Why you MUST have One Minute Feaso?

Introduction to Residual Land Value and Profit Margin

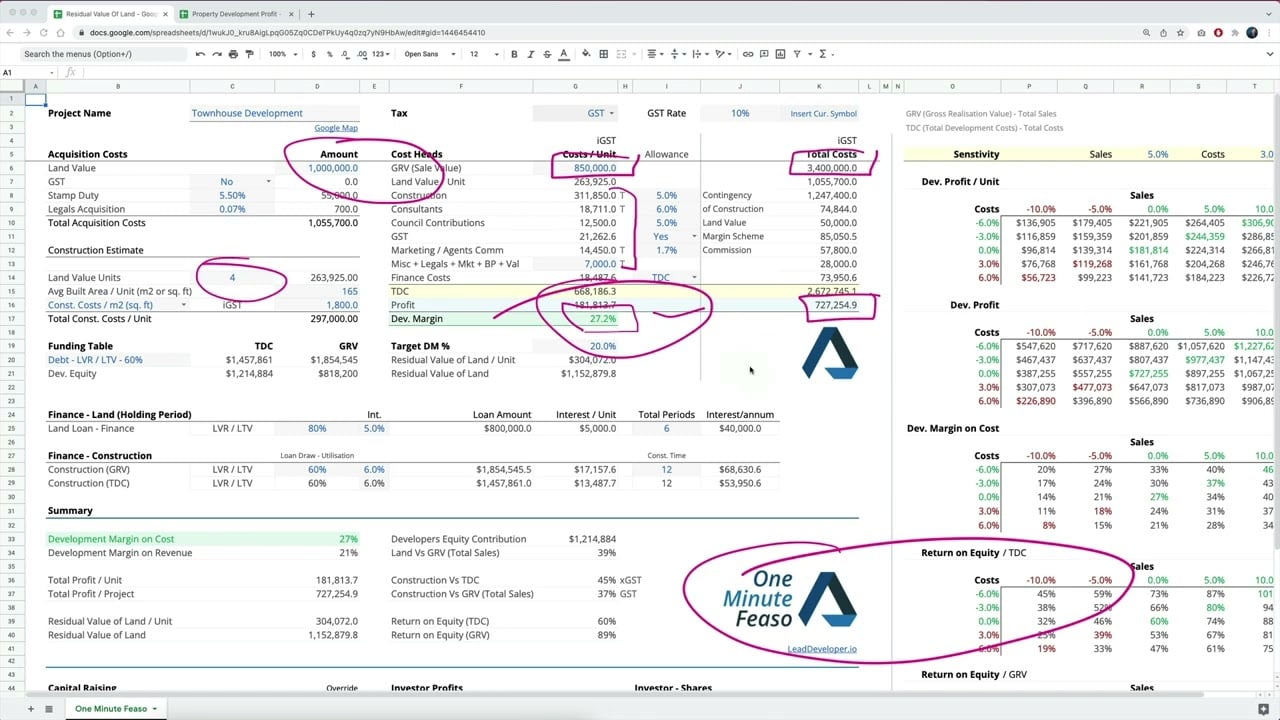

Understand the concepts of residual land value, which represents the value of land after all costs are paid, and profit margin, which is sales minus costs.

Timestamp 00:00

Land Development Example

Explore a land development example where a $10 million land is divided into 40 lots, with each lot costing $50,000 to service. The goal is to calculate the development margin and profit per lot.

Timestamp 00:31

Calculating Residual Land Value

Learn how to calculate the residual land value to ensure you are not overpaying for land. This calculation is essential in determining the maximum price you should pay based on a target profit margin.

Timestamp 01:24

Minimum Acceptable Rate of Return (MAR)

Understand the concept of the minimum acceptable rate of return (MAR), also known as the hurdle rate, which sets the lowest acceptable profit margin.

Timestamp 02:54

Townhouse Development Example

Apply the residual land value concept to a townhouse development, considering factors like GST, construction costs, and selling prices to determine the maximum land price.

Timestamp 03:05

Using Residual Land Value in Auctions

Discover how to use residual land value calculations during auctions to ensure you do not overpay for land, while still achieving your target profit margin.

Timestamp 05:24

Impact of Market Fluctuations on Land Value

Learn about the risks of paying more for land in a rising market and the importance of basing your calculations on current market conditions rather than speculative future values.

Timestamp 06:43

Residual Land Value vs. Profit Margin

Compare residual land value and profit margin, and understand how they serve different purposes in evaluating development projects and making investment decisions.

Timestamp 08:34

Project-Related Site Value (PRSV)

Explore the concept of project-related site value (PRSV), a valuation method used by lenders when a development approval is in place, and how it differs from residual land value.

Timestamp 10:53

Conclusion and Summary

Conclude with a summary of the key takeaways from the video, including the importance of using residual land value calculations to make informed decisions in real estate development.

Timestamp 12:27