Decision-Making Framework

Decision-Making Framework [PDF]

Decision-Making Framework - FAQs

1. What is market research in real estate development, and why is it important?

Market research involves analyzing current market trends, such as supply and demand dynamics, lending restrictions, and interest rates. It is crucial because it helps developers understand the feasibility of their projects and how external factors, including government interventions and economic policies, can impact property prices. This understanding aids in making informed development decisions.

2. What are the primary decision options available to real estate developers?

Developers can choose from buying and holding property, flipping, or engaging in full-scale development. Each option comes with its strategies, such as managing holding costs, adding value through rezoning or renovations, and maximizing profitability from the sale of developed properties.

3. How does strategic use of finance affect real estate development?

Having a financial buffer and making informed decisions about construction costs, design, and financing terms are critical. Developers should maintain control over their projects to ensure that architectural designs and marketing strategies meet market needs and financial goals.

4. What are market constraints, and how do they influence real estate development?

Market constraints include factors like customer confidence, interest and mortgage rates, credit restrictions, and market timing. These directly impact the feasibility and timing of development projects, affecting overall success and profitability.

5. What factors contribute to the success of real estate development projects?

Key success factors include the location of the project, an effective execution plan, strategic planning and anticipation, the right use of strategies, financial management, targeted marketing, and maintaining quality in design and construction.

6. How do government interventions impact real estate development?

Government policies and economic tools can significantly influence market dynamics, affecting demand for property, borrowing costs, and the attractiveness of development projects. Developers must adapt their strategies to these interventions to mitigate risks and seize opportunities.

7. What advantages does flipping properties offer?

Flipping properties can provide quick returns on investment, allow developers to leverage market opportunities, and offer flexibility in responding to market conditions. It involves adding value to properties, making them more attractive to buyers at higher prices.

8. What are the risks associated with flipping properties?

Risks include dependence on market conditions, potential for cost overruns in renovations or permits, and liquidity challenges in finding buyers, which can impact the expected profit margin and investment return.

9. How can developers navigate market constraints effectively?

Effective navigation of market constraints involves conducting thorough market research, staying informed about government policies and economic conditions, maintaining strategic flexibility, ensuring robust financial planning, and developing an adaptable execution plan.

10. Why is understanding market dynamics crucial for real estate developers?

Understanding market dynamics helps developers make informed investment decisions. Recognizing customer confidence, borrowing costs, lending criteria, and market cycles enables developers to time their investments wisely, minimizing risks and maximizing potential returns.

Summary

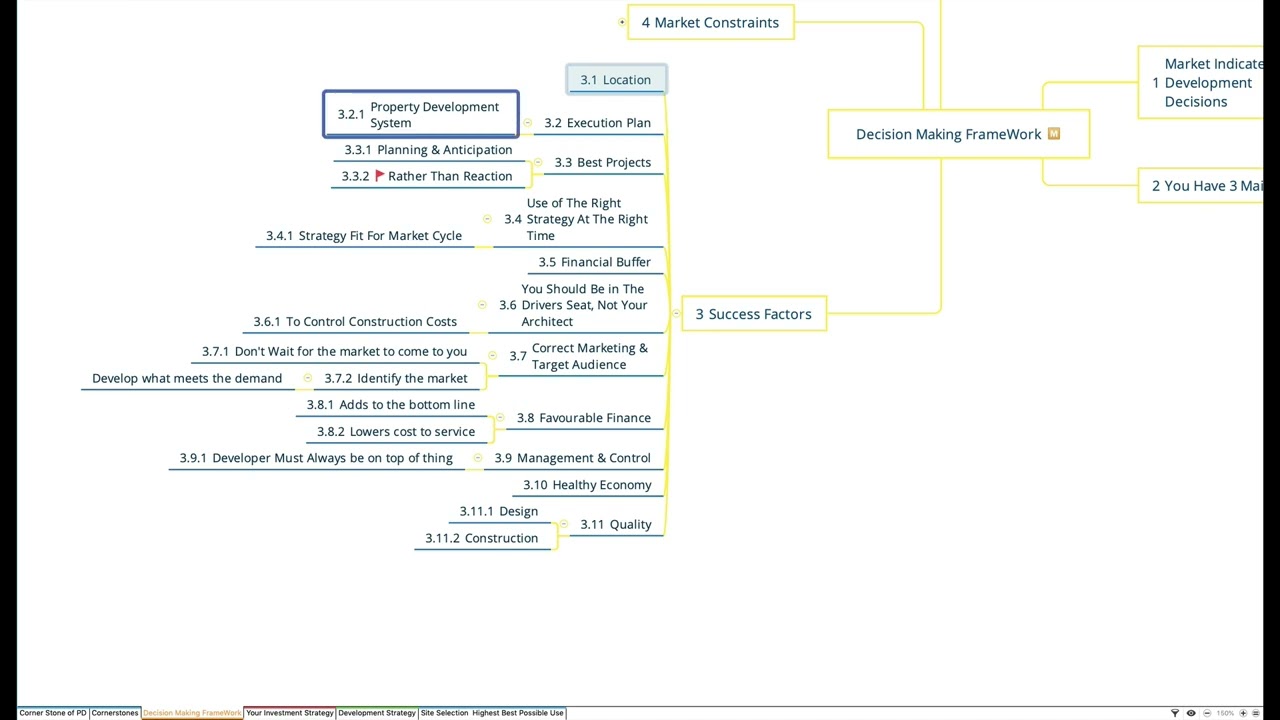

In the “Decision Making Framework”, the focus is on understanding how market research influences development decisions in the real estate sector.

Market Research

Identifies current market trends, including over-supply, lending restrictions, and interest rates. This research is crucial for understanding the feasibility of development projects and how external factors, like government interventions and economic policies, impact property prices.

Decision Options

Developers face three primary choices: buying and holding property, flipping, or full-scale development. Each option has its strategies and considerations, such as covering holding costs, adding value to properties through rezoning or renovation, and the potential profitability of developing and selling the end product.

Execution Plan

Successful development requires a detailed execution plan, including a system or guidance to ensure all aspects of the project are considered. This plan emphasizes proactive problem-solving and anticipating challenges rather than reacting to them.

Strategic Use of Finance

The video stresses the significance of having a financial buffer and making informed decisions regarding construction costs, design, and financing terms. Developers are encouraged to maintain control over the project, ensuring that architectural designs and marketing strategies align with market needs and financial objectives.

Market Constraints

Understanding market constraints, such as customer confidence, interest and mortgage rates, credit restrictions, and market timing, is vital. These factors directly influence the feasibility and timing of development projects, affecting the overall success and profitability.

Success Factors

Key success factors for development projects include location, an effective execution plan, strategic planning and anticipation, appropriate use of strategies, financial management, targeted marketing, and maintaining quality in design and construction.

Market Dynamics

The interplay between customer confidence, borrowing costs, lending criteria, and market cycles (down cycles, absorption cycles, and market saturation) are explored. Developers must recognize these dynamics to make informed decisions regarding when and how to invest in projects.

This video offers a comprehensive overview of the decision-making process in real estate development, focusing on the importance of market research, strategic planning, and understanding market constraints. It provides valuable insights for developers looking to navigate the complexities of the market and make informed decisions to maximize profitability.

- Market conditions, influenced by governmental policies, significantly impact property prices beyond the basic economics of supply and demand.

- The strategic decision among buying and holding, flipping, or developing directly relates to market research outcomes and the project’s feasibility.

- Success in real estate development hinges on several factors, including market understanding, financial management, and strategic planning.

Regulatory Impact

Government policies and economic measures can artificially stimulate or restrict the economy, impacting property and asset prices. These measures include credit control, interest rate adjustments, and other macroprudential reforms aimed at managing economic growth and stability.

Market Conditions

Instead of market prices solely being determined by supply and demand, government actions can alter market conditions, influencing both the feasibility of real estate projects and their potential profitability. This includes setting regulations that affect lending rates, property taxes, and development approvals.

Strategic Decisions

Developers must consider these government-induced market conditions in their strategic planning. Whether deciding to buy and hold, flip, or develop a property, understanding the implications of government policies is crucial for timing investments and predicting market responses.

Economic Tools

The use of economic tools by the government, such as manipulating interest rates or adjusting lending restrictions, can lead to changes in market behavior, impacting developers’ ability to finance projects or forecast returns. Developers need to stay informed about these tools and adapt their strategies accordingly.

Advantages of Flipping Properties

Value Addition

Flipping involves adding value to a property through methods such as rezoning, obtaining permits, renovation, or maximizing its utility, making it more attractive to buyers at a higher price.

Short-Term Investment

It offers the potential for quick returns on investment. By controlling a property for a short period, developers can capitalize on market trends without a long-term commitment.

Market Agility

Flipping allows developers to react quickly to market conditions, taking advantage of opportunities as they arise. This can be particularly beneficial in a volatile market where conditions change rapidly.

Risks Associated with Flipping

Market Dependence

The success of flipping heavily depends on market conditions. In a volatile market, unexpected downturns can diminish the value added to a property, reducing profits or even leading to losses.

Cost Overruns

Value-adding activities such as renovations or obtaining permits can incur higher costs than anticipated, which can erode the expected profit margin.

Liquidity Challenges

In volatile markets, finding buyers can be more challenging, affecting the liquidity of the investment. Developers might find it difficult to sell the property quickly or at the desired price, impacting cash flow and investment return.

Strategic Considerations

- The video emphasizes the importance of strategic planning and market research before deciding to flip a property. Developers need to thoroughly understand market trends, potential buyer demand, and the costs involved in adding value to a property.

- It also suggests considering alternative strategies like holding onto a property for rental income or full-scale development, depending on the feasibility study and market research outcomes.

In conclusion, while flipping properties can offer significant advantages such as quick returns and the ability to leverage market opportunities, it also carries risks, particularly in volatile markets. Developers must carefully assess these factors, conduct thorough market research, and plan strategically to mitigate risks and maximize the potential for profit.

Navigating market constraints effectively

Market Research

The foundation for anticipating market constraints lies in thorough market research. This involves understanding current market conditions, including supply and demand dynamics, interest rates, lending restrictions, and governmental policies. Such research helps in identifying potential challenges and opportunities in the market.

Government Policies and Economic Conditions

Developers need to stay informed about government interventions and economic trends, as these can significantly impact market conditions. By understanding these factors, developers can better predict shifts in the market and plan their projects accordingly.

Strategic Flexibility

The video highlights the importance of being strategically flexible. Developers should have multiple strategies in place, allowing them to pivot as market conditions change. This could involve altering the project scope, adjusting timelines, or even changing the target market for the development.

Financial Planning

Anticipating market constraints requires robust financial planning. Developers should ensure they have sufficient financial buffers to withstand market downturns. This includes securing favorable finance terms and maintaining a level of liquidity that allows for flexibility in decision-making.

Execution Plan

An effective execution plan is crucial for navigating market constraints. This plan should include contingency measures for potential market changes. It involves proactive problem-solving, anticipating challenges before they arise, and having a systematic approach to project management.

Engaging with Stakeholders

Open communication with stakeholders, including investors, local communities, and regulatory bodies, can provide valuable insights into potential market constraints. This engagement can offer early warnings of changing market sentiments or regulatory shifts, allowing developers to adjust their strategies proactively.

Market Timing

Understanding the cyclic nature of the real estate market is vital. Developers need to recognize signs of market saturation, downturns, and upturns. By accurately timing their projects, they can minimize exposure to adverse market conditions and capitalize on favorable ones.

In essence, the video underscores the necessity for developers to conduct comprehensive market research, maintain strategic flexibility, and plan meticulously. These practices enable developers to anticipate market constraints and adjust their strategies, ensuring project viability and profitability despite the challenges of a dynamic market environment.

Test Your Knowledge

1. What is the primary purpose of conducting market research in real estate development?

A) To determine the best architectural styles for new developments

B) To analyze current market trends, supply and demand dynamics, and external factors impacting property prices

C) To choose interior designs for development projects

D) To identify potential buyers and sellers in the market

2. Which of the following is NOT a primary decision option available to real estate developers?

A) Buying and holding property

B) Flipping properties

C) Engaging in full-scale development

D) Investing in unrelated businesses

3. How can the strategic use of finance affect real estate development?

A) By ensuring projects are completed ahead of schedule

B) Through careful planning of construction costs, design, and financing terms to meet market needs

C) By reducing the importance of architectural design in project success

D) Through aggressive marketing strategies only

4. Market constraints in real estate development include all the following EXCEPT:

A) Customer confidence

B) Color schemes in property interiors

C) Credit restrictions

D) Interest and mortgage rates

5. Key success factors in real estate development projects include the following EXCEPT:

A) Strategic location of the project

B) Random planning and execution

C) Financial management and targeted marketing

D) Maintaining quality in design and construction

6. Government interventions impact real estate development mainly through:

A) Influencing market dynamics and affecting demand for property

B) Deciding on the color palettes for residential properties

C) Directly managing real estate development projects

D) Limiting architectural styles that can be used in construction

7. What advantages does flipping properties offer?

A) Guaranteed returns regardless of market conditions

B) Quick returns on investment and the ability to leverage market opportunities

C) Elimination of all investment risks

D) Fixed income over a long period

8. Risks associated with flipping properties include:

A) Stability in market conditions guaranteeing profit

B) Dependence on market conditions and potential for cost overruns

C) Guaranteed liquidity and buyer availability

D) No need for strategic planning or market research

9. Effective navigation of market constraints involves:

A) Ignoring market research and focusing solely on construction

B) Conducting thorough market research and maintaining strategic flexibility

C) Relying exclusively on past experiences without adapting to new conditions

D) Avoiding engagement with stakeholders and regulatory bodies

10. Why is understanding market dynamics crucial for real estate developers?

A) It ensures that projects are always under budget

B) It enables developers to make informed investment decisions based on customer confidence and market cycles

C) It is only necessary for large-scale development projects

D) It guarantees that every project will be successful without any risk

Answers

- B) To analyze current market trends, supply and demand dynamics, and external factors impacting property prices

- D) Investing in unrelated businesses

- B) Through careful planning of construction costs, design, and financing terms to meet market needs

- B) Color schemes in property interiors

- B) Random planning and execution

- A) Influencing market dynamics and affecting demand for property

- B) Quick returns on investment and the ability to leverage market opportunities

- B) Dependence on market conditions and potential for cost overruns

- B) Conducting thorough market research and maintaining strategic flexibility

- B) It enables developers to make informed investment decisions based on customer confidence and market cycles

Assignment

Real Estate Development Decision Making Framework: Practical Exercise

Objective

This exercise aims to apply the concepts learned from the “Decision Making Framework” video to a hypothetical real estate development project. By completing this assignment, students will demonstrate their understanding of market research, strategic decision-making, and planning within the context of real estate development.

Instructions

You are tasked with assessing the viability of a real estate development project in a selected location. This will involve conducting market research, evaluating decision options, developing a strategic plan, and anticipating market constraints. Your findings should be compiled into a comprehensive report.

Part 1: Market Research

To Do

Select a location for your hypothetical real estate development project. This could be a residential, commercial, or mixed-use project.

Research Question

What are the current market trends affecting real estate development in your chosen location, including supply and demand, interest rates, and lending restrictions?

To Do

Analyze how government interventions and economic policies might impact property prices and development feasibility in your chosen location.

Part 2: Decision Options

To Do

Evaluate the three primary real estate development options (buying and holding, flipping, or full-scale development) for your project. Consider strategies, costs, and potential profitability.

Research Question

Which development option is most viable for your project based on current market conditions and your market research findings? Justify your decision.

Part 3: Strategic Planning and Execution

To Do

Develop a detailed execution plan for your chosen development option. Include considerations for financial planning, design, marketing strategies, and problem-solving.

Research Question

How will you ensure that your project aligns with market needs and financial objectives? What contingencies will you put in place to address potential challenges?

Part 4: Anticipating Market Constraints

To Do

Identify potential market constraints that could impact the success of your project, such as customer confidence, market timing, and credit restrictions.

Research Question

How will you adjust your development strategy to navigate these constraints effectively? Include considerations for strategic flexibility, stakeholder engagement, and market timing in your response.

Part 5: Reflection

To Do

Reflect on the importance of market dynamics in real estate development decision-making. How do factors like customer confidence, borrowing costs, and government interventions influence your strategic decisions?

Research Question

How can real estate developers use the decision-making framework discussed in the video to mitigate risks and maximize profitability in a dynamic market environment?

Submission Guidelines

- Compile your findings, analyses, and reflections into a report format.

- Include data, charts, or diagrams to support your market research and strategic planning.

- Cite any external sources of information used in your analysis.

- Your report should be between 1500-2000 words in length.