GST & Margin Scheme

Here is a detailed overview of a specific GST (Goods and Services Tax) calculation method used in property sales within Australia. Aimed at property developers and business owners, it demystifies the scheme’s applicability, calculation, and impact on taxation.

GST Calculation

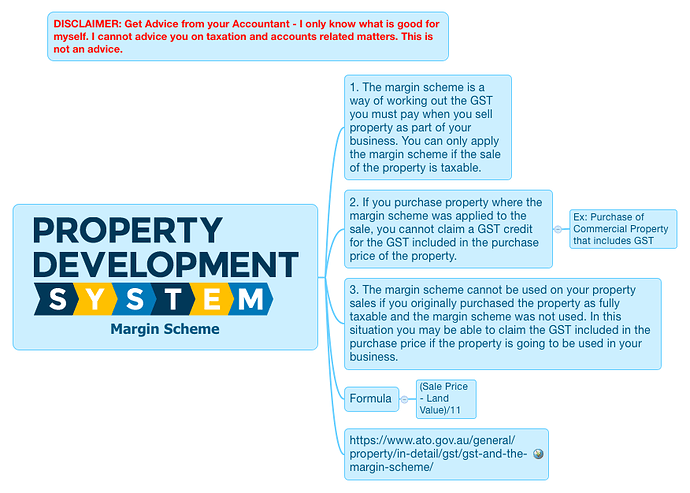

The Margin Scheme offers a method for determining GST due when selling property as part of a business. It focuses on added value rather than the full property value.

Applicability

It applies to taxable property sales, disallowing GST credit on purchases under the scheme.

Formula

The sale price minus land value, divided by 11, represents the GST on added value.

Restrictions

The Margin Scheme cannot be applied to subsequent sales if the property was purchased with GST included.

Insights based on numbers:

- When calculating GST under the Margin Scheme, for a property with a land value of $200,000 and construction costs of $300,000, GST is charged on the $300,000 added value.

- This method significantly reduces the GST payable by excluding the land’s cost.

Frequently Asked Questions

How does the Margin Scheme impact the overall tax burden for property developers?

This scheme allows developers to calculate GST based on the value added to the property rather than the total sale price. Specifically, GST is computed by subtracting the land value from the sale price then dividing the remainder by 11.

This approach often results in a lower GST liability because it excludes the pre-existing land value from the taxable amount, thereby reducing the overall tax burden on developers.

This strategy is particularly beneficial for developers involved in significant construction or renovation projects, where the added value constitutes a substantial portion of the property’s total value.

By focusing on the added value, the Margin Scheme effectively lowers the tax cost associated with property development, enhancing profitability and financial efficiency in the development process.

What are the eligibility criteria for applying the Margin Scheme to property sales?

Firstly, the scheme is only applicable to taxable property sales within the scope of a business’s operations. This means that the property in question must be part of a commercial endeavor, such as development or resale, and the sale itself must be subject to GST.

A key eligibility factor is whether the Margin Scheme was applied at the time of the property’s purchase. If a property was acquired under the Margin Scheme, the seller can opt to use the scheme for subsequent sales.

However, if the property was purchased with GST included in the sale price and the Margin Scheme was not applied, the new owner cannot use the scheme when they decide to sell the property. Additionally, properties purchased without GST cannot utilise the Margin Scheme upon resale.

These criteria ensure that the Margin Scheme’s benefits are appropriately applied, supporting developers in managing GST liabilities while maintaining the integrity of the tax system. The scheme’s use is thus restricted to situations where it can legitimately reduce GST payable, based on the value added by the developer rather than the property’s full sale price.

How does the Margin Scheme affect the GST credits for buyers of such properties?

When a property is sold under the Margin Scheme, the buyer is not entitled to claim GST credits for the purchase. This is because the GST calculated under the Margin Scheme is based on the added value to the property rather than its full sale price. Thus, the GST component included in the purchase price is not discernible in the same way as it is under standard GST calculations.

This lack of GST credit can influence buyers’ decisions, especially for commercial properties or investments where GST implications are a significant consideration.

The inability to claim GST credits on the purchase may affect the overall cost-benefit analysis of such an investment, potentially making properties sold under the Margin Scheme less attractive to some buyers, particularly those who could have offset such credits against their own GST liabilities.

Understanding these implications is crucial for both sellers considering the Margin Scheme for their property sales and buyers evaluating the financial aspects of purchasing properties sold under this scheme.

What is the GST Margin Scheme?

The GST Margin Scheme is a specific method used in Australia to calculate the Goods and Services Tax (GST) payable on property sale as part of a business. Unlike the standard GST calculation, the Margin Scheme focuses on the added value of the property rather than its full sale price.

Who can use the GST Margin Scheme?

The scheme is applicable to property developers and business owners who are involved in taxable property sales within Australia. It is designed to reduce the GST payable on such transactions by focusing on the added value.

How is GST calculated under the Margin Scheme?

Under the Margin Scheme, GST is calculated by subtracting the value of the land from the sale price of the property and then dividing the result by 11. This formula calculates the GST payable based on the added value of the property rather than its total sale price.

What types of sales are applicable under the Margin Scheme?

The Margin Scheme applies to taxable property sales. It is important to note that GST credits on purchases related to properties sold under this scheme are not available.

Are there any restrictions on using the Margin Scheme?

Yes, there are restrictions. One significant restriction is that the Margin Scheme cannot be applied to the sale of a property if the property was originally purchased with GST included in the price.

Can you provide an example of how the GST is calculated under the Margin Scheme?

Sure. For instance, if a property has a land value of $200,000 and construction costs amounting to $300,000, under the Margin Scheme, GST would only be charged on the $300,000 added value. This is calculated by taking the added value ($300,000) and dividing it by 11, which results in the GST payable.

How does the Margin Scheme benefit property developers and business owners?

The primary benefit of the Margin Scheme is the potential reduction in GST payable on the sale of property. By calculating GST on the added value rather than the total sale price, the scheme can significantly lower the amount of GST owed, making it a favourable option for property developers and business owners.

Test Your Knowledge

Multiple Choice Questions on GST & Margin Scheme

1. What is the primary focus of the GST Margin Scheme?

A) Calculating GST based on the full property value.

B) Reducing GST payable on property sales by focusing on the added value.

C) Allowing GST credits on all property purchases.

D) Applying GST equally to all types of property sales.

2. Which statement best describes the applicability of the Margin Scheme?

A) It applies only to residential property sales.

B) It is applicable to all property sales, regardless of GST.

C) It applies to taxable property sales, disallowing GST credit on purchases.

D) It is exclusively for properties sold at auction.

3. How is GST calculated under the Margin Scheme?

A) Sale price divided by 11.

B) Construction costs divided by 11.

C) Sale price minus land value, divided by 11.

D) Land value divided by 11.

4. Which of the following is a restriction on using the Margin Scheme?

A) It can only be used for properties purchased at public auction.

B) It cannot be applied if the property was originally purchased with GST included.

C) It is restricted to sales under $1 million.

D) It requires the property to have been held for at least 5 years.

5. What is the impact of the Margin Scheme on the GST credit for buyers?

A) Buyers can claim double GST credits.

B) Buyers are entitled to full GST credits as per standard GST calculation.

C) Buyers cannot claim GST credits for the purchase.

D) Buyers can claim GST credits on the land value only.

6. Which scenario best illustrates the calculation of GST under the Margin Scheme?

A) For a property with a sale price of $500,000 and land value of $200,000, GST is charged on the sale price.

B) For a property with a sale price of $500,000 and land value of $200,000, GST is charged on the $300,000 added value.

C) For a property with a construction cost of $300,000, GST is charged on the total construction cost plus land value.

D) For a property with a construction cost of $300,000 and no land value, GST is charged on the total sale price.

Answers

- B) Reducing GST payable on property sales by focusing on the added value.

- C) It applies to taxable property sales, disallowing GST credit on purchases.

- C) Sale price minus land value, divided by 11.

- B) It cannot be applied if the property was originally purchased with GST included.

- C) Buyers cannot claim GST credits for the purchase.

- B) For a property with a sale price of $500,000 and land value of $200,000, GST is charged on the $300,000 added value.

Assignment

Practical Exercise on Understanding the GST & Margin Scheme

Objective:

This assignment is designed to deepen your understanding of the Goods and Services Tax (GST) Margin Scheme in Australia, focusing on its calculation, applicability, and impact on both sellers and buyers in the property market.

Instructions:

Complete the tasks below using the information provided in the overview of the GST & Margin Scheme. Some tasks require calculations, while others will ask for your interpretation or application of the scheme based on given scenarios.

Tasks:

Calculate GST under the Margin Scheme:

Given: A property with a land value of $250,000 and a sale price of $600,000. Calculate the GST payable under the Margin Scheme.

Case Study Analysis:

Scenario: A property developer purchased a property without GST, spent $200,000 on renovations, and is now ready to sell for $500,000. Discuss whether the Margin Scheme could be applied and calculate the GST payable.

Research Question:

Investigate and summarise why the Australian government might have introduced the Margin Scheme for GST on property sales. Focus on the benefits to property developers and the overall economy.

Discussion Question:

Discuss the impact of not allowing GST credits on purchases under the Margin Scheme from the buyer’s perspective. How might this influence a buyer’s decision-making process?

Scenario Analysis:

A property was purchased for $300,000 with GST included in the sale price. After several years, the owner decides to sell the property for $450,000. Can the Margin Scheme be applied to this sale? Justify your answer based on the restrictions of the Margin Scheme.

Practical Application:

Design a brief guide for property developers on when and how to apply the Margin Scheme to maximise their tax benefits. Include eligibility criteria, calculation examples, and any potential restrictions they should know.