Understanding Interest Calculation in the Smart Feasibility Calculator

Introduction

The Smart Feasibility Calculator (SFC) is an advanced tool designed to assist users in financial calculations, particularly those related to project interest rates. This article delves into the specifics of how the SFC handles interest calculations using two common conventions: the 30/360 and 30/365 methods.

Overview of Interest Calculation Methods

Interest calculation is essential in financial planning and project feasibility analysis. Depending on the selected method, slight variations can lead to significant differences in financial projections over time. The SFC allows users to choose between two interest calculation options:

- 30/360 Method: This approach assumes a 360-day year with 12 months, each containing 30 days. It’s a method often used by banks and financial institutions to simplify calculations.

- 30/365 Method: This alternative uses a 365-day year, offering a more precise daily interest rate but resulting in a slightly lower monthly rate compared to the 30/360 method.

Detailed Calculation Breakdown

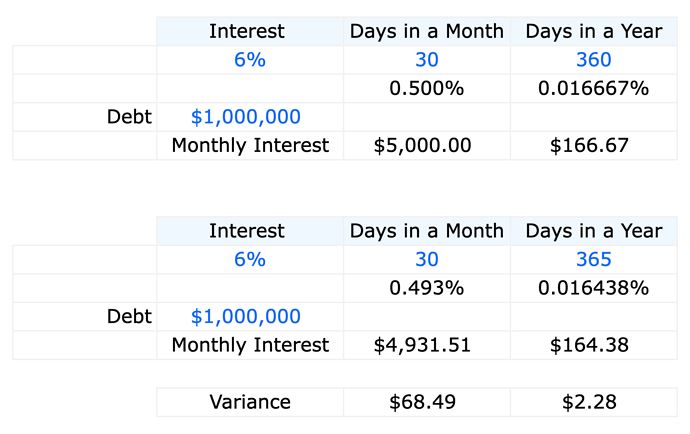

In the video demonstration, an example is given to clarify how these methods affect daily and monthly interest rates. Here’s a simplified summary of the process:

- Interest Rate Calculation: Let’s assume an interest rate of 1% per annum.

- For the 30/360 method, divide 1% by 360 days, yielding a daily interest rate of approximately 0.02778%. This rate is then multiplied by 30 to get a monthly rate, which equals roughly 0.083%.

- For the 30/365 method, the daily rate is slightly lower at 0.0274%, resulting in a monthly rate of about 0.082%.

- Impact of Calculation Method: Over time, choosing the 30/360 method results in a slightly higher interest accumulation. For instance, on a $1 million loan, this choice can mean an additional 1.42% in interest.

Why Choose the 30/360 Method?

The 30/360 method is often preferred for its slight buffer, particularly in project feasibility studies. By allowing for extra interest, it can help build more conservative financial projections, which are beneficial when accounting for unexpected project delays or additional costs.

Practical Applications in the SFC

When setting up the SFC, users can choose between these two options depending on the level of precision or conservatism they want in their projections. The calculator then applies the chosen method across all interest calculations, making it a versatile tool for planning and budgeting.

Conclusion

Understanding the nuances between the 30/360 and 30/365 methods can help users make informed decisions based on their specific project needs. The SFC’s integration of these options underscores its flexibility and value as a tool for accurate financial planning.

By leveraging the 30/360 method, users can benefit from slightly higher projected interest, adding a financial cushion to their projects. The choice between the two methods ultimately depends on whether one prioritizes accuracy or conservatism in interest calculations.