Debt Service Coverage Ratio (DCR) and Interest Coverage Ratio (ICR) are key metrics used in real estate to assess the financial stability and risk associated with a property’s income relative to its debt obligations.

1. Debt Service Coverage Ratio (DSCR)

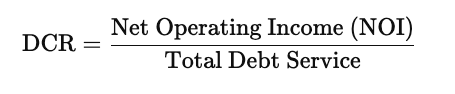

- Definition: DSCR measures the ability of a property’s net operating income (NOI) to cover its total debt service (both principal and interest payments). It is calculated as:

- Interpretation:

- A DSCR greater than 1 indicates that the property’s income is sufficient to cover its debt obligations. For example, a DSCR of 1.25 means the property generates 25% more income than required to pay the debt.

- A DSCR less than 1 suggests that the property does not generate enough income to cover its debt service, signaling higher financial risk.

- Usage:

- For Real Estate Developers: Helps in evaluating whether a completed project’s income will be sufficient to cover debt payments. It is also important for securing financing, as lenders typically require a minimum DSCR (often 1.2 to 1.4) to approve a loan.

- For Real Estate Investors: Assesses the risk and financial health of a potential investment. A higher DCR indicates a lower risk of default, making the investment more attractive.

2. Interest Coverage Ratio (ICR)

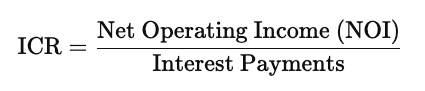

- Definition: ICR measures the ability of a property’s NOI to cover only the interest payments on its debt. It is calculated as:

- Interpretation:

- An ICR greater than 1 means the property can cover its interest payments comfortably. For example, an ICR of 2.0 means the income is twice the amount needed to pay the interest.

- An ICR less than 1 indicates insufficient income to meet interest obligations, suggesting potential financial strain.

- Usage:

- For Real Estate Developers: Used during the construction phase when debt may be interest-only. It ensures the project generates enough income to cover interest payments until principal payments begin.

- For Real Estate Investors: Helps gauge the financial stability of a property and its ability to manage interest rate changes. A higher ICR means less risk of default due to fluctuating interest rates.

3. Differences Between DCR and ICR

- Coverage Scope:

- DCR covers the total debt service (principal and interest), while ICR only covers interest payments.

- Usage Stage:

- DCR is more relevant post-construction when debt repayments include both principal and interest.

- ICR is often used during the construction or lease-up phase when loans may be structured as interest-only.

4. Why Do These Ratios Matter?

For Real Estate Developers:

- Debt Feasibility: Lenders use DCR and ICR to assess whether the project is financially viable. Meeting minimum ratio requirements is often crucial for loan approval.

- Cash Flow Management: These ratios help developers anticipate cash flow needs and ensure they can cover debt obligations during and after construction.

For Real Estate Investors:

- Risk Assessment: Both ratios provide insight into the financial health of an investment property. A higher ratio indicates a safer investment with lower default risk.

- Financing Strategy: Understanding these ratios allows investors to better negotiate loan terms and structure deals that align with their cash flow expectations.

Both DCR and ICR are critical for ensuring that a real estate investment or development project can sustainably manage its debt obligations, thus reducing financial risk for all parties involved.