Yield on Cost | Return on Cost

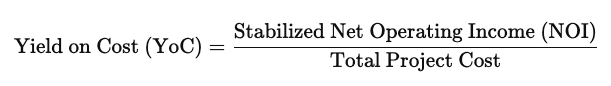

Yield on Cost (YoC) and Return on Cost (RoC) are often used interchangeably, as they both measure the return a developer or investor expects to make on a project relative to its total cost.

It helps compare the profitability of the project against other investment opportunities or the prevailing market cap rates.

Where:

- Stabilized NOI refers to the annual net operating income once the property has reached stable occupancy (typically around 90-95%).

- Total Project Cost includes land acquisition, construction costs, soft costs, and excluding financing costs.

Stabilized Net Operating Income (NOI)

Is the annual NOI once the building has reached its stabilized occupancy, typically around 90-95%. This usually happens after the lease-up phase when the property is fully operational and generating consistent income.

For example, if the lease-up period for a new development takes 18 months, the stabilized NOI would be the annualized NOI for the 12 months following that lease-up period, once the property reaches a steady state of occupancy.

Stabilized NOI is essential because it reflects the expected, ongoing income from the property when it’s fully operational, without the volatility of the initial leasing period or repositioning. This figure is used in key calculations such as Yield on Cost, Cap Rate, and overall project profitability.

Yield on Cost

In the Yield on Cost (YoC) or Return on Cost (RoC) calculation, the total project costs typically include the following:

- Land acquisition costs (purchase price of the land).

- Hard construction costs (materials, labor, and construction-related expenses).

- Soft costs (architectural fees, permits, legal fees, financing costs, etc.).

- Development fees and contingencies.

- Typically excludes Finance Costs

- YoC/RoC are based purely on the actual capital spent on development and construction, which does not include financing expenses.

This approach provides a clear, unlevered measure of the project’s return relative to the development costs without being influenced by the financing structure.

Reversion or sale costs

(like broker fees, legal fees, or closing costs associated with selling the property at the end of the holding period) are not typically included in the total project costs for YoC/RoC. These costs are part of the exit strategy and impact your return metrics (such as the Internal Rate of Return (IRR) or Equity Multiple) rather than the initial development costs.

Benchmarking RoC:

- Compare to Market Cap Rates: The most common way to assess whether a Return on Cost is good or bad is to compare it with the prevailing market cap rate for stabilized properties in the same asset class and location.

- If your RoC is higher than the market cap rate, it indicates that your project is likely generating a better return than if you were to purchase an existing stabilized property.

- If your RoC is lower than the market cap rate, it might suggest that your project is riskier or less efficient, which could signal a “bad” deal.

Typical Ranges:

- Good RoC: A good rule of thumb is that your Return on Cost should generally be 1-2% higher than the market cap rate for stabilized properties in your market. For example:

- If the market cap rate is 5%, a good RoC might be around 6-7% or higher. This “spread” compensates for the development risk and time it takes to stabilize the property.

- Bad RoC: If your RoC is close to or below the market cap rate (e.g., RoC = 5% and market cap rate = 5%), the project may not be attractive since you’re not being compensated adequately for the development risks.

Example:

- High-Risk Markets (e.g., speculative developments, emerging markets): You may want a higher RoC, such as 8-10%, to justify the additional risk.

- Low-Risk Markets (e.g., core assets in established cities): A 6-7% RoC might be considered acceptable, as these projects generally have lower risk but also lower reward potential.

Factors that Influence Good or Bad RoC:

- Development Risk: Higher RoC is needed for riskier projects.

- Project Duration: Longer projects typically require a higher RoC.

- Market Dynamics: In a hot market, even a lower RoC might be acceptable if future appreciation is expected.

Ultimately, a “good” RoC depends on how well it compensates you for the risk you’re taking and whether it’s better than your other investment opportunities.