Coaching calls

Data Analysis

This webinar, hosted by Amber, is a comprehensive guide for individuals struggling with how to effectively conduct spatial analysis for real estate investment, particularly focusing on determining the Gross Realization Value (GRV) of projects and conducting preliminary due diligence. The session is designed to equip viewers with the skills to analyse data, compare and contrast properties, and utilise specific tools for better decision-making. The key takeaways include:

Spatial Analysis

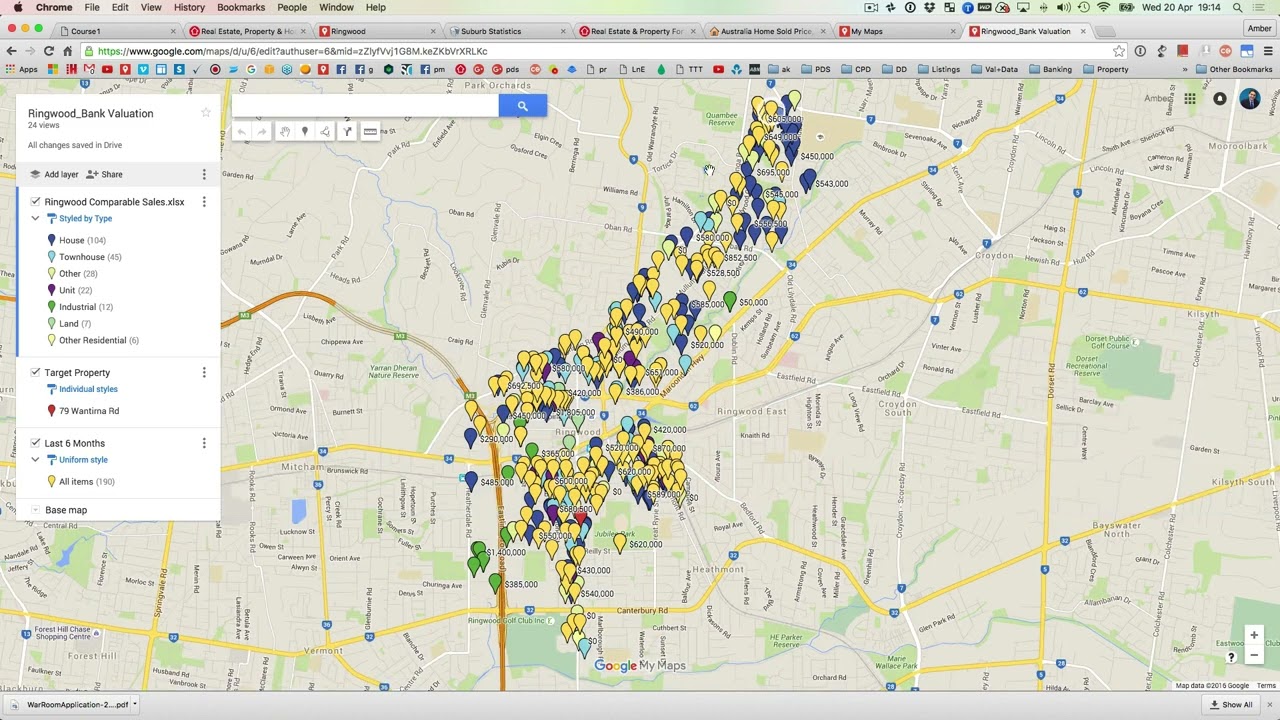

Amber introduces Google Maps’ Map Engine as an essential tool for conducting spatial analysis. This tool allows users to plot data on a map, enabling a visual comparison of various properties and their selling prices.

Data Analysis

The process of making sense of real estate data involves adding and organising additional columns in the dataset, such as address, price, and days on the market. This analysis helps in understanding market trends, including how properties are priced and how long they stay on the market.

Project Feasibility

A practical example of a project feasibility analysis is shared, highlighting the importance of understanding the local market, the potential selling price, and how to conduct a quick real scenario feasibility to ensure profitability before investing.

Interactive Learning

Viewers are guided through using Google’s Map Engine to input data and analyse the spatial distribution of properties in a specific area, such as Ringwood, Victoria. This hands-on approach helps in visualizing how properties compare to each other spatially.

Insights based on numbers

The webinar emphasises the significance of understanding the pricing trends, discount rates, and the impact of market demand on property prices. For instance, a property selling above its listed price indicates a high demand in the area.

Frequently Asked Questions

How does spatial analysis influence real estate investment decisions?

Spatial analysis plays a crucial role in real estate investment decisions, as demonstrated by Amber in the webinar. By utilizing Google’s Map Engine for spatial analysis, investors can visually compare properties within a specific area, analyse market trends, and assess property values relative to their geographic locations. This tool allows investors to plot data on a map, providing a clear visual representation of various properties and their selling prices. Here are several ways spatial analysis influences real estate investment decisions:

Visual Comparison

Investors can see the spatial distribution of properties, enabling them to compare and contrast properties in terms of location, price, and other significant factors. This comparison is vital for understanding the market dynamics of a particular area.

Understanding Market Trends

By analysing the spatial distribution of properties, investors can identify patterns such as high-demand areas, price trends, and the average time properties stay on the market. This information is crucial for making informed investment decisions.

Informed Decision Making

Spatial analysis helps investors identify potential investment opportunities by highlighting areas with high growth potential or underserved markets. It also aids in determining the best use of a property based on its location, enhancing the project’s feasibility and profitability.

Risk Mitigation

Through detailed spatial analysis, investors can assess risks associated with specific locations, such as flood zones, proximity to amenities, or areas prone to market volatility. This assessment helps in mitigating potential risks before making significant investment decisions.

What factors should be considered in project feasibility analysis to ensure profitability?

Understanding the Market

A deep understanding of the local real estate market, including current pricing, demand, and competitive analysis, is vital. This involves analysing data such as the selling prices of nearby properties, the demand in the area, and how similar projects have fared in the market.

Cost Analysis

Detailed cost analysis, including the purchase price, construction costs, legal fees, marketing expenses, and any other associated costs. This helps in creating an accurate budget for the project and identifying the expected return on investment (ROI).

Profitability Analysis

Conducting a thorough profitability analysis by comparing the total project costs against the potential selling price (Gross Realization Value - GRV) of the project. This involves calculating the expected profit margin and determining if the project meets the investor’s financial goals.

Spatial Analysis

Utilising tools like Google’s Map Engine for spatial analysis to visually compare properties, assess the geographical distribution of prices, and understand the area’s development potential. This can influence decisions on property acquisition and project scope.

Regulatory Considerations

Understanding local zoning laws, planning permissions, and any other regulatory requirements that could affect the project. This ensures that the project complies with all legal requirements, which is crucial for its feasibility and success.

Risk Assessment

Identifying potential risks, including market fluctuations, construction delays, and cost overruns, and planning for contingencies. This helps in preparing for unexpected challenges that could impact the project’s profitability.

How do market trends affect the pricing and selling of properties in a specific area?

Demand and Supply Dynamics

High demand in a specific area, coupled with limited supply, can significantly drive up property prices. Conversely, if an area experiences an oversupply of properties with lower demand, prices may stagnate or decline. Understanding these dynamics is crucial for setting realistic pricing expectations for both buying and selling properties.

Economic Factors

General economic conditions, including interest rates, employment rates, and economic growth, can influence buyer purchasing power and willingness to invest in real estate. Economic downturns may lead to lower property prices, while robust economic growth can increase property values.

Area Development and Amenities

Developments in an area, such as new shopping centres, schools, or public transport options, can enhance the appeal of a region and lead to increased property prices. Investors need to stay informed about planned developments that could affect property values in the future.

Historical Price Trends

Past price trends in an area can provide insights into future market movements. An area with a consistent history of price appreciation may be more likely to continue that trend, whereas areas with volatile price histories might present more risk.

Market Sentiment

The overall sentiment and expectations of buyers and sellers in the real estate market can also affect property prices. Positive sentiment can lead to price increases, while negative sentiment can result in price corrections.

Comparative Analysis

Comparing properties and their selling prices in the targeted area is vital. Spatial analysis tools enable investors to visually compare properties, analyse price distributions, and make informed decisions based on how similar properties are priced and sold.

What is Spatial Analysis in Real Estate Investment?

Spatial analysis involves the examination of geographical locations to understand real estate trends better. It allows investors to visually compare properties, their prices, and other significant factors on a map, which aids in making more informed investment decisions

What main tools were introduced for conducting Spatial Analysis?

Amber introduced Google Maps’ Map Engine as the primary tool for conducting spatial analysis. This tool enables users to plot and compare data on a map, facilitating the visual comparison of different properties and their selling prices.

How does Data Analysis help in Real Estate Investment?

Data analysis in real estate involves organising and examining data related to properties, such as addresses, prices, and days on the market. This process helps investors understand market trends, including property pricing and the duration properties stay on the market, which is crucial for making informed decisions.

What is the importance of Project Feasibility Analysis in Real Estate?

Project feasibility analysis is crucial as it helps investors understand the local market, potential selling prices, and the profitability of a project before making an investment. It ensures that investments are made in viable projects with a high likelihood of profitability.

How does interactive learning enhance understanding of Real Estate Data Analysis?

Interactive learning, such as using Google’s Map Engine to input and analyse data, helps users visualise the spatial distribution of properties. This hands-on approach is beneficial in understanding how properties compare to each other spatially and aid in better decision-making.

What are Insights Based on Numbers in Real Estate Analysis?

Insights based on numbers refer to the analysis of pricing trends, discount rates, and market demand’s impact on property prices. Understanding these numerical insights is crucial for determining the Gross Realization Value (GRV) of projects and making informed investment decisions.

How is the Gross Realization Value (GRV) determined?

The GRV is determined by analysing current market data to understand pricing trends and market demand. Accurate pricing and a deep understanding of these trends are essential for estimating the potential selling price and overall profitability of real estate investments.

Why is Preliminary Due Diligence important in Real Estate Investment?

Conducting preliminary due diligence is crucial for mitigating risks associated with real estate investments. It involves thorough research and analysis to ensure that the investment is sound and the project is viable before proceeding.

How does analysing Market Trends aid in Real Estate Investment?

Analysing market trends, including property pricing and demand, provides valuable insights into the real estate market’s current state. This analysis helps investors make informed decisions by understanding the market dynamics and potential investment opportunities.