Encumbrances

Q: What is an encumbrance in real estate?

A: An encumbrance is any claim, right, lien, estate, or liability that limits the fee simple title to property. It is essentially a restriction or limitation on the ownership and use of the property.

Q: Can you give examples of common encumbrances?

A: Common encumbrances include easements, encroachments, deed restrictions, liens, leases, and air and subsurface rights. Qualified fee estates and life estates are also considered encumbered.

Q: How does an encumbrance affect property ownership?

A: Encumbrances create impediments to the free and clear ownership of property. For instance, a lease is an interest in land for the tenant but an encumbrance for the fee simple owner.

Easements

Q: What is an easement?

A: An easement is a right granted to use the land of another for a specific purpose that is consistent with the general use of the land. The landowner retains ownership but shares concurrent use with the easement holder.

Q: How can easements be created?

A: Easements can be established via a written document, by reservation when property is transferred, by government condemnation, by necessity (for landlocked parcels), or by prescription (continuous and obvious use without permission).

Q: What is an easement in gross?

A: An easement in gross is an easement that benefits a person or company, not a parcel of land. Common examples include utility easements for telephone, electric, and gas companies.

Q: What is a party wall easement?

A: A party wall easement occurs when a shared wall, located on a property boundary line, provides mutual support for structures on both properties. Each owner has rights to the wall on their land and an easement for support on the other half.

Q: How can an easement be terminated?

A: Easements may end when the need for them no longer exists, if the dominant and servient estates are combined with intent to terminate the easement, by release from the easement holder, or through abandonment.

Q: What is an encroachment?

A: An encroachment is the unauthorized intrusion of a building or other structures onto another’s land, such as a tree limb overhanging or a roof eave crossing a property line.

Q: What are deed restrictions?

A: Deed restrictions are private agreements that dictate the use of land, such as requirements for building size or type, to maintain property values and ensure consistency within a neighborhood.

Liens

Q: What is a lien?

A: A lien is a claim on property to secure payment of a debt or obligation. It does not transfer title but can result in forced sale if the debt is not repaid.

Q: What are the differences between voluntary and involuntary liens?

A: A voluntary lien is created by the property owner’s actions, like a mortgage, while an involuntary lien arises by law, such as tax or judgment liens.

Q: What is the difference between special and general liens?

A: A special lien affects only a specific property, like a mortgage or mechanic’s lien. In contrast, a general lien applies to all of a person’s property within a jurisdiction, like a judgment lien.

Q: Who are lienors and lienees?

A: The lienor is the party holding the lien, such as a mortgage lender or tax authority. The lienee is the party whose property is subject to the lien.

Qualified Fee Estates

Q: What is a qualified fee estate?

A: A qualified fee estate is a type of property interest that is subject to certain limitations set by the person who created the estate.

Q: How many categories of qualified fee estates are there?

A: There are three categories: determinable, condition subsequent, and condition precedent.

Categories of Qualified Fee Estates

Q: What is a fee simple determinable estate?

A: It’s an estate where the duration is determined by the deed, with conditions like “so long as” the land is used for a specified purpose (e.g., religious purposes).

Q: What happens if the condition of a fee simple determinable estate is breached?

A: If the condition is breached, the estate automatically reverts to the grantor or a named remainderman.

Q: What is a fee simple subject to condition subsequent?

A: This estate gives the grantor the right to terminate the estate if a condition is breached.

Q: Can you provide an example of a fee simple subject to condition subsequent?

A: If Mr. Smith donates land to a church with the right to take it back if it’s no longer used for religious purposes, that’s a fee simple subject to condition subsequent.

Q: What is a fee simple upon condition precedent?

A: The title will not take effect until a specified condition is met.

Q: How might a fee simple upon condition precedent be used?

A: For instance, Mr. Smith could deed land to a church, but the deed will not take effect until a religious sanctuary is built on it.

Life Estates

Q: What does a life estate convey?

A: A life estate conveys property ownership for the duration of someone’s life.

Q: What must be determined when creating a life estate?

A: When creating a life estate, it must be decided who will acquire the estate upon the life tenant’s death.

Q: Can a life estate be tied to the life of someone other than the life tenant?

A: Yes, a life estate can be tied to the life of a third party, known legally as a life estate pur autrie vie.

Q: What is a life estate pur autrie vie?

A: It’s a life estate tied to the lifetime of someone other than the grantee, like deeding property to someone for the life of their mother.

Practical Use of Life Estates

Q: Why might someone use a life estate in estate planning?

A: Life estates can be used to avoid probate, reduce estate taxes, or ensure financial assistance by providing a home for someone’s lifetime.

Q: Can a life estate be used for purposes other than providing a home?

A: Yes, a life estate can also be used strategically, such as retaining control over property or reducing taxable estate value.

Prohibition of Waste

Q: What is the prohibition of waste regarding life estates?

A: The prohibition of waste requires that a life tenant must not damage or destroy the property and must maintain it in reasonable repair, including paying any property taxes, assessments, and interest on debts secured by the property.

Q: Can a life tenant generate income from the property?

A: Yes, a life tenant is entitled to any income generated by the property and may sell, lease, rent, or mortgage their interest in the property.

Q: Why are life estates not commonly marketed?

A: Due to the uncertainty of the estate’s duration, life estates are not commonly advertised for sale as they are considered unmarketable.

Statutory Estates

Q: What are statutory estates?

A: Statutory estates are property rights created by state law, including dower, curtesy, community property, and homestead protection.

Dower

Q: What is dower?

A: Dower is a legal right originating from old English law, which grants a wife rights to a portion (usually one-third or one-half) of the family’s real property for the rest of her life.

Q: How does dower affect the sale of property?

A: When a property is sold, the wife must relinquish her dower rights, typically by signing the deed or a separate quitclaim deed, to avoid future legal claims on the property.

Curtesy

Q: What is curtesy?

A: Curtesy is the counterpart to dower, providing a husband with rights in his deceased wife’s property for the duration of his life.

Q: How can a wife affect her husband’s curtesy rights?

A: A wife can defeat her husband’s curtesy rights through her will, and state law may impose additional requirements for the husband to qualify for curtesy.

Community Property

Q: What is community property?

A: Community property is a legal concept recognized in ten states where each spouse has an equal interest in property acquired during the marriage.

Q: What happens to community property upon the death of a spouse?

A: Upon a spouse’s death, community property passes to the heirs and/or the surviving spouse.

Homestead Protection

Q: What is homestead protection?

A: Homestead protection laws are designed to shield a family’s home from certain debts and provide a surviving spouse with a home for life.

Q: Are there any requirements to claim homestead protection?

A: While some rights are automatic, claiming homestead protection may require recording a written declaration in public records.

Q: How does the Federal Bankruptcy Reform Act relate to homestead protection?

A: The act provides an exemption for homeowners, protecting a portion of home equity and certain personal property from bankruptcy proceedings.

Freehold vs. Leasehold Estates

Q: What is the difference between freehold estates and leasehold estates?

A: Freehold estates involve actual ownership and an unpredictable duration, while leasehold estates involve possession without ownership and a definite duration.

Q: What are the two main features of a freehold estate?

A: The two main features are actual ownership of the land and unpredictable duration of the estate.

Q: What types of estates are considered freehold estates?

A: Fee estates, life estates, and estates created by statute are all considered freehold estates.

Leasehold Estates

Q: What is a leasehold estate?

A: A leasehold estate is where there is possession of the land without ownership and the estate lasts for a specific, agreed-upon duration.

Q: What rights does the freehold estate owner retain during a leasehold?

A: The freehold estate owner retains a reversion right, which is the right to recover possession at the end of the lease period.

Q: What are the four categories of leasehold estates?

A: They are estate for years, periodic estate, estate at will, and tenancy at sufferance.

Estate for Years

Q: What is an estate for years?

A: An estate for years is a lease with a specific starting and ending time, which does not automatically renew and does not require action to terminate on the specified end date.

Q: Can a lessee of an estate for years become a lessor?

A: Yes, the lessee can sublease the property to another person but cannot grant more rights than they possess.

Periodic Estate

Q: What is a periodic estate?

A: A periodic estate is a lease with an original fixed period that automatically renews unless the tenant or landlord acts to terminate it.

Q: What is required to terminate a periodic tenancy?

A: Termination of a periodic tenancy usually requires advance notice from the tenant or landlord.

Estate at Will

Q: What is an estate at will?

A: An estate at will allows either the lessor or the lessee to terminate the lease at any time, typically with reasonable advance notice as defined by state law.

Tenancy at Sufferance

Q: What is tenancy at sufferance?

A: Tenancy at sufferance occurs when a tenant remains in possession without the landlord’s consent after the legal tenancy has ended.

Q: How can tenancy at sufferance be converted to a periodic estate?

A: If the landlord accepts rent from a holdover tenant, the tenancy at sufferance can become a periodic estate.

License in Real Estate

Q: What is a license in the context of real estate?

A: A license is a personal privilege given to someone to use land, such as parking in a lot or attending an event, which is nonassignable and can be canceled by the issuer.

Q: Is a license an encumbrance against land?

A: No, a license is not an encumbrance against land because it is merely a personal privilege.

Chattels

Q: What is a chattel?

A: A chattel is an article of personal property, such as cattle historically, and in modern terms, it could refer to any movable item that is not real estate.

Q: How is chattel used in legal contexts?

A: Chattel can be used in legal documents like a chattel mortgage, which is a mortgage against personal property.

Law Sources

Q: What are the roots of American real estate law?

A: American law originates from English, Spanish, and French legal systems, which have evolved significantly over time due to legislative and court modifications.

Q: How did different colonization efforts affect American law?

A: English colonization influenced most American laws, Spanish law influenced the southwestern states, and French civil law is the basis for Louisiana’s law.

Common Law vs. Statutory Law

Q: What is the difference between common law and statutory law?

A: Common law is derived from long-standing usage and customs, while statutory law is created through legislation.

Q: Can common law concepts be found in statutory law?

A: Yes, many statutory laws pertaining to real estate have their roots in common law, and sometimes statutory laws are enacted to clarify or update common law.

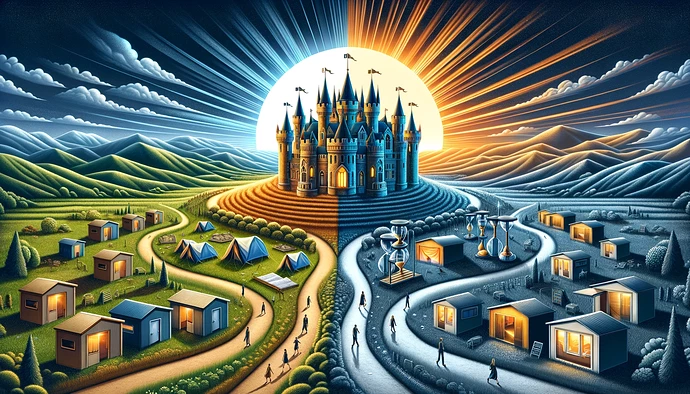

Pictorial Summary

Q: What is the concept of lateral severance in real estate?

A: Lateral severance refers to dividing a single parcel of land into different components such as surface, subsurface, and air rights, which can be separately leased or sold.

Q: Can a landowner lease different rights to different parties?

A: Yes, for example, a landowner can lease surface rights to a farmer and subsurface rights to an oil company, creating separate estates for each use.

Q: How does government regulation affect property rights?

A: The government can impose limitations on property rights, such as allowing aircraft to fly overhead, which limits a landowner’s rights to the airspace above their property.

Surface Right of Entry

Q: What does it mean if a landowner has not leased or sold the surface right of entry?

A: If the surface right of entry has not been leased or sold, the company with subsurface rights must access the subsurface from adjacent properties where it has the right of entry.

Q: Can a homeowner still use their property if the surface right of entry is not sold?

A: Yes, the homeowner retains full use of the land and air space, subject to zoning laws, building codes, and any easement rights granted to utility companies.

Q: How do easement rights for utilities affect a homeowner’s property?

A: Easement rights allow utility companies to install infrastructure for services like electricity and water, which can pass above or beneath the surface without affecting the homeowner’s use of the land.

Land Lease

Q: What is a land lease in real estate terms?

A: A land lease is an agreement where the landowner leases the land to an investor for a long-term, allowing the investor to construct buildings and use the land for a fixed period, often between 55 and 99 years.

Q: What happens to a property at the end of a land lease?

A: At the end of the land lease, the rights to the land, including any buildings or improvements, revert back to the landowner.

Condominium Lots

Q: How do condominium air lot rights work?

A: Individual condominium owners own air lots and have a fee simple bundle of rights for their units, including the right to mortgage or lease their space.

Q: Do condominium owners typically own the land and subsurface?

A: Yes, condominium owners usually collectively own the land and subsurface, not used as air lots, beneath the building.

Q: What rights might be granted for underground transportation in condominiums?

A: Condominium owners may sell, lease, or grant rights to a transit authority to build underground transportation systems, like subway lines beneath their building.

Subsurface Rights for Transportation

Q: What is an alternative for managing subsurface rights in urban areas?

A: An alternative approach is for transit authorities or companies to own the entire parcel and use the subsurface for transportation, while leasing or selling the surface and air rights for other developments like office buildings.