-equity ratio, and whether the project is intended for sale or to hold as a long-term investment.

The speaker notes that understanding these components is essential for formulating an effective development strategy. The video also teases a follow-up discussion on six main development strategies, suggesting that a comprehensive understanding of these elements allows developers to select the strategy best suited to their objectives and financial criteria.

Test Your Knowledge

1. In most cases, what factor is NOT part of evaluating a potential site for development in the site acquisition process?

A. Infrastructure availability

B. Historical significance of the land

C. Government and zoning regulations

D. Topography

2. Financial feasibility in real estate development does NOT directly assess which of the following?

A. Design trends and area’s master plan

B. Project’s branding and marketing strategy

C. Comparable sales and market research

D. Taxes and site-specific issues

3. Which ownership structure is NOT mentioned as a common type in real estate development?

A. Sole proprietorship

B. Joint tenancy

C. Limited partnerships

D. Develop-and-sell options

4. How does the decision on product type impact real estate development?

A. Determines the color schemes and interior design of developments

B. Influences development strategy, aligning with market demand and investment goals

C. Solely impacts the construction materials used

D. Affects the landscaping choices more than the financial viability

5. Why are objectives and goals crucial in real estate development?

A. They ensure the project will be completed on time and within budget

B. Objectives and goals set clear targets, aligning the development with the broader business plan

C. They primarily focus on aesthetic aspects of the project

D. Goals are only relevant for short-term projects

6. Which is NOT a financial criterion considered in real estate development?

A. Desired development margin

B. Annual property taxes after completion

C. Return on equity

D. Debt-to-equity ratio

7. What aspect of site topography is least likely to influence real estate development?

A. Soil fertility for agricultural prospects

B. Infrastructure development costs

C. Regulatory compliance

D. Design and construction costs

8. When choosing an ownership structure for a development project, which factor is least relevant?

A. Color preference of the investors

B. Legal and tax implications

C. Investment and financing needs

D. Control and decision-making preferences

9. How does the choice of ownership structure NOT affect a development project?

A. Determines the project’s environmental impact

B. Influences the project’s legal and tax standing

C. Affects the ability to attract investment and secure financing

D. Impacts risk-sharing among stakeholders

Answers:

- B. Historical significance of the land

- B. Project’s branding and marketing strategy

- A. Sole proprietorship

- B. Influences development strategy, aligning with market demand and investment goals

- B. Objectives and goals set clear targets, aligning the development with the broader business plan

- B. Annual property taxes after completion

- A. Soil fertility for agricultural prospects

- A. Color preference of the investors

- A. Determines the project’s environmental impact

Assignment

Objective

This assignment is designed to help students understand the multifaceted aspects of real estate development strategy, incorporating the lessons from the provided article. Students will apply theoretical knowledge to practical scenarios, enhancing their comprehension of site acquisition, financial feasibility, ownership structures, product type decisions, objectives and goals, and the impact of topography on real estate development.

Instructions

Complete each of the following tasks, ensuring to incorporate research, analysis, and critical thinking. Your responses should demonstrate a thorough understanding of the concepts covered in the article. Where necessary, support your answers with real-world examples or hypothetical scenarios that align with the principles discussed.

Part 1: Understanding and Application

Site Acquisition Analysis

Choose a location in your city suitable for a new real estate development project. Conduct a basic site acquisition analysis considering factors such as infrastructure availability, topography, government and zoning regulations, and town planning issues. Justify your choice of location based on these criteria.

Financial Feasibility Report

Create a simplified financial feasibility report for a hypothetical project at the site you chose. Include sections on project objectives, market research, comparable sales, absorption rates, expected taxes, and site-specific issues. Conclude with an assessment of the project’s viability.

Ownership Structure Decision

Discuss the advantages and disadvantages of three ownership structures (e.g., LLC, joint tenancy, and limited partnerships) for your proposed project. Conclude with a recommendation for the most suitable structure, providing reasons for your choice.

Part 2: Deep Dive and Critical Analysis

Product Type Selection

Analyze the current market demand in your selected location and propose a product type (residential or commercial). Provide a rationale for your choice, considering market trends and investment goals.

Setting Objectives and Goals

Define clear social and financial objectives for your project. How do these objectives align with broader business plans or community needs? Outline the strategic importance of having well-defined goals in real estate development.

Financial Criteria Evaluation

Discuss the significance of key financial criteria (development margin, return on equity, debt-to-equity ratio) in project assessment. Using hypothetical figures, illustrate how these criteria could impact the decision to proceed with the development.

Topography’s Impact Analysis

Explain how the topography of your chosen site affects development plans. Include considerations for infrastructure development, regulatory compliance, design, and construction costs. How would you mitigate any topographical challenges?

Part 3: Research and Future Planning

Ownership Structure Impact

Conduct further research on a real-world development project. Examine how the chosen ownership structure impacted its legal, financial, and operational aspects. Summarize your findings, linking back to the concepts discussed in the article.

Long-Term Strategy Development

Propose a long-term strategy for your project, considering whether it will be sold immediately or held as an investment. Discuss the implications of this strategy on financial planning, marketing, and management.

Evaluation Criteria

Assignments will be evaluated based on the following criteria:

- Depth of analysis and understanding are demonstrated in each section.

- Clarity and coherence of arguments and justifications.

- Creativity in applying theoretical knowledge to practical scenarios.

- Quality of research and real-world application.

This assignment is designed to not only test your knowledge but also to deepen your understanding and application skills in real estate development strategy. Good luck!