What is Growth on Equity Return?

- Growth on Equity Return measures the increase in equity value over time relative to the initial equity invested.

- It focuses on the appreciation of the investor’s ownership stake, taking into account the capital growth of the asset.

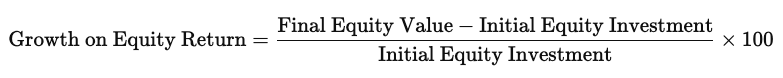

How is it Calculated?

- Initial Equity Investment: This is the total amount of money invested by the equity holders at the beginning of the project.

- Final Equity Value: The equity value after the asset has appreciated or depreciated, calculated at the end of the investment period.

Formula:

Advantages and Disadvantages

Advantages:

- Long-term Focus: Encourages long-term investment by measuring the value growth rather than just cash returns.

- Capital Appreciation Insight: Provides insight into how much the equity value has grown, giving investors a sense of the project’s profitability.

- Applicable to Assets with High Capital Growth: This metric is particularly useful for properties in markets experiencing rapid appreciation.

Disadvantages:

- Market Dependency: Highly dependent on property market conditions; if the market is stagnant or declining, equity growth may be minimal or negative.

- Lacks Cash Flow Insight: Does not account for cash flow generated during the holding period, which might be more important for some investors.

- Unrealized Gain Focus: Growth on equity return focuses on paper gains, which may not materialize if the asset is not sold or refinanced.

Pros and Cons

Pros:

- Shows Value Appreciation: Directly measures how much value the property has added to the investor’s equity.

- Useful for Long-Term Investors: Ideal for those holding assets for several years and looking for capital gains.

Cons:

- Ignores Cash Flow: Does not include interim income from rents, making it less useful for cash flow-driven investors.

- Market Volatility Risk: Susceptible to changes in market conditions, which could reduce equity gains unexpectedly.

Shortcomings

- Short-term Investors: Not very useful for short-term investors who need cash flow or quick profits.

- Lack of Liquidity Insight: It does not show how much liquidity the project generates, which can be critical for certain types of investors.

What is it Really Good For?

- Growth-Oriented Investors: Ideal for investors focused on capital appreciation rather than immediate returns.

- Equity Building Strategy: Suited for projects where the goal is to build substantial equity over a long period, especially in appreciating markets.

What is a Good Range?

- Target Range: A healthy Growth on Equity Return generally falls between 15% and 25% per annum for real estate projects, depending on the market and risk profile.

- Market Variations: In high-growth markets, returns could be higher, while in slower markets, they may fall below 10%.

What Does it Mean for the Investor?

- Wealth Creation: Growth on equity return is a clear indicator of wealth creation through the property, showing how much the investor’s stake has appreciated.

- Risk Tolerance: Investors need to be comfortable with longer hold periods and market risks, as growth returns can fluctuate based on external conditions.