Time Interval: 00:00:00 - 00:05:21

Summary

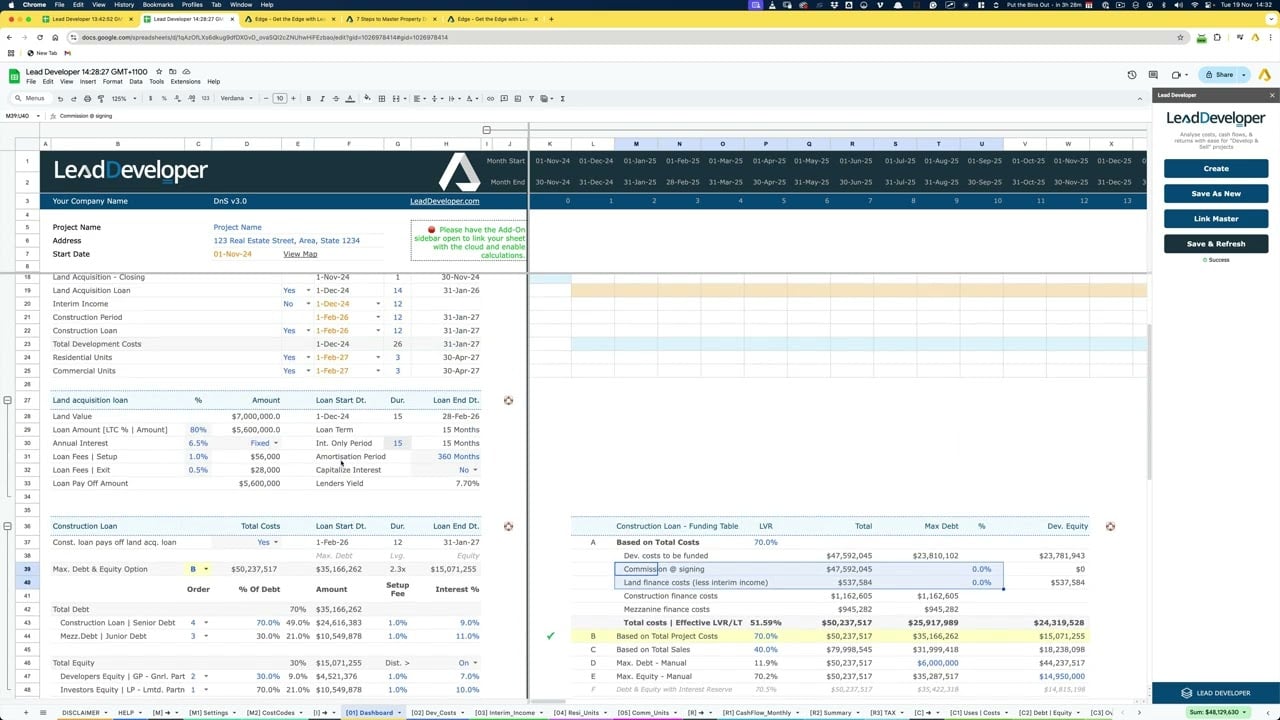

Definition of Funding Table: Explains the methods of loan funding and sizing, focusing on determining the maximum debt based on various factors.

Definition of Funding Table: Explains the methods of loan funding and sizing, focusing on determining the maximum debt based on various factors. Loan Parameters by Banks: Banks typically fund 60%-70% of the total project cost, often considering only hard costs and excluding soft costs.

Loan Parameters by Banks: Banks typically fund 60%-70% of the total project cost, often considering only hard costs and excluding soft costs. Flexible Options in Lead Developer: Provides customizable options for assessing project feasibility by selecting funding strategies and their impact on total funding and equity requirements.

Flexible Options in Lead Developer: Provides customizable options for assessing project feasibility by selecting funding strategies and their impact on total funding and equity requirements. Equity and Cost Dynamics: Highlights how reduced borrowing from banks increases equity needs, affecting interest, bottom line, and equity cost.

Equity and Cost Dynamics: Highlights how reduced borrowing from banks increases equity needs, affecting interest, bottom line, and equity cost. Detailed Allocation Features: Allows allocation of costs (e.g., land acquisition) across funding categories and manual entry for broker-determined debt limits.

Detailed Allocation Features: Allows allocation of costs (e.g., land acquisition) across funding categories and manual entry for broker-determined debt limits. Construction Loan Integration: Explains how to adjust funding assumptions to see equity distribution and construction loan proportions dynamically.

Construction Loan Integration: Explains how to adjust funding assumptions to see equity distribution and construction loan proportions dynamically.

Insights Based on Numbers

- 60%-70%: Typical funding percentage by banks for project costs, underlining the limited scope of soft costs.

- Interest Reserve Adjustments: Automated calculations of interest reserves are incorporated into total project costs for precise feasibility analysis.

- Maximum Debt Examples: Scenarios of borrowing (e.g., $50M or $6M) illustrate the flexibility of manual input for tailored project insights.