Negotiations Overview - 05

Here, you will learn strategies for navigating the complexities of financial preparation, due diligence, and option contracts in hot real estate markets.

Preparation

Being prepared is crucial in a hot market. Have your finances ready, as finance delays can significantly increase project costs. Due diligence is essential before unconditionally committing to a purchase.

Financial Structure

Ensure your financial structure is prepared to make your offer competitive without overpaying. Utilise a financial feasibility template to work backward and determine the residual value of land.

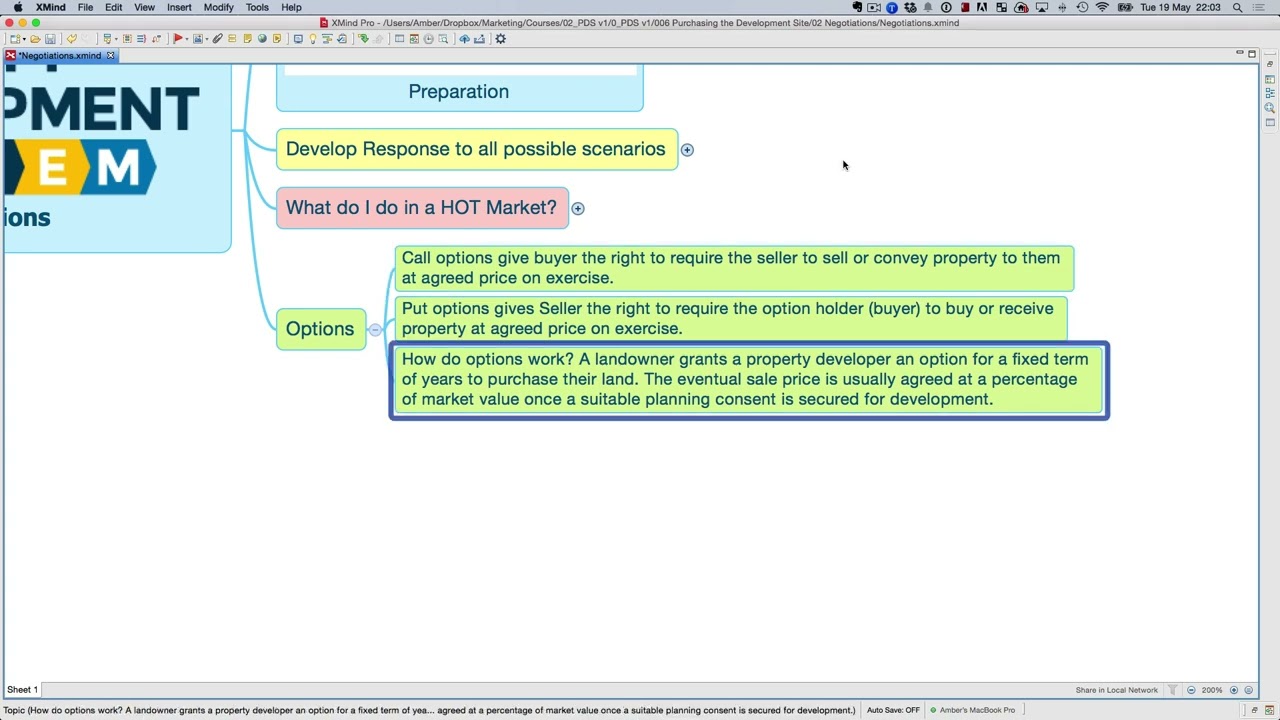

Options

Understand the difference between call and put options. Always opt for a call option, allowing you to compel the seller at a predetermined price. Legal advice is paramount when drafting an option contract.

Insights based on numbers

- Finance delays can increase holding costs significantly, affecting profits.

- A proper financial feasibility analysis can help determine the right price for land, ensuring you don’t overpay and jeopardise your investment.

Frequently Asked Questions:

How can finance preparation impact the success of a project in a hot market?

Being well-prepared with your finances is crucial, as delays related to financing can lead to increased holding costs, such as council rates and interest payments on loans.

These unexpected expenses can eat into your profits. Therefore, having your finances ready and conducting thorough due diligence before making an offer can significantly enhance the likelihood of a project’s success by reducing delays and additional costs.

What steps are essential in financial structuring to make an offer more attractive?

Due Diligence

Performing thorough due diligence before making an offer. This ensures you can proceed confidently, making your offer unconditional and more appealing to sellers.

Financial Feasibility

Utilising a financial feasibility template to calculate the project’s economic viability. This involves working backwards to figure out the residual land value, ensuring you pay the appropriate amount of money and compromise your investment.

Competitive Offer

Structuring your finances to make your offer more competitive without exceeding the market value. The aim is to present a compelling offer to the seller without jeopardising your profit margins by overpaying.

These steps help in crafting an offer that is both competitive and financially prudent, enhancing the attractiveness of your bid to sellers without sacrificing your project’s financial health.

Why is a call option preferred over a put option in real estate negotiations?

Call Option

It allows the buyer to compel the seller to sell the property at a previously agreed price. This option is beneficial because it gives the buyer the right to purchase the property at a set price, ensuring they can still buy it at a lower cost if the property’s value increases. It’s a strategy that secures the buyer’s position and offers flexibility in timing the purchase, which is particularly useful in obtaining planning consents or permits before finalising the purchase.

Put Option

This option gives the seller the right to force the buyer to purchase the land. It’s less favourable for buyers because it can make them obligated to proceed with the purchase, regardless of changes in circumstances or if further due diligence reveals issues with the property.

What are the key strategies for dealing with real estate negotiations in hot markets?

The key strategies include financial preparation, thorough due diligence, and understanding the intricacies of option contracts. These approaches help navigate the complexities and stay competitive in hot real estate markets.

Why is preparation essential in a hot real estate market?

Preparation is critical because it allows you to act swiftly and efficiently. Having your finances in order ensures you can make prompt offers and avoid delays that could increase project costs significantly.

What does financial preparation involve?

Financial preparation involves ensuring your financial resources are ready and accessible when you make an offer. This means arranging your funding, loans, or other financial structures beforehand to avoid any delays in transaction processes.

How can you make your offer competitive without overpaying?

By using a financial feasibility template, you can calculate backwards to find the residual value of the land, ensuring your offer is competitive but does not exceed the land’s worth or compromise your investment.

What is a financial feasibility template?

A financial feasibility template is a tool used to analyse the financial viability of a real estate project. It helps investors determine the maximum amount they can pay for land, considering projected costs and desired profit margins, ensuring they don’t overpay.

What are call-and-put options in real estate?

Call options allow the buyer the right to compel the seller to sell the property at a predetermined price within a specific timeframe. Put options give the seller the right to compel the buyer to purchase the property under agreed conditions. In hot markets, call options are preferable for buyers.

Why is legal advice important when drafting an option contract?

Legal advice is crucial because option contracts can be complex and have significant financial implications. A lawyer can ensure that the contract protects your interests and is legally sound.

How do finance delays affect real estate projects?

Finance delays can significantly increase holding costs, such as interest payments, eroding profit margins. Being financially prepared helps avoid these delays and their associated costs.

Why is determining the right price for land necessary?

Determining the right price is essential to avoid overpaying for the land and ensuring the investment remains viable and profitable. A financial feasibility analysis helps assess the land’s maximum payable amount, considering the project’s costs and expected returns.

Test Your Knowledge

Multiple-Choice Questions on Real Estate Negotiation Strategies

1. Why is being financially prepared important in a hot real estate market?

A) To ensure you can bid higher than others.

B) To avoid finance delays that can increase project costs.

C) Because it looks good on your credit report.

D) It’s not; negotiation skills are more important.

2. What is the purpose of using a financial feasibility template?

A) To calculate the maximum interest rate you can afford.

B) To determine the residual value of the land, ensuring you don’t overpay.

C) To impress the seller with your financial knowledge.

D) To figure out your net worth.

3. Why is a call option preferred over a put option in real estate negotiations?

A) It allows the seller to decide on the final price.

B) It gives the buyer the right to purchase at a lower price if the value increases.

C) It commits the buyer to purchase, no matter the circumstances.

D) It benefits the seller by guaranteeing a sale.

4. Which of the following is NOT a reason finance delays can affect real estate projects negatively?

A) They can decrease the total cost of the project.

B) They can increase holding costs significantly.

C) They might erode profit margins.

D) Delays can lead to missing out on favorable market conditions.

5. What is the main reason thorough due diligence is crucial before making an unconditional offer?

A) It ensures you have a backup plan.

B) It is a legal requirement.

C) It helps in understanding the true value of the property and any potential issues.

D) It allows for a better mortgage rate.

6. How does determining the right price for land using a financial feasibility analysis help investors?

A) It ensures they get the biggest land available.

B) It helps in paying more than necessary to secure the land.

C) It prevents overpaying and jeopardizing the investment.

D) It is only useful for tax purposes.

7. What role does legal advice play in drafting an option contract?

A) It is useful for defining real estate terms.

B) Legal advice guarantees the seller will accept your offer.

C) It ensures the contract is legally sound and protects your interests.

D) It simplifies the contract language for easier understanding.

Answers:

- B) To avoid finance delays that can increase project costs.

- B) To determine the residual value of the land, ensuring you don’t overpay.

- B) It gives the buyer the right to purchase at a lower price if the value increases.

- A) They can decrease the total cost of the project.

- C) It helps in understanding the true value of the property and any potential issues.

- C) It prevents overpaying and jeopardizing the investment.

- C) It ensures the contract is legally sound and protects your interests.

Assignment

Real Estate Negotiation Strategies: Practical Exercise

Objective:

This assignment will deepen your understanding of financial preparation, due diligence, and option contracts in real estate negotiations, particularly in hot markets. You will apply these concepts to a hypothetical real estate investment scenario through a series of tasks.

Scenario:

Imagine you are a real estate investor looking to purchase a piece of land in a hot market. The land is in a prime location and has attracted interest from several investors. Your goal is to secure the land competitively without overpaying, ensuring your future project on this land is financially viable.

Tasks:

Financial Preparation

- To Do: Create a checklist of financial preparations you need to complete before making an offer. Consider aspects like funding, loan pre-approval, and budget allocation.

- Research Question: Investigate the impact of finance delays on real estate projects. Provide a brief summary of your findings, including how these delays can increase project costs.

Due Diligence

- To Do: Draft a due diligence plan for the land purchase. Include steps to assess the land’s legal standing, zoning restrictions, environmental assessments, and any other relevant factors.

- Research Question: Why is due diligence crucial before making an unconditional offer on a piece of land? Illustrate your answer with examples.

Financial Structuring

- To Do: Using a financial feasibility template (create one or find a template online), calculate the residual value of the land based on hypothetical project costs and desired profit margin. Outline your assumptions and results.

- Research Question: How does a financial feasibility analysis assist in making an offer competitive without overpaying?

Understanding Options

- To Do: Simulate a scenario in which you negotiate an option contract for the land purchase. Choose between a call option and a put option, justifying your choice based on the scenario’s context.

- Research Question: Describe the differences between call and put options in real estate and explain why a call option might be preferable in a hot market.

Legal Consultation

- To Do: List the key considerations you would discuss with a legal advisor when drafting your option contract. Include aspects related to the price, duration, and any contingencies.

- Research Question: Why is seeking legal advice important when dealing with option contracts in real estate transactions?

Submission Guidelines:

- Format: Prepare your responses in a structured document, clearly labelling each task and research question.

- Length: Each task response should be approximately 250-300 words. Research questions should be answered comprehensively with a minimum of 150-200 words per question.

- References: Include any sources you consulted for the research questions, ensuring they are credible and relevant.