Revenue on Cost

Also called the Revenue-to-Cost Ratio or Return on Cost, RoC is a financial metric that compares the total projected revenue from the sale of the developed property to the total project costs (excluding or including finance costs, depending on preference).

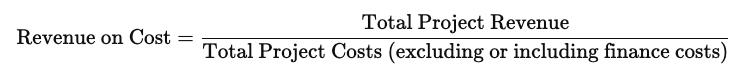

Formula

Revenue on Cost = Total Project Revenue / Total Project Costs (excluding or including finance costs)

Interpretation:

- Revenue on Cost > 1: Indicates that the revenue from the project exceeds the costs, suggesting profitability.

- Revenue on Cost = 1: Break-even point; the revenue matches the costs, so there’s no profit or loss.

- Revenue on Cost < 1: Implies that costs exceed revenue, leading to a loss.

What Is a Good Revenue on Cost Metric?

A typical benchmark for a healthy development project is 1.2 to 1.5 (or 20% to 50% above costs), though this can vary by market, project type, and risk tolerance. A higher Revenue on Cost reflects greater profitability and a buffer to absorb unforeseen costs or delays.

How Does It Help in Understanding Project Viability?

- Profitability Insight: A high Revenue on Cost suggests that the development will generate enough revenue to cover all costs, making the project financially viable.

- Risk Assessment: A lower metric may indicate tight margins, leaving little room for cost overruns, delays, or market changes.

- Benchmarking: Investors and developers use this ratio to compare multiple projects, ensuring they allocate capital to the most profitable ones.

- Financing and Attractiveness: A strong Revenue on Cost can make a project more attractive to lenders and investors since it signals a good return on investment.

In your proformas, using Revenue on Cost can help identify whether a project will meet profitability goals, and it acts as a key decision-making tool.