Negotiate for Advantage 02

Here are advanced strategies for negotiating in the context of property development, focusing on how to leverage various aspects of a deal to one’s advantage.

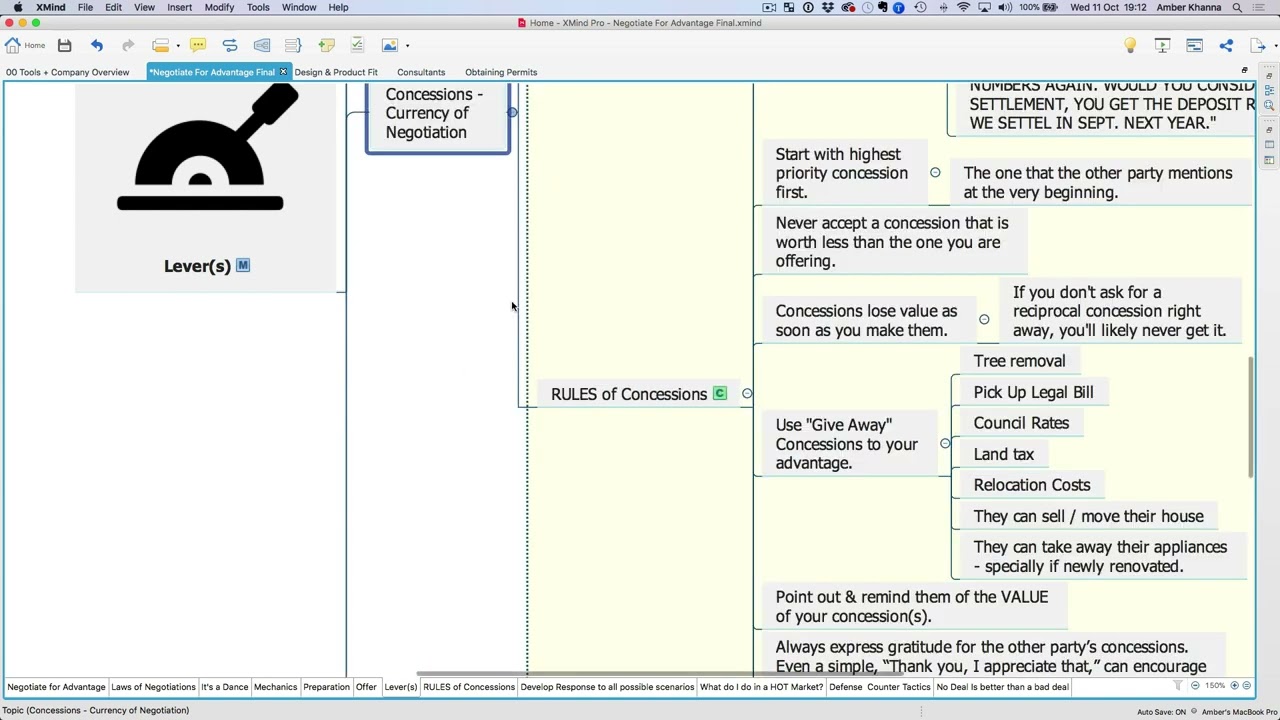

You will know the importance of negotiation preparation, particularly through the use of mind maps and reviewing previous materials to enhance understanding and application of negotiation techniques.

Key Negotiation Strategies

Leverage Tools

The video above introduces the concept of ‘levers’ or tools that a negotiator can pull to influence the negotiation in their favor. These include various negotiation techniques and strategies to adjust the terms of a deal to benefit the negotiator.

Price vs. Terms

A crucial insight shared is the significance of terms over price. The instructor explains that controlling a property without outright purchasing it (e.g., through extended settlement periods or option agreements) can be more advantageous than the purchase price itself.

Adding Value

Strategies for adding value to a site without incurring significant costs are discussed. This includes obtaining development approvals (DAs) and planning permits to increase a property’s market value without full settlement.

Deposit Negotiations

Learn the tactics for negotiating deposit amounts and terms, including deposit release clauses and staged payments, to improve cash flow during the negotiation process.

Vendor Finance

Various forms of vendor finance are explored as means to structure deals in ways that benefit the developer, such as by offering higher interest rates to the vendor in lieu of traditional financing methods.

Insights Based on Numbers

- The cost of a DA on a small development site is mentioned to not exceed $30,000 to $40,000, highlighting the relatively low barrier to adding value through planning permissions.

- A comparison of costs associated with different negotiation outcomes, such as the impact of stamp duty and the importance of ensuring a significant profit margin when considering flipping a property.

Frequently Asked Questions

How do lever strategies affect the outcome of a property negotiation?

Lever strategies significantly impact the outcome of property negotiations by providing the negotiator with various options and flexibilities to influence the deal in their favor.

Flexibility in Negotiation

Levers act as negotiation tools that allow a developer to adapt their approach based on the situation.

For example, if one approach doesn’t yield the desired outcome, the negotiator can “pull” another lever, trying a different strategy such as adjusting the terms, offering different concessions, or changing the negotiation focus from price to terms.

Control Without Ownership

A crucial lever strategy is gaining control of a property without fully purchasing it. This can be achieved through extended settlement periods or option agreements.

Such strategies enable the developer to add value to the property, through development approvals or planning permits, without the immediate financial burden of purchase. This approach minimizes risk while maximizing potential gains.

Strategic Use of Terms

Emphasizing that the terms of a deal can be as important, if not more so, than the price. Lever strategies can include negotiating favorable terms that allow for value addition to the property before full settlement, thereby increasing its market value and the potential profit margin.

Vendor Finance as a Lever

Offering vendor finance is presented as a lever that can be advantageous for both parties.

It can provide the vendor with a competitive interest rate while giving the buyer (developer) flexibility in financing the purchase. This can be particularly useful in scenarios where traditional financing is not favorable or available.

What are the financial implications of negotiating deposit terms and vendor finance?

The financial implications of negotiating deposit terms and vendor finance in property development are multifaceted, impacting both the immediate cash flow and the long-term financial strategy of a project.

Negotiating Deposit Terms:

Improved Cash Flow: By negotiating lower or staged deposit payments, developers can significantly improve their cash flow.

This strategy allows them to retain more of their capital during the early stages of a project, which can be critical for covering other expenses or for investing in multiple projects simultaneously.

Flexibility: Staged deposits or lower deposit amounts provide greater flexibility, reducing the financial burden on the developer.

This can be especially beneficial in scenarios where the developer is working with limited capital or aiming to spread resources across several projects.

Vendor Finance:

Access to Capital: Vendor finance can serve as an alternative funding source when traditional financing is unavailable or undesirable.

This can be a game-changer for developers, particularly in tight credit markets or for projects that might not initially meet the strict lending criteria of traditional financial institutions.

Cost Savings: Negotiating vendor finance terms can result in cost savings compared to conventional loans.

By avoiding bank fees, application costs, and potentially securing a lower interest rate directly with the vendor, the overall financing costs of a project can be reduced.

Strategic Advantage: Utilizing vendor finance can give developers a strategic advantage, allowing them to move quickly on a project without the delays often associated with securing traditional financing.

This speed can be crucial in competitive markets where securing a property promptly can make or break a deal.

Impact on Negotiations:

Leverage: Effective negotiation of deposit terms and vendor finance can provide significant leverage in a deal.

For example, a developer might agree to a higher purchase price if the vendor offers favorable finance terms or accepts a lower deposit, balancing the overall financial equation in favor of both parties.

Relationship Building: Offering to engage in vendor finance can also help build a positive relationship with the vendor, demonstrating trust and a commitment to the project.

This goodwill can be beneficial in future negotiations or if unexpected challenges arise during the project.

How does adding value through development approvals compare to direct property purchase in terms of investment efficiency?

This approach centers on leveraging the negotiation process and understanding the property’s potential value post-approval, which significantly impacts investment efficiency. Key insights include:

Efficiency of Investment Through Development Approvals:

Maximizing Potential Value: Obtaining development approvals before completing a property purchase can dramatically increase the property’s value.

This process allows a developer to showcase the potential of a property to future buyers or investors, thereby increasing its market value beyond the initial purchase price.

Cost-Effectiveness: The cost associated with securing development approvals (mentioned to not exceed $30,000 to $40,000 for a small development site) is relatively low compared to the potential increase in property value once these approvals are granted.

This presents a cost-effective way for developers to add significant value to their investment with a relatively small upfront expenditure.

Strategies for Adding Value:

Extended Settlement Periods: Negotiating an extended settlement period allows the developer to gain control over the property and pursue necessary approvals without having the financial burden of ownership.

This strategy not only delays the outlay of substantial funds but also permits the developer to work on enhancing the property’s value through planning and approvals in the interim.

Option Agreements: Utilizing option agreements is another method to control a property and seek approvals without immediate purchase.

This approach offers flexibility and the opportunity to increase the property’s value significantly before deciding to execute the purchase fully.

Comparative Advantage over Direct Purchase

Risk Mitigation: Adding value through development approvals before completing a purchase mitigates risk by ensuring the developer is not committed to a significant investment without understanding the property’s full potential.

This contrasts with direct purchases, where the developer assumes immediate financial and market risks without the benefit of added value through planning.

Increased Profit Potential: The strategy of focusing on value addition through approvals before finalizing the purchase enhances the investment’s profit potential.

By securing the rights to develop and improve the property, the developer can command a higher selling price or achieve greater returns on the developed project.

Investment Efficiency:

Investing in the process of obtaining development approvals is a more efficient use of capital than simply purchasing properties at face value.

This approach leverages the legal and planning frameworks to enhance a property’s value without the immediate need for large capital investments, leading to higher returns on the invested funds and a more strategic allocation of resources.

What are ‘levers’ in the context of negotiation?

In negotiations, ‘levers’ refer to tools or techniques that a negotiator can use to influence the negotiation in their favor. These levers are strategies designed to adjust the terms of a deal, such as negotiation tactics and persuasive techniques, to benefit the negotiator. Leveraging these tools effectively can lead to more favorable outcomes in property development deals.

Why might controlling property terms be more advantageous than focusing on price?

Controlling the terms of a property deal, such as through extended settlement periods or option agreements, can be more advantageous than focusing solely on the purchase price. This is because terms can provide flexibility and potential for higher profitability.

For example, controlling a property without outright purchasing it allows for value-adding activities like obtaining development approvals, which can significantly increase the property’s market value without the need for full settlement or large initial investments.

How can value be added to a property without significant costs?

Value can be added to a property without incurring significant costs by obtaining development approvals (DAs) and planning permits. These approvals can increase a property’s market value by demonstrating its potential for development, making it more attractive to buyers or investors.

This strategy allows developers to enhance the value of their investment with relatively low expense, focusing on the strategic legal and planning aspects rather than physical development costs.

What tactics can be used to negotiate deposit amounts and terms?

Tactics for negotiating deposit amounts and terms include discussing deposit release clauses and staged payments.

These strategies can improve cash flow during the negotiation process by allowing the developer to maintain more liquidity and potentially use funds for other aspects of the project. Negotiating favorable deposit terms can also provide financial flexibility and reduce upfront costs.

What is vendor finance and how can it benefit developers?

Vendor finance refers to financing arrangements where the seller (vendor) provides a loan to the buyer (developer) instead of the buyer obtaining a loan from a traditional financial institution.

This can be structured to benefit the developer by offering higher interest rates to the vendor in exchange for more favorable terms, such as lower initial payments or longer repayment periods.

Vendor finance can provide developers with alternative financing solutions that may be more flexible or accessible than traditional loans.

What is the cost implication of obtaining a Development Approval (DA) on a small development site?

The cost of obtaining a Development Approval (DA) on a small development site is typically not expected to exceed $30,000 to $40,000.

This relatively low cost highlights the barrier to adding value through planning permissions is accessible, allowing developers to potentially increase the market value of a property through legal and planning strategies without a significant financial burden.

How do negotiation outcomes affect costs like stamp duty and profit margins?

Negotiation outcomes can significantly impact costs associated with a property deal, such as stamp duty, and the overall profit margin. For instance, negotiating a lower purchase price can reduce the amount of stamp duty payable.

Similarly, successful negotiation on terms can increase profit margins by reducing costs or enhancing the value of the property through strategic developments. Developers must consider these financial implications when negotiating to ensure that the deal remains profitable and aligns with their investment strategy.

Test Your Knowledge

Multiple-Choice Questions on Advanced Negotiation Strategies for Property Development

1. What is the primary goal of negotiation preparation in property development?

A) To finalize the deal as quickly as possible

B) To enhance understanding and application of negotiation techniques

C) To reduce the overall investment needed in the project

D) To convince the other party to agree to all demands

2. ‘Levers’ in negotiation refer to:

A) Physical tools used in construction

B) Legal documents required for property development

C) Techniques and strategies to adjust deal terms in one’s favor

D) Financial incentives offered to the other party

3. Why might controlling the terms of a property be more advantageous than focusing on the purchase price?

A) It allows for quicker transactions

B) Terms offer no real advantage; price is always the priority

C) Controlling terms can lead to greater flexibility and profitability

D) It simplifies the negotiation process

4. Adding value to a property without significant costs can be achieved by:

A) Cutting corners on construction

B) Obtaining development approvals and planning permits

C) Ignoring local zoning laws

D) Reducing the size of the development

5. Tactics for negotiating deposit amounts and terms do NOT include:

A) Deposit release clauses and staged payments

B) Requesting 100% upfront payment

C) Improving cash flow during the process

D) Providing financial flexibility

6. Vendor finance benefits developers by:

A) Eliminating the need for any deposit

B) Offering higher interest rates to the vendor in exchange for favorable terms

C) Guaranteeing immediate full ownership of the property

D) Reducing the property’s market value

7. The cost of obtaining a Development Approval (DA) on a small development site typically does not exceed:

A) $5,000

B) $15,000

C) $30,000 to $40,000

D) $100,000

8. Negotiating favorable terms over focusing on the purchase price affects costs and profit margins by:

A) Increasing stamp duty payable

B) Limiting potential profit margins

C) Reducing overall investment returns

D) Potentially increasing profit margins by enhancing property value

Answers:

- B) To enhance understanding and application of negotiation techniques

- C) Techniques and strategies to adjust deal terms in one’s favor

- C) Controlling terms can lead to greater flexibility and profitability

- B) Obtaining development approvals and planning permits

- B) Requesting 100% upfront payment

- B) Offering higher interest rates to the vendor in exchange for favorable terms

- C) $30,000 to $40,000

- D) Potentially increasing profit margins by enhancing property value

Assignment

Advanced Negotiation Strategies in Property Development

Objective:

To apply the concepts of advanced negotiation strategies in property development, focusing on leveraging deal aspects to gain advantages.

Instructions:

Students will engage in a series of tasks designed to deepen their understanding of negotiation strategies, focusing on preparation, leverage, and financial implications within property development. This assignment includes research, practical application, and reflection components.

Tasks:

1. Research and Preparation:

1.1. Mind Mapping: Create a mind map that outlines your negotiation strategy for a hypothetical property development project. Include elements such as negotiation levers, key terms versus price considerations, and tactics for adding value without significant costs.

1.2. Review of Materials: Review case studies or previous real estate negotiations focusing on lever strategies and their outcomes. Summarize your findings and how they can influence your approach to property development negotiations.

2. Practical Application:

2.1. Role-Play Scenario: In groups, participate in a role-play negotiation scenario where one party is a property developer and the other is a property owner. Apply lever strategies, focusing on terms over price, adding value through development approvals, and negotiating deposit amounts and terms. Reflect on the negotiation outcome and discuss the effectiveness of the strategies used.

2.2. Vendor Finance Proposal: Draft a proposal for a vendor finance arrangement for a property you are interested in developing. The proposal should include the rationale for vendor finance, the benefits to both parties, and how it could be structured to ensure flexibility and financial advantage for the development project.

3. Research Questions:

3.1. Lever Strategies in Practice: Investigate a real-world property development project where lever strategies significantly impacted the negotiation outcome. Describe the strategies used and the final outcome.

3.2. Cost Analysis: Conduct a cost analysis on obtaining development approvals in your local area. Compare these costs to the potential increase in property value and discuss the investment efficiency of this approach.

4. Reflection:

4.1. Strategic Reflection: Reflect on how understanding and applying negotiation levers can change the approach to property development. Consider how this knowledge might influence future projects you undertake.

4.2. Financial Implications: Reflect on the financial implications of negotiation outcomes, such as the impact on cash flow, financing options, and profit margins. Discuss how these considerations will influence your negotiation strategies in the future.

Submission Guidelines:

- Compile your findings, reflections, and role-play scenario outcomes into a comprehensive report.

- Include any supporting materials such as mind maps, proposals, and cost analyses.

- Submit your report through mail or comments.