Coaching calls

SFC v3.0

The video provides a detailed walkthrough of installing and utilizing the Smart Feasibility Calculator (SFC) version 3.0, a tool designed for property developers. This software aims to enhance the decision-making process by providing a comprehensive analysis of property development feasibility. The key highlights and functionalities of SFC v3.0 are:

Installation Process

Instructions on downloading and installing SFC v3.0 are provided. Users are reminded to use the license key sent via email for activation.

Software Overview

SFC v3.0 is celebrated as a significant advancement for property developers, offering a range of new features designed to simplify and optimize property development feasibility studies.

Key Features:

Gross Realization Value (GRV) and Construction Cost

This tab allows users to breakdown the GRV and construction costs comprehensively.

Enhanced Finance Module

A notable enhancement in SFC v3.0 is the finance section, which helps determine the equity needed upfront for a project. This module addresses common queries about initial financial requirements for property development.

Yield Analysis

The yield tab offers projections on the development’s performance over time, showing potential returns over 5, 10, and 15 years. It includes a rental yield calculator that factors in the Consumer Price Index, rent per week, and outgoings to calculate net rental value over specified periods.

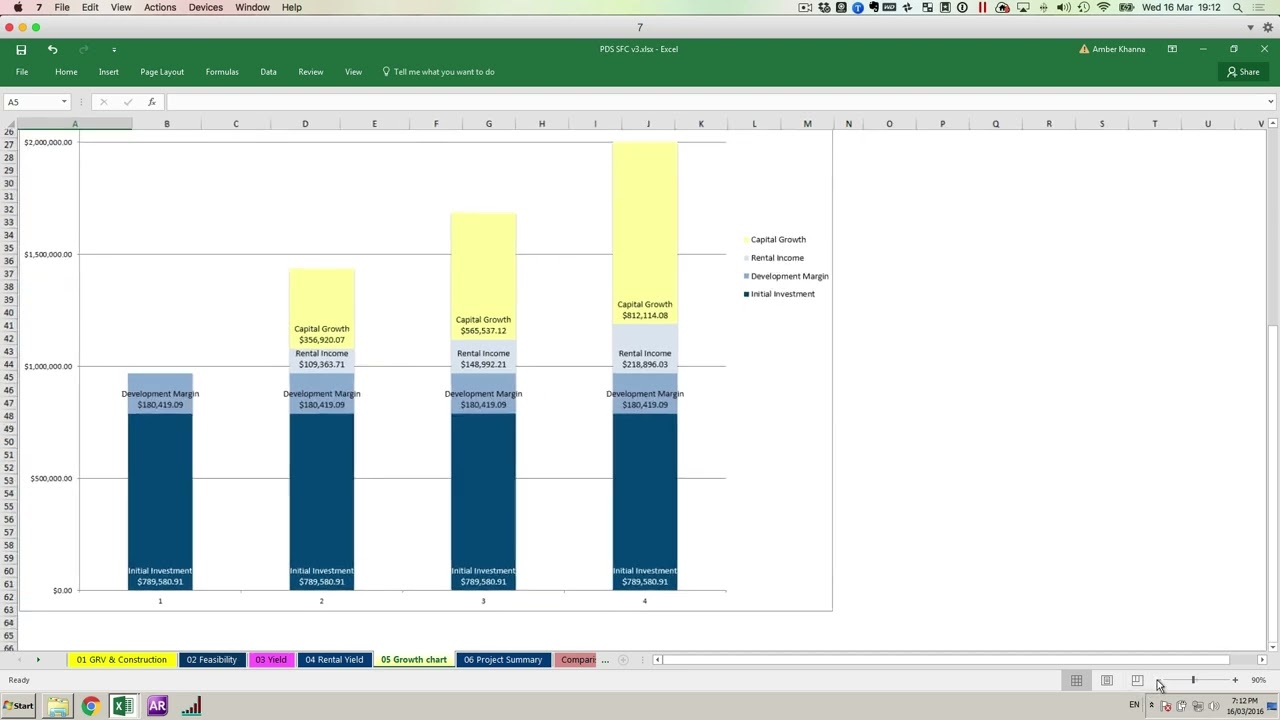

Graphical Representations

Graphs are included to illustrate no money down deals and the financial dynamics of being a developer versus a mere investor.

Project Summary and Comparison

These sections are designed to help compile no money down deals and compare outcomes between developers and investors.

Practical Application

The video includes a practical demonstration of the software using a real property development project as an example. The walkthrough covers entering project details, calculating GRV and construction costs, and utilizing the enhanced finance module to assess project feasibility.

Frequently Asked Questions

How does SFC v3.0 calculate the gross realisation value for a property development project?

Breakdown of GRV and Construction Costs

SFC v3.0 provides a dedicated tab where users can input detailed information related to GRV and construction costs. This structured approach allows for a nuanced understanding of the project’s financial outlook.

Dual Methods for GRV Calculation

Per Unit Basis

This method is straightforward, where the user inputs the expected selling price for each unit or property within the development. This method suits projects with a small number of units or when the pricing for each unit is distinct.

Square Meter Rate

This method calculates GRV based on the size of each unit and the going rate per square meter in the project’s area. This approach is particularly useful for apartment buildings or developments where units are similar in size. The calculator multiplies the size of each unit by the expected rate per square meter to estimate the GRV for the entire project.

Comprehensive Inputs for Accurate Estimates

Users are prompted to input various details, such as the number of units, their sizes, and expected prices or rates per square meter. These inputs ensure that the GRV calculation reflects the project’s specific context and market conditions.

What enhancements does the finance module offer in SFC v3.0 compared to previous versions?

Detailed Equity Assessment

The updated finance module allows developers to accurately determine the amount of equity needed upfront for their projects. This is a critical enhancement, as it helps developers plan their capital requirements more efficiently and reduces the risk of financial shortfalls during the development process.

Advanced Finance Calculations

SFC v3.0 expands upon the basic finance calculations available in earlier versions. The tool now includes sophisticated options for calculating loan-to-value ratios, interest rates, and other financing costs over the course of the project. This provides a more nuanced understanding of the financial health of the project at every stage.

Inclusion of Various Financial Metrics

The finance module incorporates a range of financial metrics, including development margin, initial investment needs, and the impact of these factors over time. This allows for a comprehensive financial analysis that can support strategic decision-making.

Yield Analysis for Long-term Planning

A notable addition is the yield tab, which forecasts the project’s performance over 5, 10, and 15 years, offering insights into long-term returns. This feature is particularly beneficial for developers considering holding onto the developed property as an investment.

Graphical Representations

The module now includes graphical representations that visually depict the financial dynamics of property development. These graphs help in understanding how different financial decisions impact the project’s profitability and feasibility over time.

What is the Smart Feasibility Calculator (SFC) v3.0?

SFC v3.0 is a sophisticated tool tailored for property developers to enhance their decision-making process through comprehensive analyses of property development feasibility. It is designed to simplify and optimise feasibility studies for property development projects.

What are the key features of SFC v3.0?

SFC v3.0 introduces several key features to aid property developers, including:

Gross Realization Value (GRV) and Construction Cost Breakdown

This feature allows for a detailed analysis of GRV and construction costs.

Enhanced Finance Module

Improvements in the finance section help determine the initial equity required for a project, addressing common financial queries.

Yield Analysis

Provides projections on a development’s performance over time, including potential returns over 5, 10, and 15 years, and calculates net rental value.

Graphical Representations

Includes graphs to illustrate the financial dynamics of deals and the comparative outcomes for developers versus investors.

Project Summary and Comparison

Helps compile and compare the financial outcomes of development projects.

How does the Enhanced Finance Module benefit users?

The Enhanced Finance Module is a notable improvement in SFC v3.0 that assists users in determining the equity needed upfront for a project. It addresses queries regarding the initial financial requirements for property development, making financial planning more accessible.

What is the purpose of the Yield Analysis feature?

The Yield Analysis tab offers projections on the development’s long-term performance, showing potential returns over specified periods. It includes a rental yield calculator that factors in various costs and the Consumer Price Index to calculate the net rental value, providing critical insights for strategic planning.

How can SFC v3.0’s graphical representations aid in decision-making?

Graphical representations in SFC v3.0 illustrate no money-down deals and the financial dynamics of being a developer versus an investor. These visuals help users understand the financial implications of their projects and make informed decisions by comparing different investment strategies.

Can SFC v3.0 be used for real property development projects?

Yes, SFC v3.0 can be applied to real property development projects. The video includes a practical demonstration of the software, showing how to enter project details, calculate GRV and construction costs, and utilize the Enhanced Finance Module to assess project feasibility.

Why is knowing the upfront equity needed for a project important?

Understanding the upfront equity required for a project is crucial as it provides developers with insights into the financial preparedness needed. SFC v3.0 offers detailed calculations for this, emphasizing the importance of financial planning in the initial stages of property development.

How does the Yield Analysis help in understanding long-term returns?

Yield Analysis in SFC v3.0 is an essential tool for property developers, offering insights into the long-term returns from development projects. This feature aids in strategic planning by providing projections on potential returns, helping developers make informed decisions about their investments.