Coaching calls

Creative Strategies

The video “Creative Strategies” delves into the realm of property development, specifically focusing on executing deals with no initial capital outlay, commonly known as no-money-down deals. It emphasises the importance of effort, strategic planning, and building relationships to succeed in such ventures.

The presenter shares insights from their personal experiences, highlighting various strategies and considerations essential for anyone looking to enter or excel in property development without a significant upfront financial commitment.

Key Takeaways

No Money Down Deals

These are achievable for anyone willing to invest effort. The webinar outlines strategies to engage in property development without initial capital, debunking myths that such deals are unattainable.

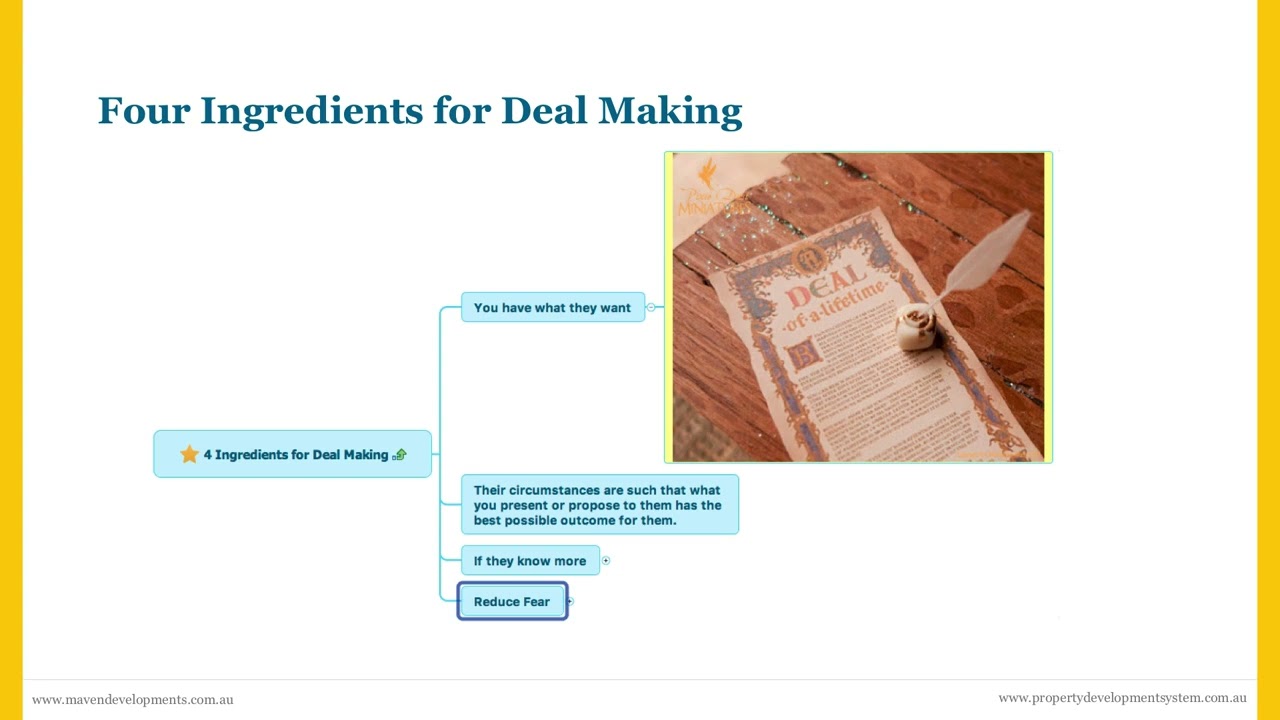

Four Ingredients for Success

The video details four critical components for making no-money-down deals work: becoming a deal-maker, leveraging different sources of equity, understanding and creating ‘sweat equity,’ and exploring joint ventures with stakeholders like landowners, builders, and private funders.

Personal Integrity

A significant emphasis is placed on integrity and ensuring partners or investors benefit from deals. The presenter suggests prioritising investors’ returns to build long-lasting, trust-based relationships.

Overcoming Challenges

Real-life hurdles in property development are discussed, including unexpected costs, disputes with builders, and issues with pre-sales. The video stresses the importance of transparency and responsibility towards investors’ funds.

Building Trust

Trust is foundational, achieved through thorough knowledge, leveraging consultants’ expertise, and demonstrating credibility through past successes or partnerships.

Managing Fear and Risks

Insights on overcoming fear and managing risks in property development are shared. It highlights the importance of understanding the process, building a reliable team, and being prepared for unforeseen challenges.

Relationship Building

Establishing strong relationships with investors, partners, and clients is crucial. The video encourages spending time to understand and respect each party’s needs, which fosters a positive and collaborative working environment.

Frequently Asked Questions

How can individuals without prior experience in property development start their first no-money-down deal?

Education and Knowledge

The foundation of beginning with no money-down deals lies in acquiring comprehensive knowledge about the property development process. It’s crucial for individuals to educate themselves on the market, financial analysis, project management, and legal aspects of property development. The presenter emphasises the importance of understanding the nuances of no-money-down deals, including the various strategies that can be employed and the risks involved.

Building Relationships

For novices, forging strong relationships with experienced developers, mentors, or consultants is vital. These relationships can provide guidance, insights, and even partnerships that can pave the way for successful deals. The video highlights how leveraging the expertise and credibility of seasoned professionals can compensate for a lack of personal experience.

Sweat Equity

One of the entry points into no money down deals is through the creation of sweat equity. This involves offering one’s skills, time, and effort in lieu of a financial investment. Tasks such as project management, market research, securing permits, or finding potential development sites can provide value to a project and earn a stake in the development.

Joint Ventures

Partnering with landowners, builders, or investors can also provide a pathway into property development without initial capital. The video discusses how presenting a well-researched, viable development proposal can attract partners who are willing to provide financial backing in exchange for the skills or services you bring to the table.

Integrity and Trust

Establishing trust and demonstrating integrity are underscored as essential qualities for anyone looking to start in property development. Ensuring that deals are structured in a way that prioritises the interests of all parties involved can build a reputation for reliability and fairness, which is invaluable for securing future projects.

Practical Experience

Gaining practical experience through internships, volunteering, or working in related fields can provide insights and skills that are beneficial for property development. This hands-on experience can also expand one’s network within the industry, opening up opportunities for no money down deals.

What are the most common challenges faced in no money down property deals, and how can they be mitigated?

Understanding Local Planning Frameworks

Success in rezoning hinges on a deep understanding of local planning frameworks, growth plans, and urban boundaries. Developers need to study the city or region’s long-term development plans, identifying areas poised for growth or changes in land use. This insight guides where to focus efforts for potential rezoning opportunities.

Identifying Rezoning Opportunities

Identifying parcels of land positioned on the fringes of existing zoning classifications can present significant opportunities. For instance, a piece of land zoned for commercial use but adjacent to a residential area may have untapped potential if rezoned for residential use. The reverse can also be true, where converting residentially zoned land to commercial use can significantly increase its value.

The Impact of Rezoning

Successfully rezoning a property can lead to a substantial uplift in value, particularly when it allows for a higher density of development than previously permitted. For example, rezoning land to allow the construction of a multi-story apartment building instead of a few townhouses can drastically increase the financial return on the property.

Strategic Approach to Rezoning

The process requires a strategic approach, including preliminary discussions with planning authorities, community engagement, and possibly the hiring of consultants who specialise in planning and zoning matters. Understanding the local community’s sentiments and the planning authority’s priorities can help tailor applications for a higher chance of success.

Leveraging Professional Expertise

Engaging with professionals who have a proven track record in successfully navigating the rezoning process can be invaluable. These experts can provide insights into the likelihood of success, the potential challenges, and the strategies for addressing any objections that may arise.

Financial and Time Considerations

Rezoning is not without its costs and time requirements. Developers should be prepared for the expenses associated with planning applications, consultancy fees, and potential delays in the approval process. The financial implications of rezoning must be carefully weighed against the potential uplift in property value to ensure the endeavour is economically viable.

Risks and Rewards

While rezoning can offer significant rewards in terms of increased property value and development potential, it also carries risks, including the possibility of rejection by planning authorities or opposition from the local community. Developers must assess these risks and have contingency plans in place.

How does one build and maintain trust with investors and partners in the long term?

Key Strategies for Adding Value and Structuring Deals:

JV with Landowners

Strategies for partnering with landowners are explored, including offering them a stake in the development (like a townhouse) in lieu of direct payment for the land. This approach can significantly reduce upfront costs and align interests.

Equity in Land

The use of land as equity for securing loans is discussed. However, caution is advised if the land is heavily mortgaged, as it may complicate or negate the viability of such deals.

Stage Acquisition

For large parcels of land, acquiring and developing in stages can be a practical approach. Key considerations include the land’s mortgage status, existing permits, and the landowner’s expectations.

Joint Ventures

The mechanics of JVs, including with builders and financial partners, are detailed. These partnerships can range from sharing the construction work to financing the project, offering a versatile toolkit for developers to leverage external resources and expertise.

Legal and Financial Structuring

The importance of having clear agreements, including JV contracts and exit strategies, is stressed to prevent disputes and ensure fair profit distribution. Structuring the deal properly from the outset, including transferring land to a new entity and determining shareholding, is crucial for a smooth development process.

Communication and Transparency

Maintaining open lines of communication and transparency with partners is essential. Regular updates, clear explanations of decisions, and respectful interactions build trust and facilitate successful collaboration.

What are no money-down deals in property development?

No money-down deals refer to property development ventures initiated without requiring an initial capital outlay from the developer. This strategy emphasises effort, strategic planning, and building strong relationships rather than an upfront financial investment to enter or succeed in the property development industry.

How can someone achieve success in no-money-down property development deals?

- Success in no-money-down deals requires four key components:

- Becoming a deal-maker who is adept at identifying and structuring property deals.

- Leveraging different sources of equity, including financial contributions from partners or investors.

- Understanding and creating ‘sweat equity’ by adding value to the property through effort and skill rather than financial investment.

- Exploring joint ventures with stakeholders such as landowners, builders, and private funders to share resources and risks.

Why is personal integrity important in property development?

Personal integrity is crucial in property development to ensure that all partners and investors benefit from the deals. By prioritising investors’ returns and maintaining transparent and ethical practices, developers can build long-lasting, trust-based relationships essential for the success and sustainability of their projects.

What challenges might developers face in no-money-down deals, and how can they overcome them?

Developers might encounter various challenges, including unexpected costs, disputes with builders, and issues with pre-sales. Overcoming these challenges requires transparency and responsibility towards investors’ funds, effective communication, and a commitment to resolving issues promptly and ethically.

How can trust be built in the property development industry?

Trust can be established by demonstrating thorough knowledge of the property development process, leveraging the expertise of consultants, and showcasing credibility through past successes or partnerships. Trust is also built through consistent and honest communication with all stakeholders involved in a project.

How important is relationship building in property development?

Building strong relationships with investors, partners, and clients is vital in property development. Spending time to understand and respect each party’s needs and goals creates a positive and collaborative working environment, which is essential for the success of any development project.

What role does managing fear and risks play in property development?

Managing fear and risks is crucial for success in property development. It involves a deep understanding of the development process, assembling a reliable team, and preparing for unforeseen challenges. Effective risk management strategies and a resilient mindset can help developers navigate the complexities of property development with confidence.

Why are financial planning and risk management important in no-money-down property development deals?

Financial planning and risk management are critical to ensure that projects are completed within budget and on time, and that they generate a sufficient return on investment. These practices help in anticipating potential financial pitfalls and in devising strategies to mitigate risks, ensuring the project’s success and the stakeholders’ satisfaction.

Test Your Knowledge

Multiple-Choice Questions on “Creative Strategies” in Property Development

1. What is a key strategy in executing no-money-down deals in property development?

A. Focusing solely on large projects

B. Securing a large upfront investment from a single source

C. Building relationships and strategic planning

D. Avoiding partnerships and joint ventures

2. Which of the following is NOT listed as a critical component for success in no-money-down property development deals?

A. High initial capital investment

B. Becoming a deal-maker

C. Leveraging different sources of equity

D. Understanding and creating ‘sweat equity’

3. Personal integrity in property development is important because:

A. It guarantees a high profit margin on all deals

B. It ensures partners and investors benefit from the deals

C. It allows developers to take more significant risks without consequences

D. It is required by law in all property development projects

4. How can developers overcome challenges such as unexpected costs and pre-sales issues?

A. By ignoring these issues until they resolve themselves

B. Through transparency and taking responsibility for investors’ funds

C. By shifting the blame to other stakeholders

D. By focusing solely on future projects and ignoring current issues

5. Building trust in property development is achieved through:

A. Keeping strategies and insights secret from partners and investors

B. Demonstrating credibility through past successes and leveraging experts

C. Avoiding joint ventures and partnerships

D. Making decisions based solely on intuition, ignoring data or past experiences

6. What role does managing fear and risks play in property development?

A. It is an unnecessary concern that should be ignored

B. It involves taking as many risks as possible to ensure high returns

C. It highlights the importance of understanding the process and being prepared

D. It suggests that developers should work alone to minimize risks

7. Why is relationship building crucial in no money down property development deals?

A. It enables developers to avoid legal responsibilities

B. It is only necessary for large-scale development projects

C. Understanding and respecting each party’s needs fosters a collaborative environment

D. Relationships are not as important as financial investment in property development

8. The discussion on overcoming project hurdles such as stormwater issues or banking delays illustrates:

A. The need for secrecy and withholding information from stakeholders

B. The complexity and financial dynamics requiring adaptability and problem-solving

C. That such issues are rare and not worth preparing for

D. The importance of avoiding projects that might involve such hurdles

9. What is implied about the role of financial planning and risk management in development projects?

A. They are optional practices for experienced developers

B. They have a critical role in ensuring projects are completed within budget and on time

C. They are less important than the design aspect of development

D. They only apply to projects with high initial capital investments

Answers

- C. Building relationships and strategic planning

- A. High initial capital investment

- B. It ensures partners and investors benefit from the deals

- B. Through transparency and taking responsibility for investors’ funds

- B. Demonstrating credibility through past successes and leveraging experts

- C. It highlights the importance of understanding the process and being prepared

- C. Understanding and respecting each party’s needs fosters a collaborative environment

- B. The complexity and financial dynamics requiring adaptability and problem-solving

- B. They have a critical role in ensuring projects are completed within budget and on time

Assignment

Demonstrating Understanding of Creative Strategies in Property Development

Objective:

This assignment aims to deepen students’ understanding of the principles and practices of executing no-money-down deals in property development. Through research, analysis, and practical application, students will explore the critical components of success in property development without significant upfront financial commitments.

Instructions:

Complete the following tasks, incorporating concepts from the “Creative Strategies” video. Each task is designed to challenge your understanding and application of the material presented. Provide detailed responses and examples where possible.

Tasks:

Research and Analysis:

A. Investigate a real-world example of a no-money-down deal in property development. Describe the deal, including the stakeholders involved, the financial structure, and the outcome.

B. Identify the four critical components for success (deal-making, leveraging equity, creating sweat equity, and exploring joint ventures) in the example you chose. How did each component contribute to the deal’s success or failure?

Practical Application:

A. Propose your own no-money-down deal structure. Describe a hypothetical property development project, including the type of property, the location, and the potential challenges. Outline how you would apply the four critical components for success to your proposed project.

B. Develop a strategy for building and maintaining trust with potential investors and partners in your hypothetical project. How would you demonstrate your integrity and commitment to their returns?

Critical Thinking:

A. Reflect on the importance of overcoming challenges, such as unexpected costs or pre-sales issues, in property development. Propose solutions for two potential challenges you might face in your hypothetical project.

B. Discuss the role of financial planning and risk management in your proposed project. How would you ensure the project stays within budget and on time?

Creativity and Innovation:

A. Design a creative strategy for creating sweat equity in your hypothetical project without a significant financial investment. How would you add value to the property?

B. Imagine a scenario where traditional funding options are unavailable for your project. Brainstorm alternative funding solutions, considering the principles of no-money-down deals.

Communication Skills:

A. Create a pitch for your hypothetical no-money-down property development project. Aim to convince potential investors or partners of the project’s viability, highlighting how their concerns (such as risk and return on investment) will be addressed.

B. Draft a series of emails to potential stakeholders (investors, partners, consultants) introducing your project and requesting a meeting to discuss a possible joint venture or partnership.

Submission Guidelines:

- Compile your responses in a document, clearly labeling each task.

- Include any references used for your research and analysis.

- Ensure your proposed strategies and examples are well thought out and demonstrate a comprehensive understanding of the material presented in “Creative Strategies.”