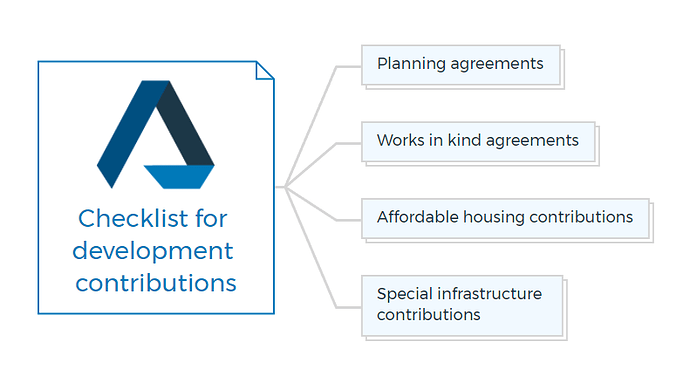

1. Planning agreements

- Identify the purpose and scope of the planning agreement.

- Ensure compliance with local planning regulations.

- Define obligations for both the developer and planning authority.

- Set clear timelines for fulfilling obligations.

- Specify penalties for non-compliance.

- Describe financial obligations, if any.

- Review zoning changes or exemptions.

- Ensure transparency and public awareness.

- Determine if the agreement covers public amenities, affordable housing, infrastructure, recurrent expenditure, planning impacts, or natural environment.

- Confirm if the agreement excludes 7.11 and 7.12 contributions for the specified area.

- Highlight advantages: greater developer control, certainty in local facilities, and infrastructure provision.

- Consider the implications of paying contributions to Council (less control and timing).

- Evaluate potential value-added from new infrastructure.

- Recognize benefits for Council: reduced management costs and minimized cost overruns.

- Understand the option to register the agreement on the land title.

- Follow the legal process outlined in the Act and Regulations.

- Ensure signatures from both parties.

- Check if it’s tied to a planning proposal or Development Application.

- Observe mandatory notification periods (at least 28 days).

- Verify that planning agreements are publicly accessible via Councils and state government registers.

2. Works in kind agreements

- Consider the option of a works in kind agreement instead of a voluntary planning agreement.

- Works in kind agreements involve the developer building infrastructure instead of making monetary contributions.

- These agreements can be made with the Council after a development contributions plan is in place.

- Determine if the infrastructure to be built aligns with the contributions plan.

- Advantages include more developer control, reduced project management costs for the Council, and simplified legal and administrative procedures.

- Works in kind agreements may be suitable for smaller developments or specific items, whereas large developers may prefer planning agreements.

- Understand that developers can either construct the infrastructure or receive future credits for contributions.

- Council may offer cash payments to developers for construction, based on the plan’s value.

- Be aware of potential cost overruns, as the plan values may be lower than actual construction costs.

- Recognize that constructing high-quality facilities can enhance the development’s overall value.

- Evaluate the agreement’s benefits and drawbacks based on the specific development and contributions plan.

You are missing out if you haven’t yet subscribed to our YouTube channel.

3. Affordable housing contributions

- Check if the State environmental planning policy identifies a need for affordable housing in the development area.

- Determine if the proposed development could reduce the availability of affordable housing in the area.

- Assess whether the proposed development might create a need for affordable housing in the area.

- Consider if the development is allowed only due to special zoning rules or rezoning.

- Verify if the regulations require this section to apply to the application.

- Check if there’s a State Environmental Planning Policy (SEPP) like SEPP No. 70 in effect in the area.

- Know which local government areas are covered by the SEPP.

- Understand that councils within these areas have the authority to impose conditions for affordable housing, separate from standard contributions (e.g., 7.11 or 7.12).

- Be aware that councils under SEPP 70 typically create an affordable housing contribution scheme, often referenced in the local environmental plan.

- Research if there are specific affordable housing schemes in operation for certain regions within the covered areas, like Ultimo/Pyrmont, Green Square, or Southern Employment Lands.

4. Special infrastructure contributions

- Understand that Special Infrastructure Contributions (SIC) are charges imposed by the state government for funding key infrastructure.

- Identify the types of infrastructure funded by SIC, including state and regional roads, transport facilities, open spaces, and social infrastructure like schools and healthcare.

- Determine if SIC applies to your development area, especially in growth regions.

- Check if your development is in an area with an existing SIC scheme or if it’s planned for the future.

- Know that the Department of Planning, Industry and Environment manages the SIC process.

- Be aware that SIC involves public consultations with councils, developers, landowners, and the community.

- Understand that the Minister for Planning formally approves the SIC scheme.

- Local councils consider SIC when reviewing development applications.

- Identify the typical stage of payment, usually at the subdivision certificate stage.

- Explore options for developers, such as entering into works in kind agreements to build infrastructure or planning agreements as alternatives to paying SIC contributions.