When it comes to commercial real estate, there are many factors to consider when determining the value of a property. This is where a commercial real estate valuer comes in, who is responsible for objectively assessing the property’s value.

What does a commercial real estate valuer do?

For property development funding, the commercial property valuer (appraiser in the US) values the development site and project.

However, dealing with a valuer can be a tricky process. Here are five tips for dealing with a commercial real estate valuer:

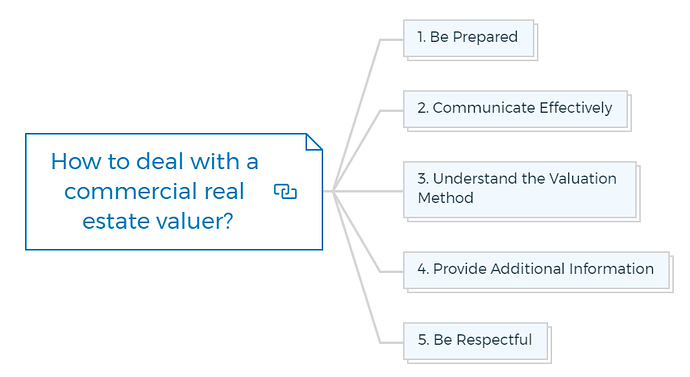

How to deal with a commercial real estate valuer?

1. Be Prepared

Before meeting with the valuer, having all the necessary information is crucial. This includes property information, such as floor plans and zoning details, and financial data, such as income and expense statements.

This readily available information will help the valuer assess the property’s value more accurately.

You are missing out if you haven’t yet subscribed to our YouTube channel.

2. Communicate Effectively

Effective communication is critical when dealing with a valuer. It’s essential to be clear and concise when discussing the property’s attributes, such as location, size, and condition.

It’s also essential to be honest about potential issues, such as maintenance problems or environmental concerns.

The valuer must have a complete picture of the property to make an accurate assessment.

How To Finance Your Property Development Project?

And Other Books On Real Estate Development Finance

Includes 5 x detailed eBooks

✓ Property Development Finance: Easily Finance Your Project? (26 Pages)

✓ 10 Big (Financial) Property Investing Mistakes Made By Investors (58 Pages)

✓ 10 Finance Options For Your Next Property Development Project (29 Pages)

✓ What Is Equity Finance And How Does It Work? (42 Pages)

✓ Property Investment Finance - Ultimate Guide

3. Understand the Valuation Method

Several methods are used to value commercial real estate, including the cost approach, sales comparison approach, and income approach.

Understanding the real estate valuer’s method and how they arrive at their final valuation is essential. This can help you better understand the property’s worth and make informed decisions.

Learn More

4. Provide Additional Information

If any unique features or characteristics may impact the property’s value, be sure to bring them to the property valuer’s attention.

For example, if the property has historical significance or is located in a high-growth area, this information can help the real estate valuer make a more accurate assessment.

5. Be Respectful

Finally, it’s essential to be respectful when dealing with a valuer. Remember that their job is to objectively assess the property’s worth, and they may only sometimes agree with your assessment.

Be open to their feedback and be willing to discuss any issues or concerns they may have.

Dealing with a commercial real estate valuer can be challenging, but by following these tips, you can ensure a smoother and more effective valuation process.

Learn More

Property Finance Made Easy

We specialise in Development funding | Commercial finance | Construction loans | Portfolio refinancing & Property investment loans in Australia.

Click Here to strategise with Amber