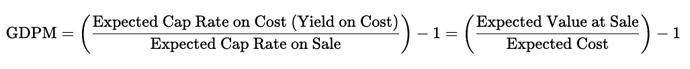

Gross Development Profit Margin (GDPM), as expressed by the formula:

is a metric used in real estate development to gauge the profitability of a project relative to the initial costs incurred versus the expected value or sale price at the end of the development.

Explanation

- Expected Cap Rate on Cost (Yield on Cost): This is the ratio of the expected operating income of the developed property to the total development cost. It essentially measures the return you expect to earn on your investment based on the cost to develop the property.

- Expected Cap Rate on Sale: This is the capitalization rate at which you expect to sell the property. It reflects market conditions, with a lower cap rate implying a higher sale price.

- Gross Development Profit Margin (GDPM): This metric shows the margin between the return on cost (how much the development will yield based on the cost) and the return at sale (how much the market will pay for that yield).

- A positive GDPM means the property is expected to sell for a higher value relative to its development costs, indicating profit.

- A negative GDPM indicates the property may sell for less than the development cost, signaling a potential loss.

Uses of GDPM

- Profitability Estimation: It helps developers estimate how much profit they will make from developing and selling a property. It compares the value created (sale value) with the investment (development cost).

- Feasibility Analysis: It aids in assessing whether a project is worth pursuing by comparing potential profits to market conditions and expectations.

- Risk Assessment: The GDPM highlights whether the expected yield on cost is significantly higher than the sale cap rate, providing insights into how market cap rates influence profitability.

What is a Good Margin?

- Good Margin: A typical good margin would be around 20-30% or higher. This would indicate that the project is not only covering its costs but also generating a significant profit, accounting for potential risks or market fluctuations.

- Bad Margin: A margin below 10% could be concerning, as it leaves little room for unforeseen costs, market downturns, or fluctuations in sale prices. A negative margin implies a loss-making scenario, meaning the project would sell for less than it cost to develop.

Implications

- Positive GDPM:

- Signals that the project is profitable.

- Attracts investors, as they are likely to see returns above their capital outlay.

- Helps justify the project’s risk, especially if margins are healthy (20%+).

- Low or Negative GDPM:

- Suggests the project might not be financially feasible.

- Could lead to a reassessment of the project’s costs, design, or sale strategy to improve profitability.

- Indicates potential market risks such as oversupply, poor location, or declining demand, all of which could affect the sale price.

- Strategic Planning:

- A developer may need to adjust expectations regarding construction costs, financing, or the timeline if the margin is slim.

- In competitive markets, knowing the expected GDPM can guide pricing decisions and exit strategies.

In short, GDPM helps developers and investors understand the profit potential relative to the costs and expected market conditions. It serves as a key benchmark in the decision-making process, from project initiation to sale.