What is Debt Yield?

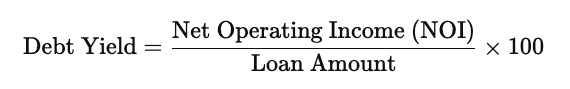

Debt Yield is a key metric used to evaluate the risk of a loan from a lender’s perspective. It is calculated as the property’s Net Operating Income (NOI) divided by the total loan amount, usually expressed as a percentage. The formula is:

Debt Yield = Net Operating Income (NOI) / Loan Amount × 100

Why Debt Yield Matters?

- Lender’s Risk Assessment: Debt yield gives lenders a simple way to assess how much income a property generates relative to the loan amount, without considering fluctuating factors like interest rates or cap rates. A higher debt yield suggests that the property generates sufficient income to cover debt obligations, even if the property’s value decreases.

- Loan Security: It helps lenders evaluate the security of the loan. If a borrower defaults, the debt yield shows how much cash flow the lender could recover relative to the outstanding loan.

- Market-Independent Metric: Unlike the Loan-to-Value (LTV) ratio, which depends on property valuations that can fluctuate with market conditions, debt yield is purely based on the property’s cash flow. Therefore, it provides a more stable and reliable risk measure.

Good vs. Bad Debt Yield Indicators

- High Debt Yield (e.g., 10% or higher):

- Good Indicator: A high debt yield indicates lower risk to the lender, as the property generates strong income relative to the loan. It means the lender has a higher margin of safety in the case of a default.

- Borrower’s Perspective: It may indicate that the property is performing well or that the borrower is more conservative with leverage.

- Low Debt Yield (e.g., below 8%):

- Bad Indicator: A low debt yield signals higher risk to the lender, as the property’s income is relatively low compared to the loan size. If the debt yield is too low, lenders may be reluctant to finance the project, or they may demand higher interest rates or more stringent loan terms.

- Borrower’s Perspective: It can mean the project is over-leveraged or not generating enough income, which can increase the borrower’s cost of capital.

Typical Thresholds

- 10% or Higher: Generally seen as a good or safe debt yield, signaling to lenders that the property generates sufficient income to cover debt obligations comfortably.

- 8% to 10%: Considered an acceptable range for most lenders, though the property may be more vulnerable to changes in market conditions.

- Below 8%: Often a red flag for lenders, suggesting higher risk and requiring a closer look at the borrower’s financials, or higher interest rates to offset risk.

Debt yield is a straightforward and effective way for lenders to assess loan risk, especially in commercial real estate financing.