What is the Target Discount Rate?

Net Present Value (NPV) is calculated using a discount rate rather than the target Internal Rate of Return (IRR). Here’s a detailed explanation to clarify the distinction and how each is used:

1. Discount Rate in NPV Calculation

- Definition: The discount rate represents the investor’s required rate of return, the project’s cost of capital, or the opportunity cost of investing in a particular project versus another with similar risk.

- Purpose: It is used to discount future cash flows back to their present value. This allows investors to assess whether the investment will generate sufficient returns relative to its risk.

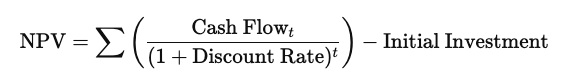

Where:

- Cash Flowt\text{Cash Flow}_tCash Flowt = Cash flow at time ttt

- Discount Rate\text{Discount Rate}Discount Rate = Required rate of return

- t = Time period

2. Target IRR

- Definition: The IRR is the rate at which the NPV of all cash flows (both incoming and outgoing) from a project or investment equals zero. Essentially, it’s the break-even rate of return.

- Purpose: Investors use the IRR to evaluate the attractiveness of a project. If the IRR exceeds the required rate of return (discount rate), the investment is considered desirable.

3. Relationship Between NPV and IRR

- Distinct Roles: While both NPV and IRR are used to evaluate investments, they serve different purposes. The discount rate is an input in the NPV calculation, whereas IRR is an output that indicates the project’s return based on its cash flows.

- Decision Making:

- NPV Positive: If NPV > 0 when using the discount rate, the project is expected to generate value above the required return.

- IRR Comparison: If IRR > Discount Rate, the project is considered favorable.

4. When Might Target IRR Influence Discount Rate?

- Setting Benchmarks: While NPV is primarily calculated using the discount rate, an investor’s target IRR can indirectly influence the choice of discount rate. For instance, if an investor has a target IRR, they might set the discount rate to this target to evaluate whether the project’s NPV is positive, indicating it meets the desired return.

- Scenario Analysis: Investors may perform sensitivity analyses where they adjust the discount rate to see how changes affect NPV and compare it against the target IRR.

Summary

- NPV Calculation: Uses a discount rate reflecting the required return or cost of capital.

- IRR Usage: Serves as a benchmark to assess whether the investment meets the desired return.

- Interrelation: While both metrics are interconnected, they play distinct roles in financial modeling and investment decision-making.