What is the Operating Expense Ratio?

The Operating Expense Ratio (OER) is a financial metric that compares a property’s operating expenses to its effective gross income (EGI). It is used to assess how efficiently a property is being managed by indicating the portion of income consumed by operating costs.

How is it Calculated?

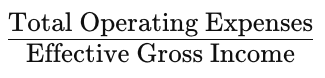

The formula for calculating the Operating Expense Ratio is:

Where:

- Total Operating Expenses include costs related to maintaining the property, such as utilities, repairs, property management fees, and taxes.

- Effective Gross Income (EGI) is the total rental income after accounting for vacancy and credit losses.

Advantages and Disadvantages

Advantages:

- Helps in evaluating the efficiency of property management.

- Easy to calculate and understand.

- Provides insight into potential areas for cost reduction.

Disadvantages:

- Ignores financing costs and capital expenditures.

- Does not directly reflect profitability.

- May not accurately capture variations in property conditions or market trends.

Pros and Cons

Pros:

- Useful for benchmarking against industry standards.

- Helps identify properties with excessive operating costs.

- Simple metric for quick assessment of expense management.

Cons:

- Can be misleading if not compared with similar property types.

- High OER may not always indicate poor performance (e.g., in luxury properties with higher maintenance costs).

- Doesn’t account for changes in income or market conditions.

What are Its Shortcomings?

- It only provides a snapshot based on current income and expenses, lacking predictive power.

- May not capture all relevant factors affecting property performance.

- Varies significantly across different property types, making comparisons challenging.

What is It Really Good For?

The OER is ideal for monitoring the efficiency of property management and identifying potential areas for cost control. It serves as a useful benchmark for comparing similar properties or evaluating portfolio performance.

What is a Good Range for It?

A typical range for the Operating Expense Ratio is 30-50%. Lower ratios indicate better efficiency, while higher ratios suggest higher costs relative to income. However, acceptable ranges can vary depending on property type and location.