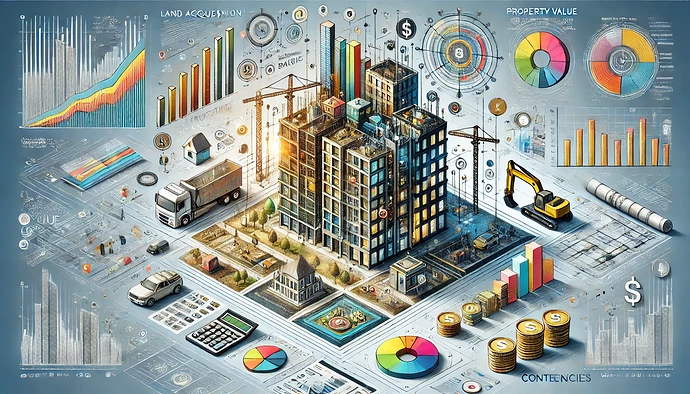

In a real estate proforma, the term “Property Value - All In Basis” refers to the total valuation of a property, including all the costs associated with acquiring, developing, and preparing the property for sale or operation. This comprehensive cost basis typically includes:

- Land Acquisition Costs: The price paid to purchase the land.

- Development Costs: All expenses associated with construction, site preparation, and development.

- Soft Costs: Fees for architects, consultants, permits, and other professional services.

- Financing Costs: Interest, loan fees, and other expenses related to financing the project.

- Interim Costs: Any temporary expenses incurred during the project’s life cycle, such as marketing or leasing costs.

- Contingencies: Funds allocated for unforeseen expenses or cost overruns.

This “all-in” approach ensures that the property’s value reflects not just the base acquisition or construction costs but the total financial investment required to bring it to market or operation. It’s crucial for calculating metrics like Return on Cost (RoC) or Yield on Cost, where the total cost basis is compared to projected revenues or stabilized net operating income.