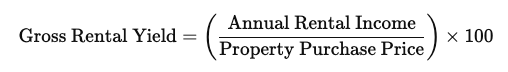

1. Gross Rental Yield

- Definition: Gross rental yield measures the annual income generated by a property as a percentage of its purchase price. It’s calculated using the formula:

- Advantages and Disadvantages:

- Advantages:

- Simple to calculate.

- Provides a quick estimate of rental income potential.

- Disadvantages:

- Does not account for operating expenses, such as maintenance, property taxes, or vacancies.

- Advantages:

- Pros and Cons:

- Pros: Offers a rough estimate of property profitability.

- Cons: May be misleading as it overestimates profitability by ignoring costs.

- Shortcomings:

- It does not consider any expenses, leading to an inflated picture of profitability.

- Good for:

- Quick comparisons between properties to identify high-yield opportunities.

- Good Range:

- Typically, 5% to 10% is considered a solid range for gross rental yield, depending on market conditions.

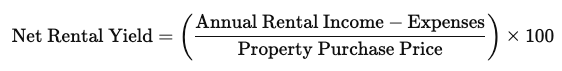

2. Net Rental Yield

- Definition: Net rental yield measures the annual rental income after deducting all property-related expenses, expressed as a percentage of the property purchase price. The formula is:

- Advantages and Disadvantages:

- Advantages: Provides a more accurate estimate of profitability by accounting for expenses.

- Disadvantages: Requires detailed information on expenses, making it more complex to calculate.

- Pros and Cons:

- Pros: Offers a realistic view of investment performance.

- Cons: Harder to estimate upfront if not all expenses are known.

- Shortcomings:

- May still overlook some expenses like large-scale maintenance or unexpected costs.

- Good for:

- Evaluating the actual cash flow and performance of a rental property.

- Good Range:

- A range of 4% to 8% is often seen as healthy, though this can vary by market.

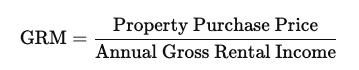

3. Gross Rent Multiplier (GRM)

- Definition: Gross Rent Multiplier is a simple measure of a property’s value based on its gross rental income. It is calculated as:

- Advantages and Disadvantages:

- Advantages: Easy to calculate and useful for quick comparisons.

- Disadvantages: Does not account for expenses, making it less precise for profitability analysis.

- Pros and Cons:

- Pros: Useful for quick evaluations and comparisons.

- Cons: Does not reflect operating costs or potential risks.

- Shortcomings:

- Oversimplifies profitability by ignoring net income.

- Good for:

- Screening potential investments quickly.

- Good Range:

- Generally, a lower GRM indicates a better deal. A GRM below 10 is typically favorable, though it depends on the local market.

4. Net Income Multiplier (NIM)

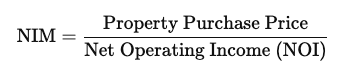

- Definition: Net Income Multiplier measures a property’s value relative to its net operating income. It is calculated as:

- Advantages and Disadvantages:

- Advantages: Considers net income, providing a more accurate reflection of the property’s profitability.

- Disadvantages: Requires detailed and accurate NOI calculation.

- Pros and Cons:

- Pros: Provides a more precise estimate of investment value.

- Cons: Complexity in estimating NOI if all expenses are not known.

- Shortcomings:

- Assumes that all expenses are accurately calculated, which may not always be the case.

- Good for:

- In-depth analysis of a property’s actual profitability.

- Good Range:

- Typically, a lower NIM is more attractive, with ranges varying widely depending on the market.