CAGR (Compound Annual Growth Rate)

CAGR represents the annualized rate of return of an investment over a specified time period, assuming the investment grows at a constant rate each year. It is used to smooth out returns when evaluating the growth of a property’s value, income, or other financial metrics over multiple years, especially when returns fluctuate from year to year.

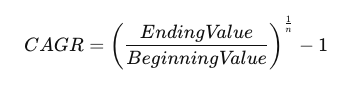

CAGR formula

Where:

- Ending Value is the value of the investment at the end of the period.

- Beginning Value is the value of the investment at the start of the period.

- n is the number of years.

CAGR is often used to:

- Evaluate Property Value Growth: Assess the annual growth in property value over time.

- Income Growth: Determine the growth rate of rental income over a holding period.

- Investment Performance: Compare different investment opportunities by analyzing their annualized growth.

CAGR helps in comparing projects or investments over different time periods, making it a useful metric for real estate investors and analysts.