Query 1

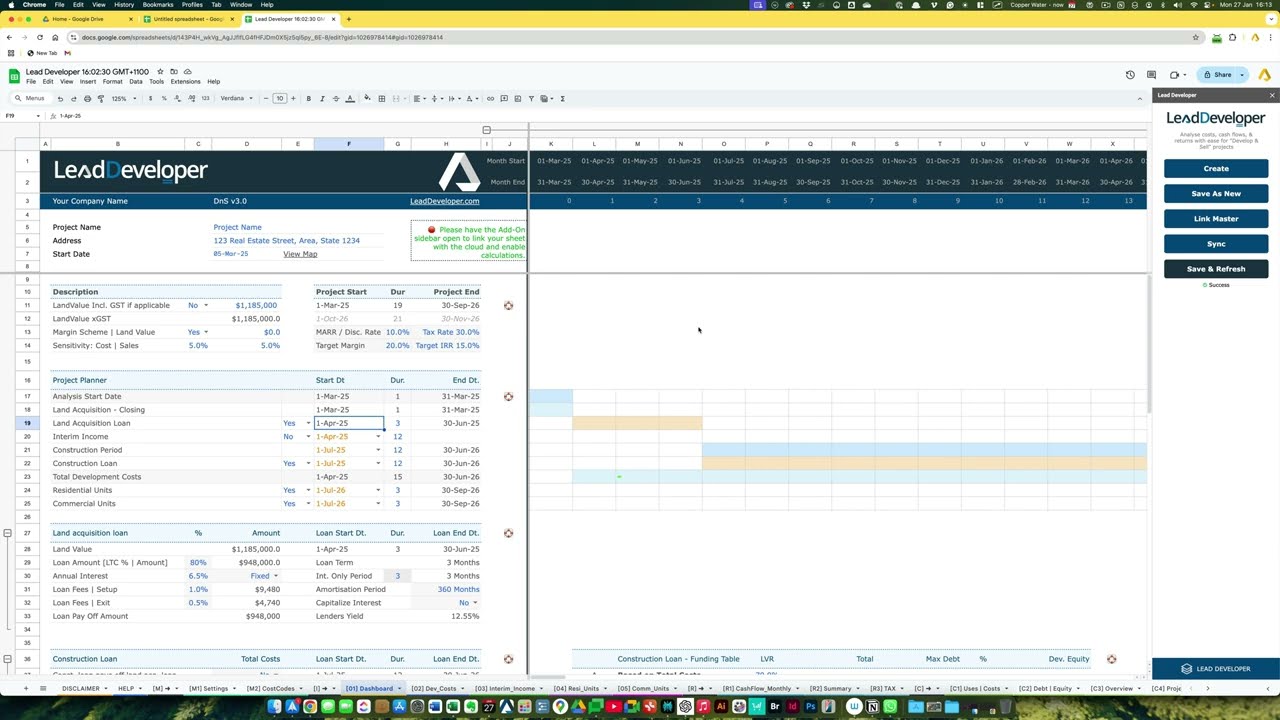

I’m having some difficulty figuring out the project dates input section. For me the project start date is 6th September 2024 (which is when we signed the contract for the land). While I input 6 Sept at the top of the sheet, it defaults to 1 Sept in the Description (Project Start). Could you tell me why this is so?

For our land acquisition, we negotiated a 6-month delayed settlement. So our Land acquisition Closing should be from 6 Sept 24 to 5 March 25. Do I need to input this on the Dates sheet? As you can see in row 18 below, the dates and durations are mismatched.

Our intention is to get a land loan that we’ll pay for approx. 3 months while we sort our Building Approval and start construction most likely in June 2025. I just wasn’t too sure watching the tutorial about exactly where the date inputs are meant to happen for my scenario. Is it all on the Dates sheet or the Dashboard?

Query 2

My other question is about the Investor section. If I have investors who are only coming in as money partners for a fixed return (say 15%) on their invested equity but are not receiving a profit share, how do I exclude the entries that are being auto-populated in the Profit/Loss share column?

Summary

Project Start Dates:

Project Start Dates:

- Explains the adjustment of project start dates to the 1st day of a selected month due to feasibility model standards.

- Demonstrates how settlement delays affect project timelines and loan calculations.

- Emphasizes standardized monthly cash flow reporting for consistent calculations.

Loan Setup and Timelines:

Loan Setup and Timelines:

- Details on configuring land acquisition loans and construction loans.

- Shows calculations for overlapping loan periods and their impact on interest payments.

- Explains the three-month delay between loan approval and utilization.

Investor Equity and Interest:

Investor Equity and Interest:

- Explains how investor equity can be managed, including interest-only loans, setup fees, and exit fees.

- Highlights options for sharing profits with investors or excluding them from equity distribution.

Calculation Adjustments:

Calculation Adjustments:

- Demonstrates adjustments in cash flow sheets and how different loan types (e.g., interest-only or principal and interest) affect costs.

- Discusses implications for cumulative balances and interest accrued for investors.

Insights Based on Numbers

- The 6-month delayed settlement results in a start date adjustment from 6th September to 1st September for standardization.

- A 3-month loan delay ensures interest calculations only begin post-disbursement, aligning with cash flow needs.

- 80% loan drawdown timing significantly affects monthly interest calculations and project feasibility.

Key Takeaways for Similar Scenarios

-

Understand Model Defaults: Many real estate feasibility models default to monthly reporting, which aligns dates to the first of the month. Adjust expectations or consult the model’s documentation if daily-level accuracy is critical.

-

Centralise Date Inputs: The dates sheet is only there to act as a database for all dates. As all dropdowns ae dynamic and keep reflecting updated start and end dates, it is crucial for us to main a “DATES”.

IMPORTANT: Users do not need to input any data in the “Dates” sheet. Simply enter data in the BLUE cells and, if needed, customise the ORANGE cells.

- Verify Timelines: Regularly cross-check date inputs and calculated durations across relevant sheets to prevent mismatches.

- Leverage Tutorials and Support: If tutorials are unclear, seek clarification from the software provider’s support team or documentation.

Continued: Handling The Pre-Development Phase in Lead Developer