Bonus Update - Project Report

Summary

Summary

Overview of the Session

Overview of the Session

The video is a comprehensive discussion on project reports, feasibility, stakeholder engagement, and development strategies for property development. Purpose of a Project Report

Purpose of a Project Report

- Ensures all aspects of the development project are considered.

- Demonstrates thorough research and feasibility.

- Helps secure stakeholder confidence, including investors and banks.

Importance of Feasibility and Due Diligence

Importance of Feasibility and Due Diligence

- A project report validates the research process.

- Helps anticipate project risks and potential roadblocks.

- Ensures credibility when presenting to investors and financial institutions.

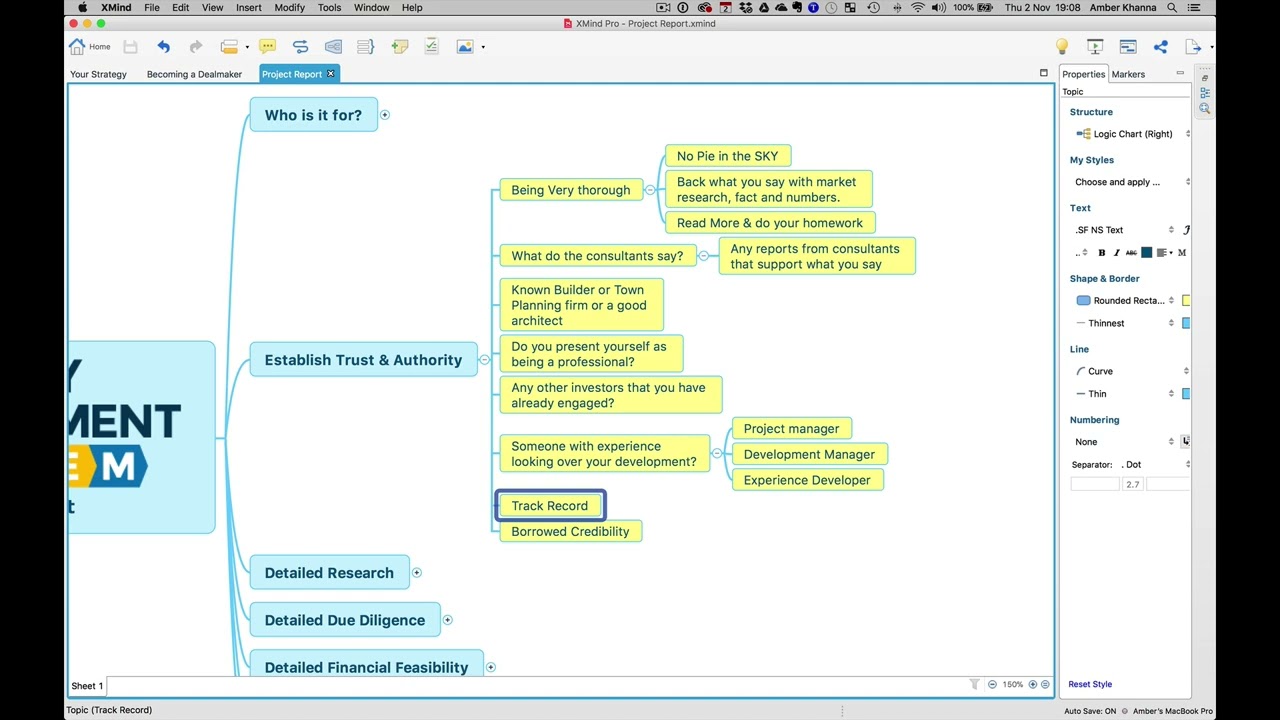

Stakeholders and Investor Engagement

Stakeholders and Investor Engagement

- Banks, private investors, and financial institutions are key stakeholders.

- The report must establish trust and credibility to secure funding.

- Investors look for well-researched projects with detailed feasibility studies.

Risk Management and Contingency Planning

Risk Management and Contingency Planning

- Plan for worst-case scenarios (market downturns, cost overruns, permit rejections).

- Maintain a buffer and flexibility to handle unexpected challenges.

- Conduct sensitivity analysis (e.g., price drops and cost increases).

Financial Feasibility and Investment Structure

Financial Feasibility and Investment Structure

- Discusses financing options, including private loans and institutional funding.

- Investors should understand their expected returns and financial obligations.

- Emphasizes structured agreements and clear financial planning.

Bank Loans and Investment Structuring

Bank Loans and Investment Structuring

- Explains commercial loans and their guarantees.

- The role of unit trusts and corporate trustees in structuring investments.

- The impact of self-managed super funds (SMSFs) on securing funding.

Common Questions from Investors

Common Questions from Investors

- How is my money safe?

- What happens if the project doesn’t get approval?

- How are profits distributed?

- Can I invest through my super fund?

Case Study: No Money Down Deal

Case Study: No Money Down Deal

- Example of a project where the speaker secured 20% equity without personal capital.

- Highlights the importance of presenting a solid project report to investors.

Best Practices for Project Reports

Best Practices for Project Reports

- Clear, professional presentation with structured milestones.

- Defined project scope, deliverables, and timeline.

- Detailed financial breakdown, feasibility studies, and risk assessment.

Insights Based on Numbers

Insights Based on Numbers

- 1.3 million profit case study

- Demonstrates the potential profitability of a well-structured project.

- Development margin guidelines

- Minimum 10-12% for feasibility

- Ideally 15%+ for larger projects

- Higher risk requires a higher return threshold

- Investment returns and structured contributions

- Return on Equity (ROE) is calculated based on cash flow timing.

- Projects should be structured with clear percentage holdings for fair distribution.