Negotiations Overview - 02

Here are the advanced techniques for property negotiation, focusing on the critical role of thorough market research and strategic offer structuring. It provides actionable insights on achieving fair deals through informed bargaining and the tactical use of financial terms.

This section provides insights into effective negotiation strategies for property transactions, emphasising the importance of fairness and detailed research.

Fair Criteria

Emphasises using objective, market-based criteria to negotiate fair prices. Highlights the importance of research through spatial analysis, comparable sale analysis, desktop valuation, and feasibility studies.

Research Depth

Detailed research underpins the negotiation, focusing on the property’s history, market duration, and pricing adjustments. This builds a strong case for negotiation, even with agents involved.

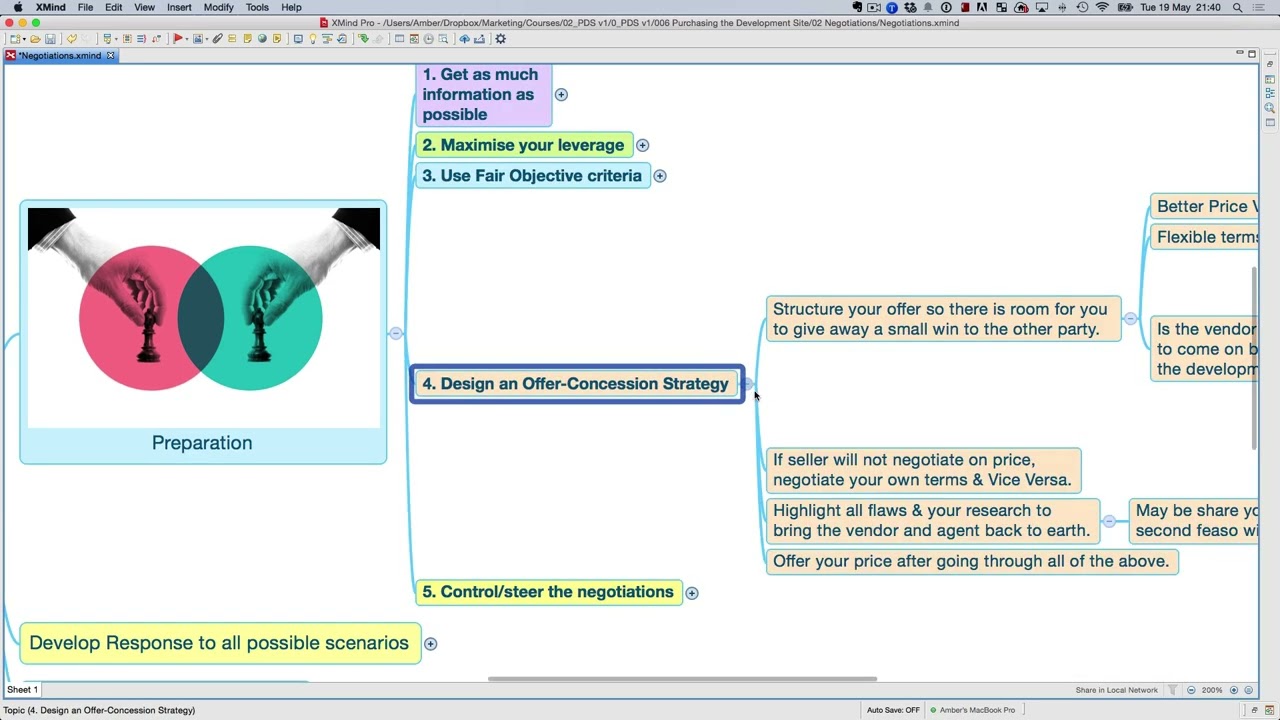

Offer and Concession

Strategies on structuring offers to allow room for concessions, such as better pricing for earlier settlements. Flexibility in terms shows the significance of adaptable terms for successful negotiations.

Vendor Collaboration

Opportunities for vendor collaboration in development projects, including vendor finance options, illustrate creative negotiation techniques to meet both parties’ needs without compromising price.

Insights based on numbers

- Settlement durations range from 15 days to 6 months, highlighting the flexibility in terms of a negotiation tool.

- The feasibility of offering a combination of immediate and post-development payments to meet the vendor’s price expectations while keeping the project viable.

Frequently Asked Questions

How can market research influence negotiation outcomes?

By conducting spatial analysis, comparing similar sales, and evaluating the property through desktop valuations and feasibility studies, you’re equipped with objective data that supports your stance on a fair price.

This research not only bolsters your position but also demonstrates to the seller and any intermediaries involved that your offer is grounded in market realities, not arbitrary figures.

This approach encourages more rational negotiations, steering the conversation towards mutually beneficial outcomes based on fairness and market standards.

What are the benefits of offering flexible settlement terms to vendors?

Offering flexible settlement terms to vendors can be a strategic advantage in negotiations. This flexibility might include proposing a quicker settlement for a better price or extending the settlement period as a trade-off for a lower purchase price.

Such options appeal to vendors with varying priorities—some may prefer a rapid transaction to liquidate assets quickly. In contrast, others might find a longer settlement period advantageous for tax purposes or to secure alternative accommodations.

By aligning your offer with the vendor’s preferences, you enhance the attractiveness of your proposal without necessarily increasing the price, creating a win-win scenario that facilitates agreement and fosters goodwill between both parties.

How does involving the vendor in the development process affect the negotiation?

Involving the vendor in the development process can significantly affect the negotiation dynamics. This approach introduces a collaborative aspect to the negotiation, where the vendor becomes a stakeholder in the project rather than just a seller.

It opens up opportunities for creative financing solutions, like vendor finance or a profit-share arrangement upon project completion. This can make the offer more appealing to the vendor without necessitating an upfront purchase price that exceeds market value.

This strategy can be particularly effective when the vendor is attached to the property or interested in the development outcome. It shifts the negotiation from a purely transactional to a partnership, potentially leading to more flexible terms and a better overall deal for both parties.

Why is market research crucial in property negotiations?

Market research is critical because it ensures that negotiation decisions are grounded in objective, factual data rather than subjective opinions. This research can include spatial analysis, comparable sale analysis, desktop valuation, and feasibility studies, helping to establish fair prices based on market-based criteria.

How does detailed research contribute to negotiation strategies?

Detailed research contributes significantly by providing a robust foundation for negotiations. It involves analyzing the property’s history, how long it has been on the market, and any pricing adjustments. This depth of understanding strengthens the negotiating position, even when dealing with agents, by highlighting evidence-based reasoning for offers or counteroffers.

What are the recommended strategies for structuring offers?

The article recommends structuring offers in a way that allows room for concessions. For instance, proposing better pricing for earlier settlements can be an attractive option for both parties. Flexibility in terms—such as settlement durations and payment methods—demonstrates the importance of adaptable negotiation terms for achieving a successful agreement.

How can vendor collaboration benefit property negotiations?

Vendor collaboration, especially in development projects, can lead to creative negotiation techniques that satisfy both parties without compromising on price. Examples include exploring vendor finance options, which can align the interests of buyers and sellers by addressing financial concerns directly through the negotiation process.

What insights are provided on the flexibility of settlement durations?

The article highlights that settlement durations can range from 15 days to 6 months. This flexibility serves as a powerful negotiation tool, as adjusting the timeline can make terms more appealing to the other party, potentially facilitating agreement where it might not otherwise be possible.

How can offering a combination of immediate and post-development payments be feasible?

Offering a mix of immediate payments and post-development payments can be a strategic way to meet the vendor’s price expectations while keeping the project financially viable. This approach can provide the vendor with a desirable upfront sum, with the promise of further payments following the completion of the project, ensuring that both the immediate and future financial needs of the vendor are considered in the negotiation.

Test Your Knowledge

Multiple-Choice Questions on Advanced Techniques for Property Negotiation

1. What is the primary role of market research in property negotiations?

A) To satisfy legal requirements before a sale

B) To provide objective, market-based criteria for fair pricing

C) To understand the seller’s personal circumstances

D) To determine the architectural style of the property

2. How does detailed research affect the negotiation process?

A) It ensures a quicker settlement process.

B) It reduces the need for real estate agents.

C) It strengthens the negotiating position with evidence-based reasoning.

D) It eliminates the need for financial analysis.

3. Which strategy is recommended for structuring offers in property negotiations?

A) Offering the highest possible price upfront

B) Structuring offers to allow room for concessions

C) Avoiding any negotiations on price

D) Demanding concessions from the seller upfront

4. How can vendor collaboration in development projects benefit negotiations?

A) By ensuring that only one party benefits from the deal

B) By using aggressive bargaining tactics

C) By providing creative solutions that meet both parties’ needs without compromising price

D) By excluding financial discussions from the negotiation process

5. What insight does the article provide regarding the flexibility of settlement durations?

A) Settlement durations are legally fixed at 30 days.

B) Flexibility in settlement durations can serve as a powerful negotiation tool.

C) Settlement durations should always be minimized to benefit the buyer.

D) Longer settlement durations unfavorably affect the property’s market value.

6. Which of the following best describes the feasibility of offering a combination of immediate and post-development payments?

A) It is discouraged due to the complexity of agreements.

B) It is considered infeasible in most market conditions.

C) It can meet the vendor’s price expectations while keeping the project viable.

D) It typically leads to disputes over property valuations.

Answers

- B) To provide objective, market-based criteria for fair pricing

- C) It strengthens the negotiating position with evidence-based reasoning.

- B) Structuring offers to allow room for concessions

- C) By providing creative solutions that meet both parties’ needs without compromising price

- B) Flexibility in settlement durations can serve as a powerful negotiation tool.

- C) It can meet the vendor’s price expectations while keeping the project viable.

Assignment

Property Negotiation Strategies: Practical Exercise

Objective:

To deepen understanding of advanced property negotiation techniques through practical application, focusing on market research, offer structuring, vendor collaboration, and flexibility in financial terms.

Instructions:

Complete the tasks and answer the questions below. This exercise involves research, analysis, and application of negotiation strategies discussed in the provided material. Assume you are preparing to negotiate the purchase of a property for a development project.

Tasks and Questions:

Market Research:

- To Do: Choose a property currently listed for sale in your area or an area you are familiar with. Conduct a spatial analysis, comparable sale analysis, desktop valuation, and feasibility study for this property.

- Question: How did the findings from your market research influence your perceived fair price for the property? Explain how each type of analysis contributed to this perception.

Offer Structuring:

- To Do: Based on your market research, draft an initial offer for the property. Include at least one concession you are willing to make, such as an earlier settlement for a better price.

- Question: What strategy did you use to structure your offer, and why? How did you decide on the concession(s) to include?

Vendor Collaboration:

- To Do: Imagine that the seller is interested in the development outcome. Propose a way to involve the vendor in the development process that could lead to more flexible negotiation terms.

- Question: What are the potential benefits of your proposed vendor collaboration for both parties? How does it affect the negotiation dynamics?

Flexibility in Financial Terms:

- To Do: Considering the financial aspects of the deal, suggest a payment structure that includes a combination of immediate and post-development payments.

- Question: How does your proposed payment structure meet the vendor’s price expectations while keeping the project viable? Explain the rationale behind the mix of immediate and post-development payments.

Research Question:

- To Do: Investigate the impact of settlement duration flexibility in real estate negotiations. Find at least one real-world example or case study where flexibility in settlement duration played a key role in the negotiation outcome.

- Question: Based on your research, how can settlement duration flexibility serve as a negotiation tool? Provide a summary of the example/case study you found.

Submission Guidelines:

- Compile your research findings, proposed offer, vendor collaboration proposal, payment structure suggestion, and case study summary into a report.

- Include references to any external sources of information used.

- Ensure that your report clearly demonstrates your understanding of the concepts discussed in the article and how they apply to practical negotiation scenarios.