Negotiations Overview - 04

This article explores strategic preparation and techniques for effective negotiation, emphasising the importance of planning for various scenarios and the tactical use of options in property deals.

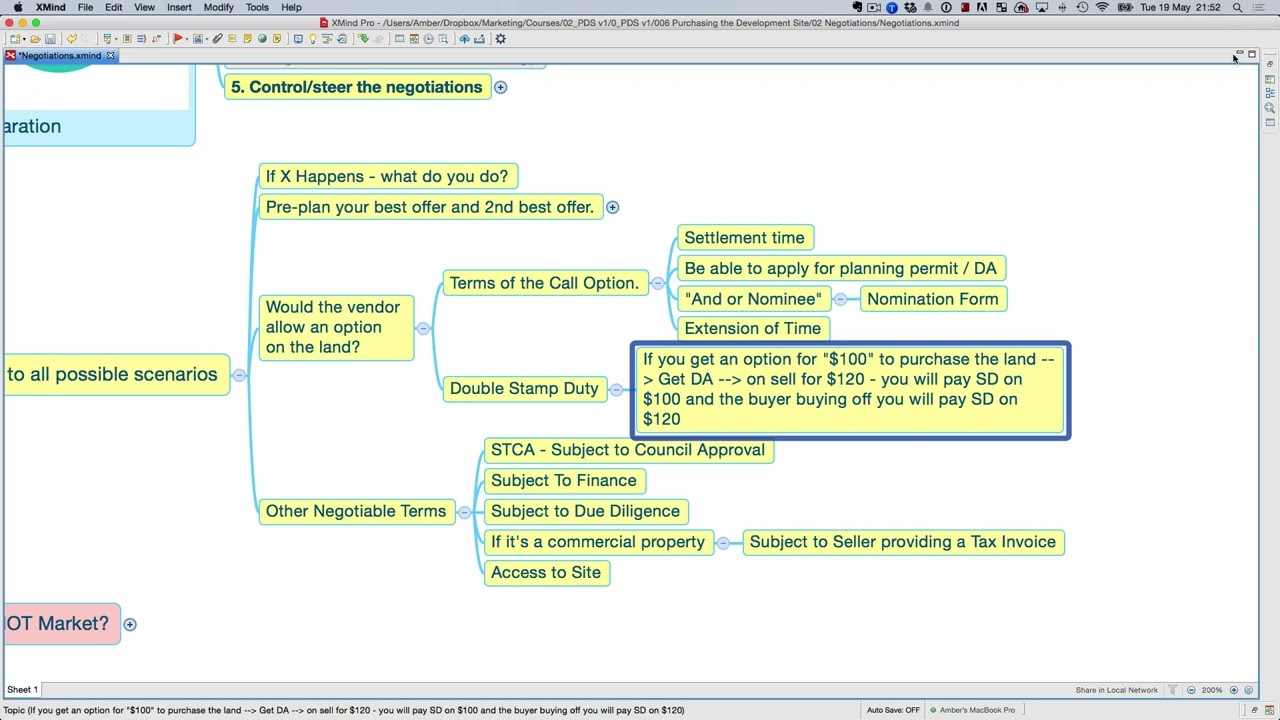

The above video delves into leveraging negotiation terms and understanding the financial implications of options and development approvals.

Preparation

Develop responses for all possible negotiation scenarios. Practice negotiations to anticipate various outcomes and establish a firm bottom line.

Strategy

Start with your second-best offer to leave room for negotiation. Use another decision maker, like a business partner, as leverage to buy time for further research or better offers.

Options

Understand the use of options in property deals, recognising they attract double stamp duty. Options are more applicable to significant acquisitions rather than small developments but should be ruled out only partially.

Negotiation Evolutions

Negotiations and deals can evolve, leading from simple terms to options or other complex agreements. It’s crucial to understand what arrangements make both parties comfortable.

Tax and Costs

Be aware of the tax implications and costs associated with development approvals and the use of options, especially regarding stamp duty and profitability on smaller projects.

Insights based on numbers:

- The double stamp duty on options means paying tax on both the purchase price and the sale price after development approval adds value.

- A 20% uplift in property value is challenging for smaller projects, affecting the profitability after accounting for development costs and taxes.

Frequently Asked Questions:

How does practising every possible scenario improve negotiation outcomes?

Practising every possible scenario before entering a negotiation room significantly improves outcomes by ensuring preparedness for any direction the discussion might take.

This approach enables negotiators to have pre-planned responses and strategies, reducing the likelihood of being caught off guard and enhancing the ability to steer negotiations towards favourable terms.

By anticipating potential objections or offers, negotiators can maintain control over the discussion, ensuring they remain within their strategic boundaries and achieve their objectives more effectively.

What are the benefits and drawbacks of using options in property negotiations?

The benefits of using options in property negotiations include the flexibility to secure rights to purchase or sell property within a specified timeframe without the immediate obligation to buy. Options allow for strategic planning and development approval processes to add value to the land.

Options can be powerful tools in large acquisitions. They provide a way to control property with minimal initial investment while assessing its potential and securing financing or partners.

However, the drawbacks include the complexity of options agreements and the financial implications, such as attracting double stamp duty—tax on the option purchase price and again on the final sale price. This aspect makes options less attractive for smaller projects, where the added costs and legal complexities may not justify the potential benefits.

Additionally, successfully leveraging options requires a deep understanding of the market and the ability to accurately predict development outcomes, which can be challenging and risky.

How do negotiation strategies evolve in response to the other party’s offers and the overall deal structure?

Negotiation strategies evolve in response to the other party’s offers and the overall deal structure to create win-win situations and adapt to unforeseen circumstances.

Initially, negotiators might start with more conservative or flexible terms, such as more extended settlement periods or second-best offers, to leave room for adjustments.

As discussions progress, both parties reveal more about their priorities and constraints, allowing for tailored solutions that address both sides’ needs.

What is strategic preparation in negotiation, and why is it important?

Strategic preparation involves planning and preparing for various negotiation scenarios, especially in property deals. It’s crucial because it helps you anticipate possible outcomes and establish a clear understanding of your minimum requirements or bottom line.

This preparation ensures you can respond effectively to different negotiation situations, leading to more favourable outcomes.

What strategy should you start with in a negotiation?

You are advised to start with your second-best offer. This strategy leaves room for negotiation, allowing you to adjust your offer based on the counterparty’s response.

Starting with an offer that’s not your minimum gives you the flexibility to engage in the negotiation process and work towards a mutually beneficial agreement.

How can using another decision-maker be beneficial in negotiations?

Involving another decision maker, such as a business partner, can be used as a strategic tool to buy time for further research or to wait for better offers.

This tactic allows you to pause the negotiation, consult with your partner, and consider your options without making immediate decisions, potentially leading to more favourable terms.

What are options in property deals, and when are they used?

Options in property deals are agreements that give the buyer the right to purchase a property under specific conditions. They are particularly useful in significant acquisitions where buyers might need time to secure financing or development approvals.

However, options attract double stamp duty and are more suited to larger projects. They should not be entirely ruled out for smaller developments but should be used judiciously.

What are the tax implications and costs associated with using options in property deals?

Using options in property deals can have significant tax implications and costs, notably double stamp duty. This means you pay tax on both the initial purchase and the sale price after the property increases in value, typically after receiving development approval.

These additional costs need to be carefully considered, especially for smaller projects where they can significantly affect profitability.

Test Your Knowledge

Multiple-Choice Questions on Strategic Negotiation in Property Deals

1. Why is strategic preparation important in negotiations?

A. It allows for a more aggressive bargaining position.

B. It helps anticipate various outcomes and establish a firm bottom line.

C. It ensures the quickest way to close deals.

D. It eliminates the need for a backup plan.

2. What is the primary reason for practising negotiations?

A. To intimidate the opposing party.

B. To reduce the importance of the bottom line.

C. To anticipate various outcomes and refine negotiation skills.

D. To eliminate the need for further research.

3. In negotiations, why should you start with your second-best offer?

A. To finalise the deal without further discussions.

B. To demonstrate financial strength.

C. To leave room for negotiation and adjustments.

D. To avoid involving another decision maker.

4. How can involving another decision-maker be beneficial in negotiations?

A. It ensures a quicker decision-making process.

B. It can be used as leverage to buy time for further research or better offers.

C. It simplifies the negotiation process.

D. It reduces the need for strategic preparation.

5. What is the role of options in property deals?

A. To simplify tax implications.

B. To eliminate the need for a bottom line.

C. To provide a right to purchase under specific conditions, useful in significant acquisitions.

D. To ensure immediate profitability.

6. How do negotiations evolve in property deals?

A. From complex to simple terms.

B. They remain static throughout the process.

C. From simple terms to options or other complex agreements.

D. They become less important over time.

7. What are the tax implications of using options in property deals?

A. Reduced overall tax burden.

B. No impact on taxes.

C. Double stamp duty, impacting profitability especially on smaller projects.

D. A fixed tax rate regardless of property value.

Answers:

- B. It helps anticipate various outcomes and establish a firm bottom line.

- C. To anticipate various outcomes and refine negotiation skills.

- C. To leave room for negotiation and adjustments.

- B. It can be used as leverage to buy time for further research or better offers.

- C. To provide a right to purchase under specific conditions, useful in significant acquisitions.

- C. From simple terms to options or other complex agreements.

- C. Double stamp duty, impacting profitability especially on smaller projects.

Assignment

Practical Exercise on Strategic Negotiation in Property Deals

Objective:

This exercise aims to deepen your understanding of negotiation strategies, their implications, and how they evolve in property transactions by applying the concepts of strategic preparation, negotiation techniques, and the tactical use of options in property deals through a series of tasks and research questions.

Tasks:

1. Scenario Planning Exercise

Create three negotiation scenarios for a property deal, including a best-case scenario, a worst-case scenario, and a most likely scenario. For each scenario, outline:

- The initial offer and the desired outcome.

- Possible responses from the other party.

- Your strategic responses to steer the negotiation towards your desired outcome.

2. Role-Play Activity

Pair up with any friend to role-play a negotiation scenario from Task 1. One friend acts as the buyer, and the other as the seller. After the role-play, switch roles and repeat the exercise with a different scenario. Discuss:

- What strategies worked well and why?

- How did involving another decision-maker (real or hypothetical) affect the negotiation?

- The challenges and benefits of starting with your second-best offer.

3. Options Analysis

Research and write a brief report on the use of options in property deals, focusing on:

- A real-world example where options were successfully used in a significant property acquisition.

- The financial implications of options, including double stamp duty, and how they can affect the profitability of smaller projects.

- The strategic advantages and disadvantages of using options in negotiations.

Research Questions:

1. How does the concept of “double stamp duty” on options influence the decision to use them in property deals?

Investigate the financial impact of double stamp duty in your jurisdiction. Explain how this could affect the cost-benefit analysis of using options in small vs. significant property developments.

2. How can strategic preparation impact the outcome of a property negotiation?

Find case studies or real-world examples where strategic preparation in negotiation led to a significantly positive or negative outcome. Analyse the key strategies used and their effects on the negotiation process.

3. How do negotiation strategies evolve in complex property deals?

Research and describe a complex property deal where the negotiation strategy had to evolve in response to new information, challenges, or opportunities that arose during the negotiation process.

Submission Guidelines

- Please submit your answers to Tasks 1 and 2, your reports for Task 3, and the research questions in a written document.

- Ensure your submissions are well-organized, with clear headings for each section.

- Include references to any external sources or case studies used in your research.