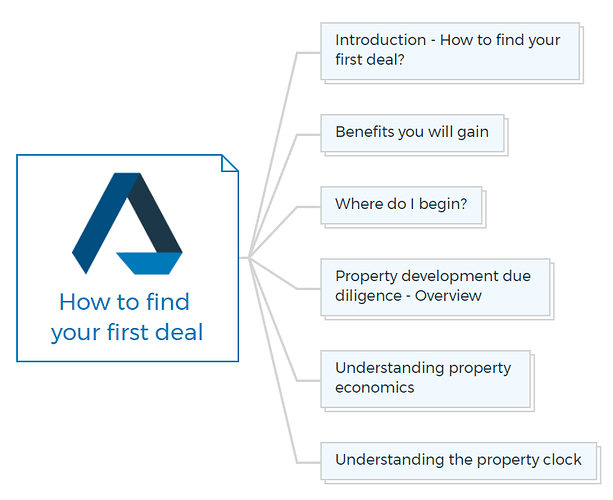

How to find your first deal

Introduction - How to find your first deal?

Course Introduction – This course is designed to teach property development and due diligence based on real-world experience.

Course Introduction – This course is designed to teach property development and due diligence based on real-world experience. Challenges in Property Development – The instructor started with no knowledge and struggled with choosing the right location, avoiding overpaying, and making profitable investment decisions.

Challenges in Property Development – The instructor started with no knowledge and struggled with choosing the right location, avoiding overpaying, and making profitable investment decisions. Learning Through Experience – After extensive research, book reading, and completing a diploma in property development, the instructor refined a system for property selection and deal analysis.

Learning Through Experience – After extensive research, book reading, and completing a diploma in property development, the instructor refined a system for property selection and deal analysis. Why This Course is Valuable –

Why This Course is Valuable –- Provides a step-by-step system to identify profitable deals.

- Teaches both free and paid resources to validate investments.

- Helps eliminate doubt and develop confidence in property development.

Growth Potential & Market Research – Understanding long-term capital growth potential is crucial in selecting a good investment.

Growth Potential & Market Research – Understanding long-term capital growth potential is crucial in selecting a good investment. Unique Approach – Unlike other courses, this program reveals every step, tool, and trick used in real-life property investment.

Unique Approach – Unlike other courses, this program reveals every step, tool, and trick used in real-life property investment. Key Takeaway – The system taught in this course has been personally tested and refined and aims to make deal-finding second nature for learners.

Key Takeaway – The system taught in this course has been personally tested and refined and aims to make deal-finding second nature for learners.

You are missing out if you haven’t yet subscribed to our YouTube channel.

You are missing out if you haven’t yet subscribed to our YouTube channel.

Benefits you will gain

Automating Property Research – Learn how to track signals for potential investment opportunities, including market trends, infrastructure updates, and news announcements.

Automating Property Research – Learn how to track signals for potential investment opportunities, including market trends, infrastructure updates, and news announcements. Conducting Due Diligence Remotely – Gain the ability to assess a property’s potential from home, eliminating unnecessary site visits.

Conducting Due Diligence Remotely – Gain the ability to assess a property’s potential from home, eliminating unnecessary site visits. Identifying Next Steps – Understand when to consult professionals like town planners, engineers, and architects to validate investment opportunities.

Identifying Next Steps – Understand when to consult professionals like town planners, engineers, and architects to validate investment opportunities. Using Data & Mapping Tools – Learn how to collect and analyze statistics, mapping out key investment locations on Google Maps to distinguish good and bad areas.

Using Data & Mapping Tools – Learn how to collect and analyze statistics, mapping out key investment locations on Google Maps to distinguish good and bad areas. Spotting Growth Suburbs – Master market research techniques to identify high-growth areas based on data-driven analysis.

Spotting Growth Suburbs – Master market research techniques to identify high-growth areas based on data-driven analysis. Access to Exclusive Websites – Gain a curated list of trusted online resources to streamline property investment research.

Access to Exclusive Websites – Gain a curated list of trusted online resources to streamline property investment research. Creating Investor Reports – Develop professional reports to present deals persuasively to potential investors for large-scale projects.

Creating Investor Reports – Develop professional reports to present deals persuasively to potential investors for large-scale projects.

Where do I begin?

Identifying Property Hotspots

Identifying Property Hotspots

- Learn how to identify suburbs with growth potential before investing.

- Capital Growth is key to wealth generation in property investments.

Understanding Capital Growth

Understanding Capital Growth

- Property value increases over time, generating wealth even while you sleep.

- Developers should target properties in areas poised for growth, not those at their peak.

Market Timing & Property Cycles

Market Timing & Property Cycles

- Avoid buying property at the peak of the market cycle.

- Best time to buy: During market recovery or just before a boom.

Long-Term vs. Short-Term Investment Strategy

Long-Term vs. Short-Term Investment Strategy

- Selling too soon incurs high taxes.

- Holding onto properties allows for greater equity accumulation over time.

The Concept of Price Floor & Price Ceiling

The Concept of Price Floor & Price Ceiling

- Price floor: The lowest property price in a suburb.

- Price ceiling: The highest property price in a suburb.

Buying Below the Median Value

Buying Below the Median Value

- Always purchase properties at or below the median value of a suburb.

- Banks value properties conservatively, considering worst-case selling scenarios.

How Overpaying Affects Valuation

How Overpaying Affects Valuation

- Buying above the median can result in lower bank valuations.

- A property purchased at $600,000 may only be valued at $550,000 by a bank, leading to immediate equity loss.

Insights Based on Numbers

- 250,000 - 1,000,000 → Example of price range (floor & ceiling) in a given suburb.

- 500,000 → The median property price, which serves as a benchmark for wise purchasing.

- 50,000 loss → Overpaying can lead to a significant reduction in bank valuation, impacting investment potential.

Course Introduction – This course is designed to teach property development and due diligence based on real-world experience.

Course Introduction – This course is designed to teach property development and due diligence based on real-world experience. Challenges in Property Development – The instructor started with no knowledge and struggled with choosing the right location, avoiding overpaying, and making profitable investment decisions.

Challenges in Property Development – The instructor started with no knowledge and struggled with choosing the right location, avoiding overpaying, and making profitable investment decisions. Learning Through Experience – After extensive research, book reading, and completing a diploma in property development, the instructor refined a system for property selection and deal analysis.

Learning Through Experience – After extensive research, book reading, and completing a diploma in property development, the instructor refined a system for property selection and deal analysis. Why This Course is Valuable –

Why This Course is Valuable – Growth Potential & Market Research – Understanding long-term capital growth potential is crucial in selecting a good investment.

Growth Potential & Market Research – Understanding long-term capital growth potential is crucial in selecting a good investment. Unique Approach – Unlike other courses, this program reveals every step, tool, and trick used in real-life property investment.

Unique Approach – Unlike other courses, this program reveals every step, tool, and trick used in real-life property investment. Key Takeaway – The system taught in this course has been personally tested and refined and aims to make deal-finding second nature for learners.

Key Takeaway – The system taught in this course has been personally tested and refined and aims to make deal-finding second nature for learners.You are missing out if you haven’t yet subscribed to our YouTube channel.

Automating Property Research – Learn how to track signals for potential investment opportunities, including market trends, infrastructure updates, and news announcements.

Automating Property Research – Learn how to track signals for potential investment opportunities, including market trends, infrastructure updates, and news announcements. Conducting Due Diligence Remotely – Gain the ability to assess a property’s potential from home, eliminating unnecessary site visits.

Conducting Due Diligence Remotely – Gain the ability to assess a property’s potential from home, eliminating unnecessary site visits. Identifying Next Steps – Understand when to consult professionals like town planners, engineers, and architects to validate investment opportunities.

Identifying Next Steps – Understand when to consult professionals like town planners, engineers, and architects to validate investment opportunities. Using Data & Mapping Tools – Learn how to collect and analyze statistics, mapping out key investment locations on Google Maps to distinguish good and bad areas.

Using Data & Mapping Tools – Learn how to collect and analyze statistics, mapping out key investment locations on Google Maps to distinguish good and bad areas. Spotting Growth Suburbs – Master market research techniques to identify high-growth areas based on data-driven analysis.

Spotting Growth Suburbs – Master market research techniques to identify high-growth areas based on data-driven analysis. Access to Exclusive Websites – Gain a curated list of trusted online resources to streamline property investment research.

Access to Exclusive Websites – Gain a curated list of trusted online resources to streamline property investment research. Creating Investor Reports – Develop professional reports to present deals persuasively to potential investors for large-scale projects.

Creating Investor Reports – Develop professional reports to present deals persuasively to potential investors for large-scale projects. Identifying Property Hotspots

Identifying Property Hotspots

Understanding Capital Growth

Understanding Capital Growth

Market Timing & Property Cycles

Market Timing & Property Cycles

Long-Term vs. Short-Term Investment Strategy

Long-Term vs. Short-Term Investment Strategy

The Concept of Price Floor & Price Ceiling

The Concept of Price Floor & Price Ceiling

Buying Below the Median Value

Buying Below the Median Value

How Overpaying Affects Valuation

How Overpaying Affects Valuation