Coaching calls

SFC v5.0 Release

Here are significant updates to the Smart Feasibility Calculator (SFC), a tool designed for conducting financial feasibilities on various real estate projects. This latest version aims to accommodate a wider range of project types, including mixed-use, commercial, retail, and residential developments. Below is a comprehensive summary of the key points discussed in the video:

Introduction

The speaker begins by explaining the motivations behind updating the SFC to version 5.0. The primary reason was the increasing reliance on SFC for quick feasibilities across different types of real estate projects, due to its efficiency and ease of use compared to more comprehensive feasibility applications.

Installation Guide

Detailed instructions are provided for installing the SFC v5.0, which is compatible with Windows systems. The process involves downloading an MSI file and running the installation wizard. Users are advised to disable antivirus software during installation to avoid any interference.

Usage Overview

The video demonstrates how to start a new project in SFC, including entering project details and saving files. It highlights the tool’s user-friendly interface, which is designed to simplify the feasibility study process for various projects.

Key Features

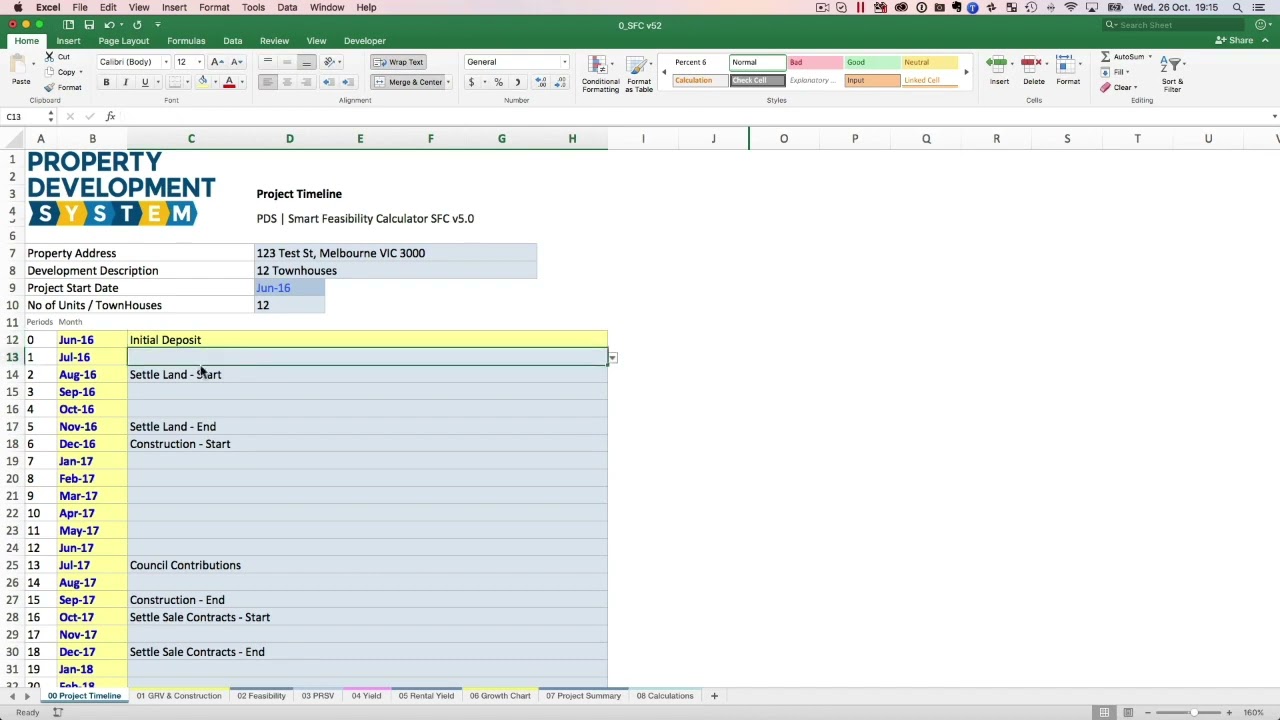

Project Timeline

A significant addition to SFC v5.0 is the project timeline feature, allowing users to map out the timeline of their development project accurately. This includes accounting for initial deposits, settlement periods, and construction phases.

Financial Inputs

Users can input detailed financial information, such as land purchase price, construction costs, and anticipated sales revenue. The tool calculates the feasibility of the project based on these inputs.

Construction and Sales

The video covers the construction phase, detailing how to input construction costs and manage timelines. It also discusses pre-sales and how to handle contractual obligations to ensure smooth project completion.

Advanced Features

The updated version introduces new tabs for more complex analysis, including commercial leasability and mixed-use project evaluations. This allows for a more nuanced financial feasibility analysis, accommodating projects with commercial components alongside residential units.

Practical Tips

Throughout the video, practical advice is offered on managing various aspects of a development project, such as dealing with council contributions, managing investor relations, and navigating legal requirements like the margin scheme for GST.

Frequently Asked Questions

How does SFC v5.0 handle different types of development projects, such as mixed-use or purely commercial?

The SFC v5.0 has been specifically updated to cater to a broader range of real estate development projects, including mixed-use, commercial, retail, and residential. This versatility is a significant enhancement from previous versions, designed to support the diverse feasibility needs of today’s real estate developers. Here are some insights into how SFC v5.0 manages different project types:

Mixed-Use Projects

For developments that combine commercial retail space with residential units, SFC v5.0 provides tools for analyzing the financial viability of each component separately and as a cohesive whole. It allows for detailed input on square footage, expected rental income, and efficiency ratings for commercial spaces, alongside residential development costs and potential sales revenue. This comprehensive approach ensures that developers can assess the feasibility of complex, mixed-use projects accurately.

Commercial Projects

SFC v5.0 introduces advanced features for evaluating commercial developments. This includes assessing leasable area efficiency, projected rental income, and the capitalized value of commercial properties based on their income-generating potential. The tool offers flexibility in applying different capitalization rates and considers outgoings to determine the net income from commercial leases.

Retail and Other Developments

The calculator is also equipped to handle feasibility studies for retail and other types of developments. It guides users through entering specific project details, such as construction costs, expected lease rates, and occupancy expenses, to evaluate the project’s potential return on investment.

What are the key financial metrics that SFC v5.0 calculates to assess the feasibility of a project?

Construction Costs

An estimate of the total expenses involved in the construction phase, including materials, labor, and other direct costs. SFC v5.0 allows for detailed input on these costs, offering a realistic picture of the financial commitment required for the project’s completion.

Projected Sales Revenue

An estimate of the income generated from the sale of the project’s units or commercial spaces. This metric is crucial for understanding the project’s potential profitability and return on investment.

Net Profit Margin

The tool calculates the net profit margin by subtracting all project costs (including construction, land purchase, and incidental expenses) from the total sales revenue. This metric gives developers an idea of the overall financial success of the project.

Return on Investment (ROI)

SFC v5.0 calculates the ROI by comparing the net profit to the initial investment costs. This ratio is vital for assessing the efficiency of the investment in generating returns.

Break-even Analysis

The tool performs a break-even analysis to determine the point at which total costs equal total revenues, helping developers understand the minimum performance required for the project to be financially viable.

Cash Flow Analysis

SFC v5.0 offers cash flow projections, illustrating how money is expected to flow in and out of the project over time. This analysis helps in managing liquidity and financial planning throughout the development process.

How does the tool aid in managing project timelines, especially with regard to construction and pre-sales?

Detailed Timeline Planning

SFC v5.0 allows users to create detailed timelines for their projects, including key milestones such as the start and end dates of construction, pre-sale activities, and anticipated completion dates. This feature helps in setting realistic timelines and adjusting project plans as necessary.

Construction Phase Management

The tool provides functionalities to meticulously plan the construction phase, accounting for the initiation of construction, progress checkpoints, and completion. It enables developers to input estimated construction costs, duration, and other relevant details to monitor the phase’s financial and temporal aspects closely.

Pre-Sales Strategy

SFC v5.0 assists in planning and tracking pre-sale activities, allowing developers to input expected sales prices, target dates for achieving sales milestones, and strategies for marketing the units. This feature is essential for ensuring that pre-sale activities align with overall project timelines and financial goals.

Cash Flow Implications

The tool integrates the impact of construction timelines and pre-sales on the project’s cash flow. By doing so, it helps developers understand how timelines affect the inflow and outflow of funds, enabling better financial planning and risk management.

Timeline Adjustments and Scenario Analysis

SFC v5.0 supports dynamic timeline adjustments, allowing developers to test different scenarios and assess their impacts on the project’s feasibility. This flexibility is vital for responding to unforeseen delays or changes in the market environment.

By providing these comprehensive timeline management capabilities, SFC v5.0 ensures that developers can more effectively plan and execute their projects, from the construction phase through to pre-sales and completion. This leads to better-optimized projects, reduced risks, and enhanced profitability.

What is the Smart Feasibility Calculator (SFC)?

The Smart Feasibility Calculator (SFC) is a tool designed for conducting financial feasibility studies on various real estate projects. It helps users quickly evaluate the financial viability of projects such as mixed-use, commercial, retail, and residential developments.

Why was SFC updated to version 5.0?

The update to SFC version 5.0 was motivated by the increasing reliance on the tool for quick feasibility assessments across different types of real estate projects. The aim was to enhance its efficiency and ease of use compared to more comprehensive feasibility applications, accommodating a wider range of project types.

How does the Project Timeline feature work in SFC v5.0?

The Project Timeline feature allows users to plot the timeline of their development project, including initial deposits, settlement periods, and construction phases, enabling a comprehensive time management plan for the project.

How do I input financial information into SFC v5.0?

Users can input financial information such as land purchase price, construction costs, and anticipated sales revenue. The tool then calculates the project’s financial feasibility based on these inputs.

What advice does SFC v5.0 offer for managing a development project?

SFC v5.0 offers practical advice on various aspects of project management, including handling council contributions, managing investor relations, and navigating legal requirements such as the margin scheme for GST.

How does SFC v5.0 help in managing construction and sales phases?

The tool provides detailed instructions on inputting construction costs, managing construction timelines, and handling pre-sales and contractual obligations to ensure smooth project completion.

Can SFC v5.0 handle complex projects with commercial and residential components?

Yes, SFC v5.0 introduces advanced features for more nuanced financial feasibility analysis, accommodating projects with commercial components alongside residential units. This includes new tabs for commercial feasibility and mixed-use project evaluations.