Property Development Process Vs System

Video 1

Important

The videos in this post are from the past, but they cover key timeless and universal concepts. Make sure to watch them and read the FAQs that explain the video content.

Property Development Process Vs System

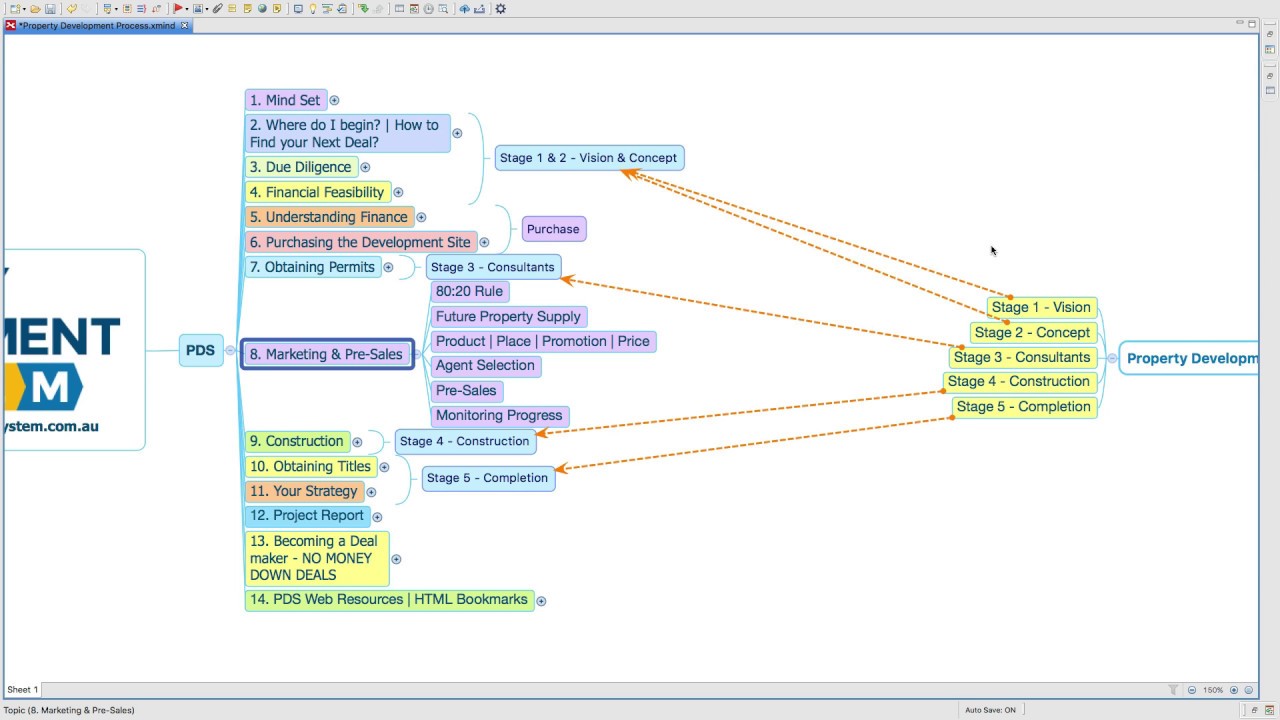

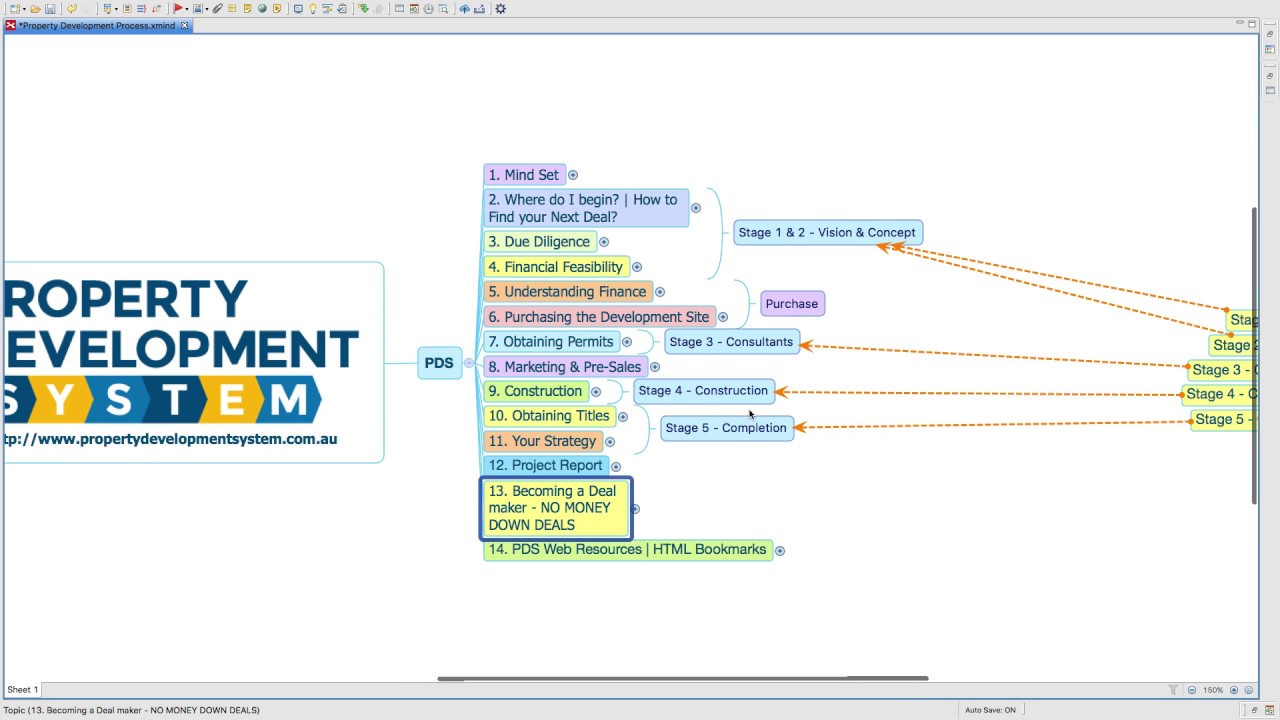

What is the difference between a property development process and a system?

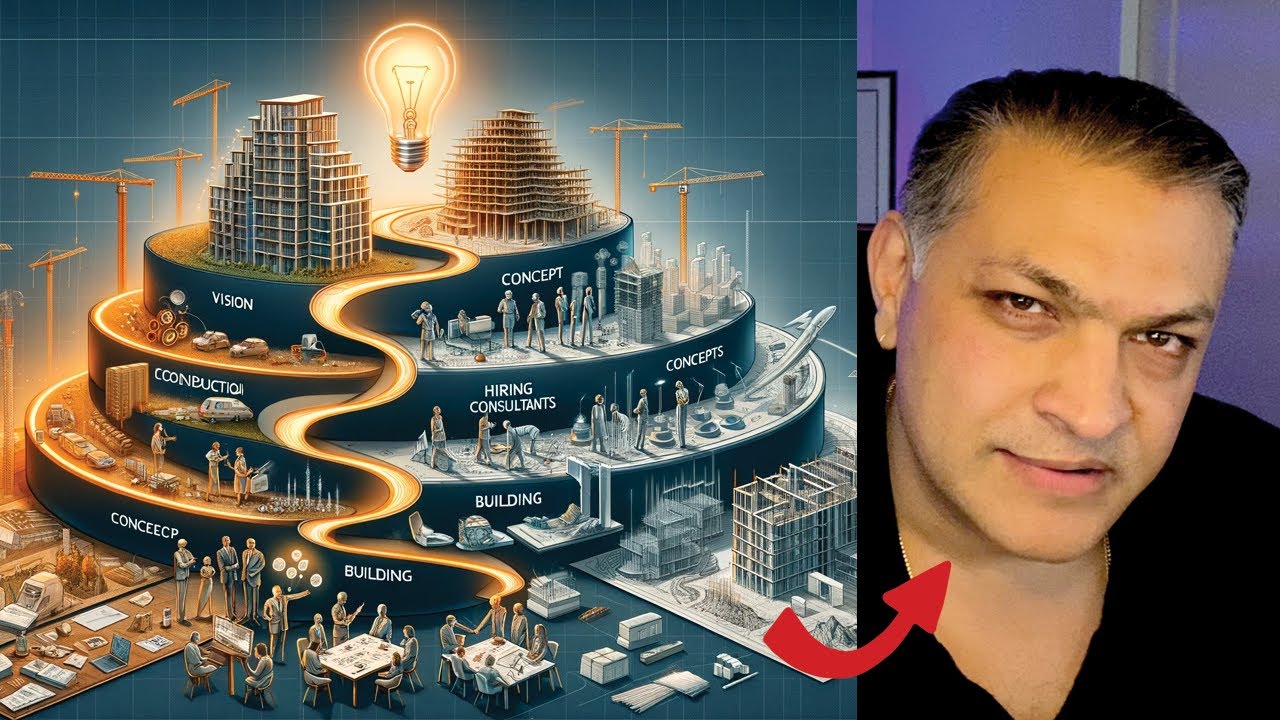

A property development process typically refers to a linear series of stages involved in developing a property, which includes vision and concept development, hiring consultants, construction, and project completion. This approach is often criticized for oversimplifying the complexities of real-world property development.

In contrast, a property development system is a comprehensive roadmap designed to navigate the multifaceted nature of property development more effectively. It includes due diligence, feasibility studies, understanding market cycles, and emphasizes the importance of having the right mindset, thereby providing a more realistic and holistic approach to property development.

Why is understanding the difference between process and system important for newcomers to property development?

Understanding the difference is crucial for newcomers because it prepares them for the realities of property development, which is far more complex than the simplified linear progression often taught. A system approach equips them with the knowledge and tools to navigate the industry’s uncertainties and make informed decisions.

Property Development System

What led to the creation of the Property Development System?

Amber’s personal experiences and the realization that traditional teachings on property development were overly simplistic and did not accurately reflect the complexities of real-world projects led to the creation of the Property Development System. This system is designed to offer a realistic and holistic approach to property development.

What are the key components of the Property Development System?

The system includes due diligence and feasibility analysis, understanding property economics and market cycles, site selection and spatial analysis, and financial feasibility. It emphasizes the importance of a thorough initial analysis, understanding market demands, evaluating the financial viability of projects, and the right mindset for success.

Mindset

How does mindset affect success in property development?

The presenter emphasizes that having the right mindset is crucial for success in property development. This includes having a positive attitude, willingness to learn, resilience, and the ability to handle uncertainty and make decisions under pressure. These qualities help individuals navigate the complexities and challenges of the industry.

What resources does the presenter offer for learning the Property Development System?

The presenter offers a free blueprint on his website that introduces his property development system, along with a smart feasibility calculator designed to help with quick assessments of development projects. These resources are aimed at providing newcomers with foundational knowledge and tools for property development.

Due Diligence & Feasibility

Why is due diligence and feasibility analysis critical in property development?

Due diligence and feasibility analysis are critical because they provide a foundation for realistic and informed decision-making at the start of a project. This involves evaluating the potential of a site, understanding legal and zoning implications, and assessing the financial viability of the development, ensuring that the vision and concept are grounded in reality.

Property Economics

How does understanding property economics and market cycles contribute to successful property development?

Understanding property economics and market cycles is vital because it helps developers recognize and interpret signals that can impact property prices and development viability. This knowledge allows for timely and strategic decisions, aligning projects with current and future market demands.

Site Selection

What is the significance of site selection and spatial analysis in property development?

Site selection and spatial analysis are crucial for ensuring a development project aligns with market demands and regulatory requirements. It involves understanding zoning laws, conducting a spatial analysis to see how a property fits within its broader context, and choosing the right site based on comprehensive research.

Financial Feasibility

How does the Property Development System address financial feasibility?

The system addresses financial feasibility through detailed financial modeling, which evaluates the projected costs, revenues, and profitability of a development project. It includes tools like a smart feasibility calculator for quick assessments and more in-depth analysis to ensure the financial viability of a project.

Video 2

Understanding Finance and Development Finance

Why is financial feasibility analysis important in property development?

Financial feasibility analysis is crucial because it helps developers understand the required cash flow at different stages of the project, including initial investment, construction, and refinancing. It enables developers to assess the viability of their project, manage risks, and ensure financial preparedness.

What should developers know about development finance?

Developers need to be aware of the various loan types and stages in the market, such as loans for land acquisition, construction, and refinancing. Understanding lender expectations and loan conditions is vital for securing financing on favorable terms.

Evaluations and Valuations

How do favorable evaluations and valuations benefit a property development project?

Favorable evaluations and valuations are critical for financing because they affect the amount developers can borrow. A higher valuation can lead to better loan terms, such as increased borrowing amounts and potentially lower interest rates, thereby enhancing the project’s financial viability.

What strategies can developers use to improve their project’s valuation?

Developers can improve their project’s valuation by understanding different valuation methods and preparing their projects accordingly. Using desktop valuations for preliminary assessments can provide insights into potential valuation outcomes before formal evaluations.

Site Acquisition and Negotiation

What is the recommended strategy for purchasing a development site?

It’s advised not to purchase a development site in personal names but rather to seek accounting advice for asset protection and tax planning. The ownership structure significantly impacts tax liabilities and asset protection.

How do negotiation skills impact the acquisition of a development site?

Effective negotiation skills are essential for securing a favorable purchase price and terms. Being well-prepared for various negotiation scenarios and understanding market conditions can lead to substantial savings and more favorable conditions, enhancing the project’s profitability.

Consultant Engagement and Design

Why is engaging with consultants important in property development?

Consultants are crucial for obtaining necessary permits and approvals at different stages of the project. They provide expertise in areas such as planning, architecture, and engineering, ensuring the project complies with regulatory requirements and standards.

How does sustainability factor into the design and development process?

Incorporating environmental sustainability and cost-effectiveness in the design is crucial. Collaborating with builders early on can identify construction cost savings, making the project more environmentally sustainable and financially viable.

Regulatory Requirements

What are some of the key regulatory requirements in property development?

Developers must be familiar with the necessary reports and permits required for development. For example, a set-out survey is fundamental before starting architectural design. Knowing which consultants and reports are needed at each stage ensures a smoother development process.

Project Viability and Informed Decision-Making

How does the Property Development System Financial Feasibility application aid in project viability and decision making?

This specialized application provides developers with insights into up-front costs, borrowing needs, and the overall financial layout of the development journey. By conducting a thorough financial analysis, developers can make informed decisions about the financial aspects of their project, reducing risks and enhancing the chances of success.

Video 3

Marketing Strategies

Why are pre-sales important in property development?

Pre-sales are crucial because they secure early financial commitment from potential buyers, which is often a requirement from lenders to ensure the project’s financial viability. This early commitment helps in demonstrating the market demand for the development, reducing financial risks, and ensuring lenders’ support.

How has the approach to property development marketing changed post-GFC?

Post-GFC, developers need to be more proactive in their marketing efforts to meet the pre-sales requirements set by lenders. This involves a deeper understanding of the target market, leveraging the unique selling points of the development, and using various marketing channels effectively to attract potential buyers.

What role do stamp duty savings in Victoria play in marketing strategies?

Stamp duty savings in Victoria serve as a financial incentive that can make developments more attractive to buyers. Developers can tailor their marketing strategies to highlight these savings, thereby enhancing the appeal of their projects and boosting pre-sales.

Construction Insights

Why is it important for developers to understand the construction process?

Understanding the construction process, even for non-builders, is crucial because it enables developers to make informed decisions, negotiate better terms with contractors, and ensure that the project is completed on time, within budget, and to the desired standards.

What is the significance of the tender process in construction?

The tender process is significant because it allows developers to evaluate bids from various contractors not only based on price but also on work quality, timelines, and reliability. This helps in selecting the right contractor who can deliver the project effectively.

What should be included in the building contract to protect developers?

A: The building contract should clearly outline terms regarding progress claims, retention, the builder’s and defects liability period, and insurance. These terms protect the developer from potential disputes and financial losses during the construction phase.

Financial and Legal Considerations

Why is conducting a financial feasibility study crucial before starting a project?

A financial feasibility study is crucial because it evaluates the project’s financial viability, including costs, potential revenue, and profitability. It helps identify the project’s economic strengths and weaknesses, enabling informed decision-making.

How does understanding market demand influence property development?

Understanding market demand is essential for aligning the project with market needs, influencing design decisions, pricing strategies, and marketing approaches. It ensures that the development meets potential buyers’ or renters’ demands, leading to successful sales or rental prospects.

What is the importance of legal readiness for titles and settlements?

A: Legal readiness for titles and settlements is important because it ensures that once construction is completed, titles are ready and pre-sales can settle as soon as possible. This minimizes the time between construction completion and revenue realization, reducing the financial burden of construction loans.

Comprehensive Planning and Adaptation

How does comprehensive planning benefit property developers?

Comprehensive planning benefits developers by considering all factors such as construction, financial modeling, market research, legal considerations, and sales strategies. It minimizes risks and maximizes profitability, ensuring the project’s success from inception to completion.

Why do developers need to adapt to market changes?

Developers need to adapt to market changes to stay competitive and meet evolving buyer needs. Being aware of and leveraging financial incentives, like stamp duty savings, and adjusting strategies according to market conditions, can make their projects more attractive and ensure successful pre-sales.

Video 4

Property Investment Strategies

What is the thumb rule for property investment mentioned in the video?

The thumb rule for property investment highlighted in the video states that for a property to be retained in a portfolio post-development, it must be either cash flow neutral or cash flow positive. This means the property should not incur additional costs to the owner, ensuring financial sustainability and preventing financial strain on the investor’s portfolio.

Why is having a personal strategy for holding or selling properties important?

Having a personal strategy for deciding whether to hold or sell properties is crucial because it helps investors manage their portfolios based on cash flow implications. This strategic decision-making process ensures that properties contribute positively to the portfolio’s cash flow, thereby avoiding costly holdings that can undermine financial stability.

What does it mean for properties to be neutrally or positively geared?

Properties are considered neutrally or positively geared when their rental income covers all expenses, including mortgage payments, maintenance, and management fees, resulting in either a neutral cash flow (where income equals expenses) or a positive cash flow (where income exceeds expenses). This gearing strategy is essential to prevent properties from becoming financial burdens.

Deal Making in Property Development

How can one become a successful deal maker in property development?

Becoming a successful deal maker involves acquiring a comprehensive understanding of the property development process, including market analysis, project management, and financial structuring. It also requires resourcefulness in accessing valuable information and tools, building strong professional networks, and structuring deals that leverage other people’s money and resources without requiring upfront personal investment.

What are no money down deals, and how do they work?

No money down deals refer to property investment strategies where the investor does not use their own upfront capital to secure a property. Instead, these deals involve structuring the investment in a way that leverages other people’s money, such as investors or lenders, to finance the purchase and development of the property. This approach allows individuals to enter the property market and undertake development projects without substantial personal financial investment.

Resources and Diversification

What resources and tools are essential for property development?

Essential resources and tools for property development include both free and paid options that aid in due diligence and market analysis. These resources might encompass databases, software for financial analysis, project management tools, and access to industry reports. They provide crucial information for evaluating the viability of development projects and managing them efficiently.

The Role of Diversification

How does diversifying investments contribute to achieving a neutrally or positively geared property portfolio?

Diversifying investments across different types of properties, such as apartments and townhouses, helps balance cash flow and long-term capital growth. This strategy enables investors to mitigate risks by spreading their investments across various sectors and locations, contributing to the financial sustainability of the portfolio by ensuring that not all investments are affected by market changes in the same way.

Education and Skill Acquisition

Why is education and skill acquisition important in property development?

Education and skill acquisition are vital in property development because they empower investors to make informed decisions, identify profitable deals, and execute development projects successfully. Knowledge in areas such as market analysis, financial structuring, and project management is crucial for navigating the complexities of the property market and maximizing investment returns.

![Property Development Process [Detailed] - Part 2 of 4](https://edge.leaddeveloper.com/uploads/db5494/original/2X/8/86537d1918c2f279cce675f8bd67772d824ddbe7.jpeg)