Continued from…

Rocket science behind rental yield calculations [Part 1-2]

Calculating discount yield

Another return estimate that every property investor may find useful for investment property is the discount yield.

It’s a term that’s more typically heard in the bond market. Bond investors want to assess their discount yield because they can purchase the bond at a discount to their par value.

This is accomplished by multiplying the discount by the face value.

A discount yield of 5% would be obtained by purchasing a bond at 95 (a discount of five). This differs from the current yield, calculated by dividing the reported interest rate by the bond’s real cost.

When individual properties are purchased at a lower price than their appraised value, you can use discount yield in real estate.

You may make a comparable case for employing this technique in real estate by comparing the assessed value to the par value. This formula could be handy if you want to keep track of the different types of discounts you can get on properties.

You are missing out if you haven’t yet subscribed to our YouTube channel.

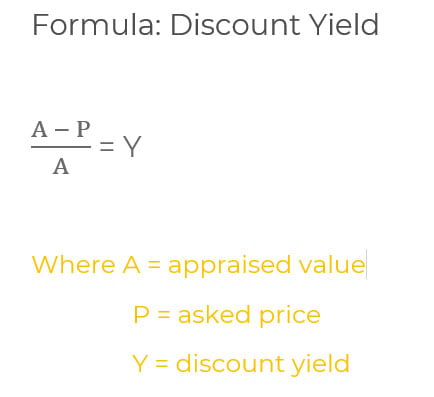

Real estate discount yield calculation formula

Here,

A = Appraised Value

P = Asked Price

Y = Discount Yield

Let’s say you’re thinking about purchasing two residences. The seller, in both circumstances, had a recent appraisal on hand. (Alternatively, you may have made an offer subject to an appraisal being completed.)

On the one hand, the asking price for the property is the same as the appraised value; on the other hand, the asking price for the property is $150,000, which is $7,000 less than the $157,000 appraised value, indicating that an offer might be made at a lower price.

When using the formula,

IMPORTANT

[$157,000 - $150,000]/$157,000 = 4.45%

In this case, you got a 4.45% discount yield by buying the investment property for less than its appraised worth. Because market supply and demand factors, seller attitudes, and the availability of appraisals when an offer is made will all limit your ability to find such discounts, you can’t use this equation in every situation.

It is a practical examination as a technique for appraising a succession of property investments. It’s the same as buying the stock at a lower price than it’s worth.

For example, employees may be given stock options at a fixed price that they can exercise at any moment. Shares can be purchased at a discount if and when the stock’s market price increases above that price.

There’s no reason why real estate investors shouldn’t be able to evaluate properties bought below appraised value in the same way. Nevertheless, discount yield is just one of many useful computations you may use to analyse your real estate investment portfolio.

Industry Insiders’ Secrets To Managing Risks & Avoiding Mistakes & Pitfalls In Property Development

Get the Risks & Mistakes Bundle Now

Includes 5 x detailed eBooks [120 pages]

✓ Risks In Property Development - Industry Insiders Guide (26 Pages)

✓ 10 Big (Financial) Property Investing Mistakes Made By Investors (58 Pages)

✓ 7 Property Development Mistakes And How To Avoid Them (8 Pages)

✓ 5 Reasons Buy-and-hold Investors Fail At Property Development (12 Pages)

✓ Property Mastermind: 8 Skills Needed For Property Development Success (16 Pages)

How to use rental yield calculation to fix your price?

You can use the above rental yield estimates to determine the maximum amount we’re willing to pay for a home.

Assume you’ve determined that a particular property must generate an annual return of 8% to pique your interest in making a sale.

You can adjust the pricing until the ROI equals 8% every year in your calculating worksheet. It is then the highest price you’re willing to pay.

Of course, there’s no guarantee that the seller will agree to sell to you at that price. However, this technique can assist you in determining your walk-away point before entering discussions.

Final thoughts

You’ve now become an expert in rental yield calculations.

These rental yield calculations discussed above will soon become your best friends. They’ll compel you to clarify your return expectations and offer you enough to talk about at those crucial property networking events.

The payback ratio is another Jedi mind trick. It can help you focus on long-term investment opportunities and rule out particular properties.

You can accept or reject offers based on your beliefs about future capital growth possibilities. You should seek a higher ROI or cap rate where capital growth prospects are weak.

Finally, it’s worth noting that the primary criterion for accepting or rejecting a real estate deal is a positive cash flow.

By understanding how to do rental yield calculation, you can better assess the potential profitability and make sure you’re comfortable with the level of risk involved before making any offers.

With a little bit of research and effort, you can be well on your way to earning a healthy return on your investment.

Enroll for Property Development Feasibility Suite to know your numbers well and get profit from your property.

FAQs

What does a soft and hard yield mean?

A soft yield is pretty simple to understand - it’s just the advertised rent divided by the purchase price, multiplied by 100. So if a property is advertised at $2000/month and you’re buying it for $200,000, your soft yield would be 8%.

Hard yield is a little bit more complicated. It’s basically your expected return after all expenses are taken into account. So if you’re expecting to spend $10,000 on renovations and your monthly expenses will be $500, your hard yield would be 5%.

What is the difference between yield and return?

It’s important to note that rental yield is different from return on investment (ROI).

Return on investment considers the appreciation (or depreciation) of the property and any rental income earned.

On the other hand, Rental yield only looks at the rental income relative to the purchase price. It doesn’t consider any changes in the property’s value over time.While rental yield is a good indicator of how well your rental property is performing, return on investment is a more comprehensive measure that gives you a better idea of your overall profitability.

How much should I charge for rent?

There’s no easy answer to this question, as the amount you should charge for rent will vary depending on several factors, including the location of your rental property, the size and condition of the unit, and the amenities that are included.

However, you can follow a few general guidelines when setting your rent price.

First, research other rental properties in your area to get an idea of what similar units are going for. This will give you a good starting point for pricing your unit. Next, consider what kind of return on investment you’re looking for from your rental property.

Typically, you’ll want to aim for a rent price that’s at least equal to your monthly mortgage payment.

What makes a good investment property?

There are a few key things to look for when considering an investment property:

Location: The location of the property is key – it should be in a desirable area with good schools, low crime rates, and plenty of job opportunities.

Size: The property should be large enough to generate a good return on investment but not too large that it becomes difficult to manage.

Age: Ideally, you want a property that is in good condition and doesn’t require too much renovation work.

Rental potential: The property should have a high rental potential so you can generate a good return on your investment.