Validating signals - Stage 3

Here, we deep dive into real estate market analysis, emphasising the importance of detailed, data-driven decisions in property investment. The video meticulously explains the process of analysing supply and demand dynamics in a given suburb, utilising various online tools and websites. Here’s a breakdown of the key insights and methodologies presented:

Zooming In

The process starts from a broad suburb overview and gradually narrows down to specific properties. This methodical narrowing is crucial for identifying the most promising investment opportunities.

Property Reporter.com

Utilised for its comprehensive data on sales, this website offers insights into what properties sold for, highlighting the dynamics of the local real estate market over specific periods.

Investment Analysis

The presenter values tools that calculate potential expenses and cash flow, providing examples of how median property values and costs (e.g., stamp duty, loan fees) can impact investment returns. The analysis underscores the importance of cash flow considerations in investment decisions, showcasing properties by bedroom count to illustrate potential negative cash flow scenarios.

Vendor Sentiment

Through sites like SQM Research, the presenter assesses vendor sentiment in the market, which indicates whether property prices are likely to rise or fall. This information is pivotal in understanding market trends and making informed investment decisions.

Price Reductions

The video details how to leverage information on price reductions for negotiation advantage. Understanding why a property hasn’t sold can be as crucial as the discount itself.

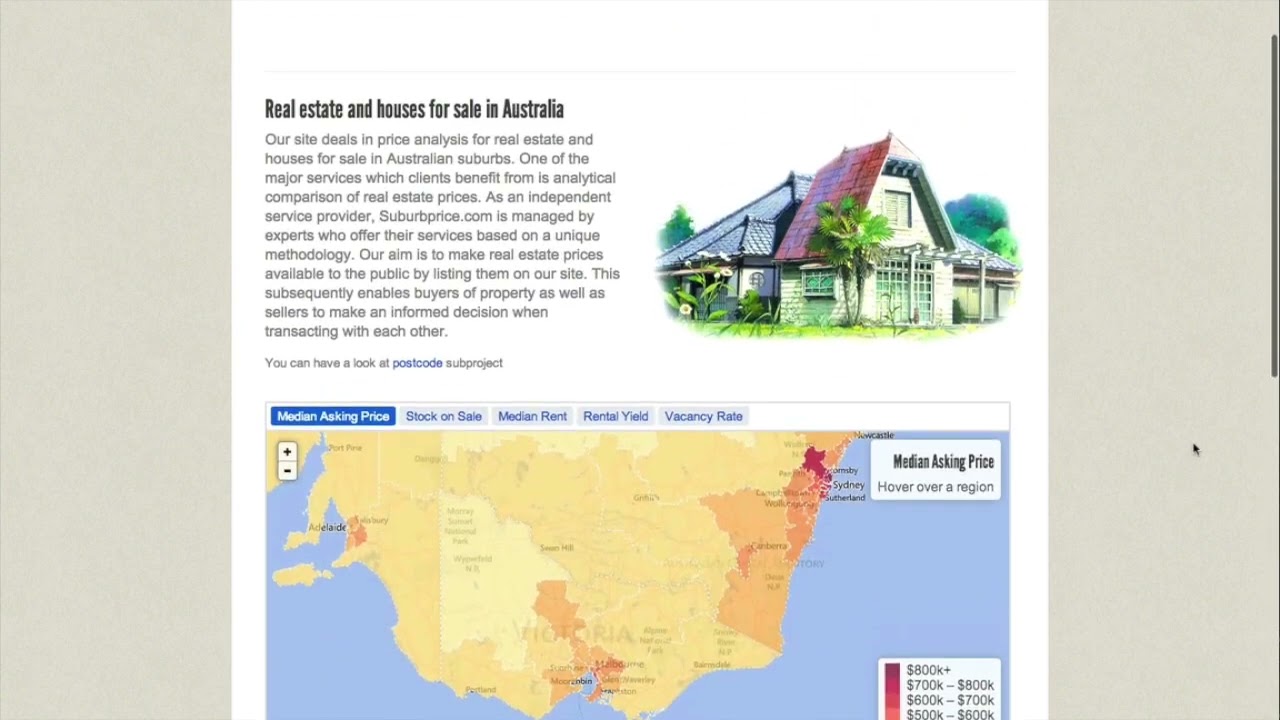

Heat Maps and Market Overviews

Tools that offer visual representations of market data, such as median asking prices and stock on sale, help investors to grasp market trends at a glance.

Listing Histories

Comprehensive databases provide the listing history of properties, which can reveal patterns or issues affecting saleability and value.

Cross-Platform Analysis

The presenter highlights the importance of comparing data across multiple platforms, including websites that list sales prices and rent potential. This cross-referencing is essential for a rounded understanding of the market.

Legal and Development Insights

Information on zoning, development potential, and property history enables investors to spot opportunities and risks that aren’t immediately apparent from price data alone.

Local and Foreign Sources

Using local and international websites, including those based in China with data on Australian properties, exemplifies the global nature of real estate research.

Interactive Tools

Websites offering interactive tools for exploring property data, including future projections and historical changes, are emphasised for their utility in making predictive analyses.

Insights based on numbers:

- Property investments often entail significant expenses beyond the purchase price, including stamp duty and loan fees, which can impact the overall cash flow of an investment.

- Vendor sentiment can serve as a leading indicator of market trends, with changes in sentiment potentially signalling upcoming price adjustments.

- Analysing price reductions and listing histories provides a strategic advantage in negotiations, allowing investors to understand the market dynamics at play better.

Frequently Asked Questions

How does the analysis process start in the real estate market?

The analysis begins with a broad overview of a suburb and gradually narrows down to specific properties. This step-by-step narrowing is essential for pinpointing the most promising investment opportunities.

How are potential expenses and cash flow analyzed?

The presenter uses tools that calculate potential expenses and cash flow, including median property values and costs like stamp duty and loan fees. This analysis is crucial for understanding how these factors can affect investment returns, illustrating scenarios with different bedroom counts to highlight potential negative cash flow situations.

What does vendor sentiment indicate, and how is it assessed?

Vendor sentiment, assessed through sites like SQM Research, indicates whether property prices are likely to rise or fall. Understanding vendor sentiment is vital for grasping market trends and making informed investment decisions.

How can information on price reductions be leveraged?

Details on price reductions can be used for a negotiation advantage, providing insights into why a property hasn’t sold and the significance of the discount.

What role do heat maps and market overviews play in the analysis?

Heat maps and market overviews offer visual representations of market data, such as median asking prices and stock on sale, helping investors quickly understand market trends.

Why is cross-platform analysis important?

Comparing data across multiple platforms, including sales prices and rent potential, is crucial for a comprehensive understanding of the market, ensuring investors have a well-rounded perspective.

How can legal and development insights benefit investors?

Information on zoning, development potential, and property history can reveal opportunities and risks not immediately apparent from price data, aiding in spotting valuable investment opportunities.

Why is it beneficial to use both local and foreign sources for real estate research?

Utilising a mix of local and international websites, including those based in countries like China for data on Australian properties highlights the global nature of real estate research and expands the data available for analysis.

What is the significance of interactive tools in real estate analysis?

Interactive tools that allow for the exploration of property data, including future projections and historical changes, are emphasized for their ability to aid in predictive analyses and enhance the decision-making process in real estate investments.

How do additional expenses impact the overall cash flow of a property investment?

Property investments involve significant expenses beyond the purchase price, such as stamp duty and loan fees. These can affect the overall cash flow of an investment, highlighting the importance of thorough financial analysis.

How can analysing price reductions and listing histories offer a strategic advantage?

The strategic advantage comes from a deeper understanding of market dynamics, which enables investors to negotiate better by knowing the history and reasons behind price reductions and property saleability.

Test Your Knowledge

1. What is the first step in analyzing the real estate market according to “Validating Signals - Stage 3”?

A) Detailed cost analysis

B) Vendor sentiment analysis

C) Broad overview of a suburb

D) Direct property inspection

2. Which website is mentioned as a source for comprehensive sales data?

A) Zillow.com

B) Property Reporter.com

C) SQM Research

D) Realtor.com

3. What is a critical aspect of investment analysis highlighted in the presentation?

A) Architectural design

B) Neighborhood popularity

C) Potential expenses and cash flow

D) Interior design trends

4. Vendor sentiment is analyzed to predict what?

A) Construction quality

B) Property size trends

C) Future price adjustments

D) Interior design preferences

5. How can information on price reductions benefit investors?

A) By identifying the most luxurious properties

B) By providing negotiation advantages

C) By highlighting the most popular suburbs

D) By determining architectural styles

6. What do heat maps and market overviews assist investors in understanding?

A) The most fashionable interior designs

B) Market trends at a glance

C) Historical architectural trends

D) The best construction materials

7. The significance of cross-platform analysis lies in its ability to:

A) Predict interior design trends

B) Provide a rounded understanding of the market

C) Determine the best property colors

D) Assess construction quality

8. What type of insights can legal and development information provide?

A) Color trends in property design

B) Opportunities and risks not apparent from price data

C) The best interior designers

D) Upcoming architectural styles

9. The use of local and foreign sources for research highlights what aspect of real estate investment?

A) The influence of interior design on property value

B) The global nature of real estate research

C) The preference for certain construction materials

D) Trends in property colors

10. Interactive tools for exploring property data are emphasised for their ability to:

A) Assist in choosing property colors

B) Aid in predictive analyses and enhance decision-making

C) Determine the best construction materials

D) Predict interior design trends

Answers:

- C) Broad overview of a suburb

- B) Property Reporter.com

- C) Potential expenses and cash flow

- C) Future price adjustments

- B) By providing negotiation advantages

- B) Market trends at a glance

- B) Provide a rounded understanding of the market

- B) Opportunities and risks not apparent from price data

- B) The global nature of real estate research

- B) Aid in predictive analyses and enhance decision-making

Assignment

Practical Exercise on Real Estate Market Analysis

Objective:

This assignment is designed to help students apply the concepts learned in “Validating Signals—Stage 3” through practical research and analysis of the real estate market. It focuses on supply and demand dynamics, vendor sentiment, and investment analysis using various online tools and websites.

Instructions:

Students must select a suburb of their choice and conduct a detailed real estate market analysis based on the methodologies presented. The assignment will consist of research questions and tasks to employ the insights and tools discussed in the material. Students will demonstrate their understanding by completing the following tasks and answering the associated questions.

To-Do’s and Research Questions:

Suburb Overview and Narrowing Down:

Select a suburb to analyze. Begin with a broad overview of the real estate market in this area.

- Task: Use online resources to gather data on the suburb’s average property prices, demographic information, and general market conditions.

- Question: What factors make your selected suburb a potentially promising or challenging investment opportunity?

Using Property Reporter.com or Similar Tools:

- Task: Research the recent sales data in your selected suburb using Property Reporter.com or a similar website.

- Question: What trends can you identify from the sales data regarding the types of properties sold and their price ranges?

Investment Analysis:

- Task: Calculate potential expenses and cash flow for a hypothetical property investment in the suburb. Consider median property values, stamp duty, loan fees, and any other relevant costs.

- Question: How do these expenses impact the potential investment return? Discuss any negative cash flow scenarios you might encounter.

Vendor Sentiment Analysis:

- Task: Using SQM Research or similar tools, analyze the vendor sentiment in your selected suburb.

- Question: How does the current vendor sentiment affect your investment strategy? Would you consider it a buyer’s or seller’s market?

Price Reductions and Negotiation Advantage:

- Task: Identify a property whose price has been reduced and research the possible reasons behind the price reduction.

- Question: How could this information be used to negotiate a better deal?

Heat Maps and Market Overviews:

- Task: Utilize heat maps or market overviews to visualise data on median asking prices and stock on sale in your suburb.

- Question: What insights can you derive from the visual data representation of market trends?

Listing Histories Analysis:

- Task: Find the listing history of a specific property and analyze any patterns or issues that could affect its saleability and value.

- Question: What did the listing history reveal about the property’s market appeal?

Cross-Platform Analysis:

- Task: Compare property data across multiple platforms to get a rounded understanding of the market in your suburb.

- Question: Did any discrepancies or notable insights arise from cross-referencing data across platforms?

Legal and Development Insights:

- Task: Research zoning, development potential, and property history for an area in your suburb.

- Question: How do these legal and development insights influence investment opportunities or risks?

Utilising Local and Foreign Sources:

- Task: Find and use an international website that provides property data in your selected Australian suburb.

- Question: What unique insights or additional information did the international source provide?

Interactive Tools for Predictive Analyses:

- Task: Use an interactive tool to explore property data, including future projections and historical changes, for your suburb.

- Question: How do these predictive analyses enhance your understanding of the investment potential in the suburb?

Submission Requirements

- Compile your findings and analyses into a detailed report.

- Include screenshots or links to the tools and data used.

- Provide a conclusion that integrates your research findings, offering a comprehensive view of the real estate market dynamics in your selected suburb.