Find the Sweet Spot: Master Replacement Rent

Replacement Rent=(Yield on Cost×Total Development Costs)+Operating Expenses

is calculating the minimum rent required for a real estate development project to justify the investment based on its costs and operating expenses.

Let’s break it down:

Key Components:

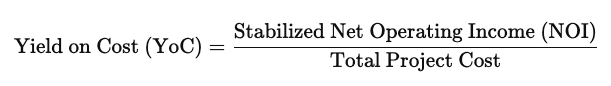

- Yield on Cost (YoC): This is a measure of return on the total cost of developing a property. It is calculated as:

- It tells investors how much income (Net Operating Income or NOI) they are generating as a percentage of their total development costs.

- Total Development Costs: These are the total costs required to bring the project to completion, including land acquisition, construction, and other project-related costs, excluding finance/interest costs if YoC excludes them.

- Operating Expenses: These are the ongoing costs of managing and operating the property, such as maintenance, insurance, property taxes, and utilities.

What the Formula Calculates:

The formula calculates Replacement Rent, which is the rent required to achieve a desired return based on the costs of developing the project. Specifically, it reflects:

- (YoC × Total Development Costs): This part represents the amount of NOI (Net Operating Income) the development needs to generate in order to meet the required return (YoC) based on its costs.

- + Operating Expenses: This adds the operating expenses to the NOI to account for the total rent that must be charged to cover both the return on development costs and the property’s operational costs.

Implications of the Formula:

- Setting Minimum Rents: This formula helps developers and investors determine the minimum rent they need to charge in order to cover their development costs, earn their targeted return (YoC), and pay for operating expenses. If the market rent is below this calculated replacement rent, the project may not be financially viable.

- Project Feasibility: If the required replacement rent is too high compared to market rents, it could indicate that the development is too costly or that a lower return (YoC) must be accepted to make the project feasible.

- Risk Assessment: It highlights the sensitivity of a development project to changes in costs or operating expenses. Higher development costs or operating expenses directly increase the required rent, which can make the project riskier in markets where rents are not expected to rise significantly.

- Market Comparison: The replacement rent can be compared to existing or expected market rents to assess the competitiveness of the project and whether it can attract tenants at the required rental rate.

This formula is crucial for assessing the financial sustainability of build-to-rent or similar projects.