Time Interval: 00:00:01 - 00:01:03

Summary

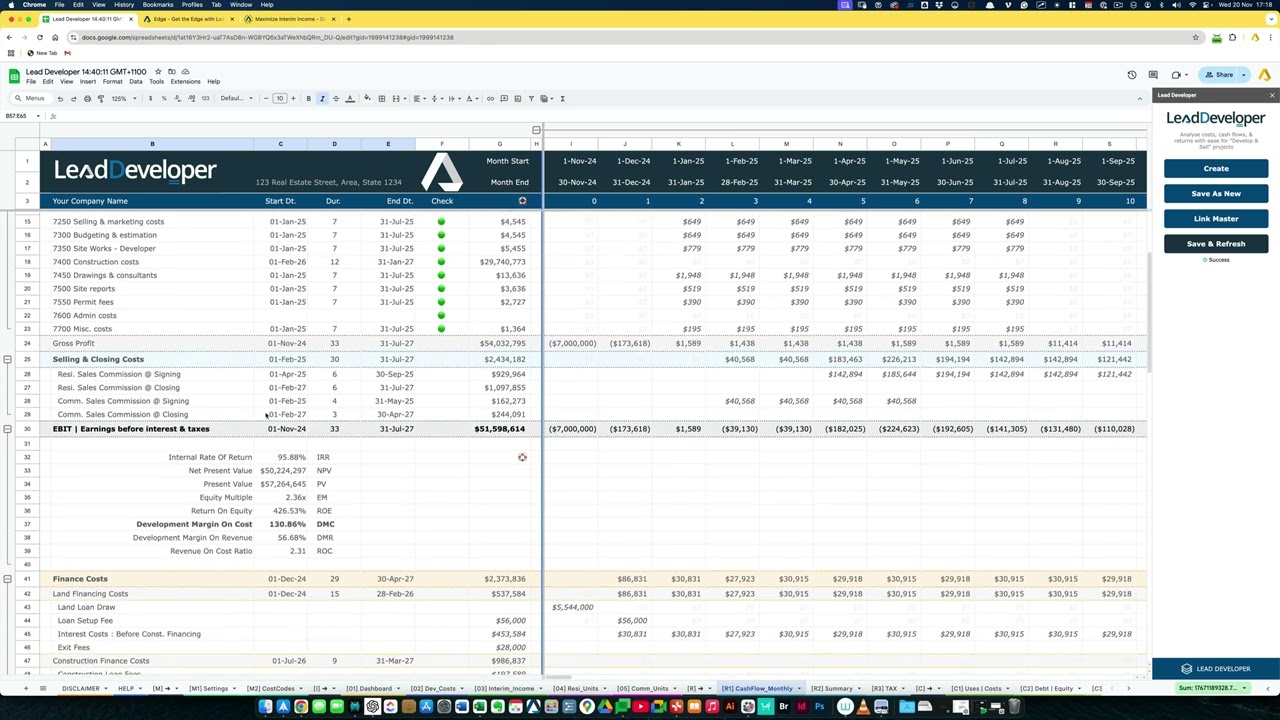

Earnings Before Interest and Taxes (EBIT): The video explains the importance of excluding finance costs when calculating EBIT, allowing a clearer understanding of profitability.

Earnings Before Interest and Taxes (EBIT): The video explains the importance of excluding finance costs when calculating EBIT, allowing a clearer understanding of profitability. Key Financial Metrics: Metrics like Internal Rate of Return (IRR) and Net Present Value (NPV) are calculated at different stages to facilitate comparative analysis.

Key Financial Metrics: Metrics like Internal Rate of Return (IRR) and Net Present Value (NPV) are calculated at different stages to facilitate comparative analysis. Comparative Analysis: Emphasis on comparing financing scenarios without involving finance assumptions for a true apples-to-apples comparison.

Comparative Analysis: Emphasis on comparing financing scenarios without involving finance assumptions for a true apples-to-apples comparison. Project Bottom Line: Differentiates between EBIT (before finance costs) and the actual project bottom line which incorporates finance options.

Project Bottom Line: Differentiates between EBIT (before finance costs) and the actual project bottom line which incorporates finance options.

Insights Based on Numbers

10 Financing Options: Highlights how multiple financing options can affect the overall project analysis.

10 Financing Options: Highlights how multiple financing options can affect the overall project analysis. Standardized Comparison: Stressing the need to remove finance complexities for scenario planning.

Standardized Comparison: Stressing the need to remove finance complexities for scenario planning.