Replacement/Min. Rent [Build To Calculation]

A Replacement or Minimum Rent (Build To Calculation) refers to the rent that would justify the cost of constructing or acquiring a property based on specific financial metrics and assumptions.

This concept is particularly relevant in Build-To-Rent (BTR) or Build-To-Sell projects, ensuring that the investment makes financial sense for developers or landlords. Here’s how it is calculated and applied:

Key Components in the Calculation

- Development Cost (TDC): Total development cost, including land, construction, soft costs, and financing.

- Target Yield: The desired stabilised return on cost (ROC) or yield on cost (YOC) that meets the investment criteria.

- Operating Expenses (OpEx): Costs associated with running the property, including property management, maintenance, insurance, and taxes.

- Vacancy Allowance: A percentage of potential gross income allocated for anticipated vacancies.

- Cap Rate or Market-Based Rent: Used to align the rent calculation with market expectations.

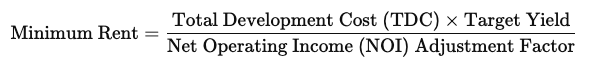

Formula

Where

- NOI Adjustment Factor accounts for vacancy and operating expenses:

NOI Adjustment Factor=(1−Vacancy Rate)×(1−Operating Expense Ratio)\text{NOI Adjustment Factor} = (1 - \text{Vacancy Rate}) \times (1 - \text{Operating Expense Ratio})NOI Adjustment Factor=(1−Vacancy Rate)×(1−Operating Expense Ratio)

Applications

- Feasibility Analysis: Ensures the project is viable based on achievable rents.

- Investor Presentations: Demonstrates the required rental performance to stakeholders.

- Market Comparisons: Benchmarks rents against market conditions to test assumptions.

- Loan Underwriting: Helps secure financing by meeting debt-service coverage ratios.

Replacement Rent per Leasable Area

Replacement Rent per Leasable Area refers to the rent required to achieve a certain financial return or cost recovery when replacing a leased property or building.

It is typically used to determine whether the rental income from a property justifies its development or acquisition costs.

Formula

Replacement Rent per Leasable Area = Total Costs/ Leasable Area

Where

- Total Costs include development costs, construction costs, financing costs, and other related expenses.

- Leasable Area is the total rentable space in square metres or square feet.

Applications

- Feasibility Analysis: Helps assess whether a development project is financially viable.

- Benchmarking: Compares achievable market rents with required replacement rents.

- Investment Decisions: Determines whether acquiring or developing a property makes sense financially.