Break Even Ratio in Property Development and Investment

What is the Break Even Ratio?

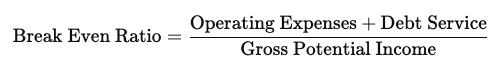

In property development and investment, the Break Even Ratio measures the proportion of rental income or property sales revenue needed to cover operating expenses and debt service costs. It helps assess the project’s financial viability and risk level.

How is it Calculated?

The Break Even Ratio can be calculated using:

Where:

- Operating Expenses include maintenance, management fees, and property taxes.

- Debt Service refers to mortgage or loan payments.

- Gross Potential Income is the total possible income from rents or property sales.

Advantages and Disadvantages of the Break Even Ratio

Advantages:

- Risk Assessment: Helps gauge the project’s financial risk by indicating the income needed to cover expenses.

- Simplifies Analysis: Provides a straightforward measure for lenders and investors to evaluate risk.

- Useful for Cash Flow Management: Helps ensure sufficient income to meet obligations.

Disadvantages:

- Ignores Market Trends: Does not account for market fluctuations or changes in property values.

- Static Nature: Assumes expenses and income remain constant, which may not be realistic.

- Limited Insight: Provides only a basic understanding of financial health without considering growth potential.

Shortcomings of the Break Even Ratio

- It may not fully reflect risk in markets with high vacancy rates or fluctuating rents.

- The ratio doesn’t factor in potential capital appreciation or depreciation.

- It’s less useful for projects with mixed-use development where different income streams have varying risk profiles.

What is it Really Good For?

- Evaluating Property Financing: Determines whether a property generates enough income to cover expenses and debt.

- Quick Feasibility Check: Provides an initial assessment of whether a project can be self-sustaining.

- Lender Decision Making: Helps lenders evaluate loan risk based on the income needed to avoid default.

What is a Good Range for the Break Even Ratio?

- Below 85%: Generally considered safe, indicating sufficient income to cover expenses with some margin.

- 85% - 95%: Moderate risk, with less cushion for unexpected costs or revenue shortfalls.

- Above 95%: High risk, suggesting that even a slight drop in income could lead to financial difficulty.